Freddie Mac on Thursday reported net income of $2.8 billion for the first quarter of 2021, an increase of $2.6 billion year-over-year, primarily driven by higher net revenues and lower credit-related expense.

Last year, amid economic shutdown, the mortgage giant reported a net income of just $200 million in the first quarter. However, this year’s $2.8 billion is still double the 2019 reported net income of $1.4 billion.

Much of this increase was driven by new business activity of $362 billion, up 162 percent year over year, reflecting strong home purchase and refinance activity. Freddie Mac reported a mortgage portfolio of $2.458 trillion, up 22 percent year over year, driven by this strong new business activity.

But the company’s serious delinquency rate of 2.34 percent was up from 0.6 percent at March 31, 2020, driven by loans in COVID-19 forbearance. This is an improvement from the end of last year, when the serious delinquency rate rested at 2.64 percent on Dec. 31, 2020.

“Freddie Mac continued to support homebuyers and renters, providing $377 billion of liquidity for home purchases, refinancings and the multifamily market in the first quarter of 2021,” Freddie Mac Chief Financial Officer Christian Lown said. “We have also helped hundreds of thousands of families stay in their homes through our foreclosure and eviction prevention programs. We are proud of our role in maintaining a vibrant housing market while providing critical assistance to borrowers and lenders during the pandemic.”

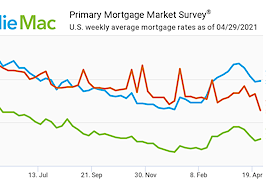

Net revenues increased 118 percent year over year to $5.3 billion, primarily driven by higher net interest income and higher net investment gains. Net interest income increased 31 percent annually to $3.6 billion, primarily driven by growth in the single-family mortgage portfolio and higher deferred fee income recognition due to faster loan prepayments from increases refinances in the low mortgage interest rate environment.

Net investment gains were $1.2 billion, compared to net investment losses of $0.8 billion for the first quarter of 2020. This change was primarily driven by higher revenues from multifamily loan purchase and securitization activities, while the first quarter of 2020 included significant spread-related losses as a result of the market volatility caused by the pandemic.

Amid this year’s low interest rate environment and high demand for homes, many of 2020’s top lenders experienced double-digit growth in mortgage originations, with some reporting increases of nearly 350 percent. Several mortgage lenders even joined the list of richest people in the U.S. on Forbes’ billionaires list.

But this year the intensity could slow. Fannie Mae and Freddie Mac released their forecasts earlier this year showing the housing market could be facing a slowdown this year.