This report is available exclusively to subscribers of Inman Intel, a data and research arm of Inman offering deep insights and market intelligence on the business of residential real estate and proptech. Subscribe today.

Loan servicing giant Mr. Cooper continues to make inroads on its quest to build a $1 trillion mortgage servicing portfolio — which it intends to wring maximum profits from by replacing many call center workers with artificial intelligence and by getting a jump start on other lenders when homeowners are ready to refinance.

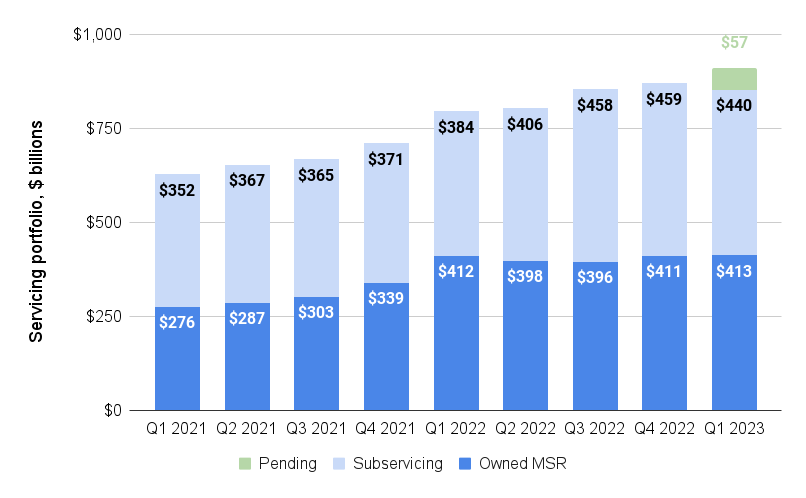

In reporting a $37 million first-quarter net profit Wednesday, Dallas, Texas-based Mr. Cooper said it grew its loan servicing portfolio — mortgages it collects payments on, on behalf of investors — by 7 percent from a year ago to $853 billion.

That figure doesn’t include an additional $57 billion in mortgage servicing rights for which Mr. Cooper has recently signed deals. Add those pending deals to the mix, and Mr. Cooper will soon be servicing more than $900 billion in mortgage debt.

Mr. Cooper’s servicing portfolio approaching $1T

Mr. Cooper mortgage servicing rights (MSR) portfolio in billions of dollars | Source: Mr. Cooper regulatory filings

That’s despite losing $30 billion in subservicing rights during the first quarter to a client that acquired their own servicing platform and is taking their loan portfolio in-house, Mr. Cooper Vice Chairman and President Christopher Marshall said on a call with investment analysts.

Mr. Cooper’s subservicing portfolio — loans that the company collects payments on under contract with lenders who retain ownership of those servicing rights — shrank by 4 percent from the fourth quarter to $440 billion.

Chris Marshall

“You could see more volatility in our total book over the balance of the year,” Marshall said. “But overall, we feel great about our subservicing business, and I’d note that we’ve already replaced a substantial portion of this loss with growth from other clients.”

Pending acquisitions of Rushmore Loan Management Services LLC’s $37 billion mortgage subservicing platform, along with an earlier agreement to acquire parent company Roosevelt Management Company LLC, are expected to close by midyear. Marshall said Mr. Cooper will onboard “several hundred people” as part of the deal.

Mr. Cooper’s owned mortgage servicing rights (owned MSR) portfolio grew by just $2 billion from the previous quarter to $413 billion — about where it was a year ago.

Although Mr. Cooper Chairman and CEO Jay Bray said the company expects to make “a lot of progress” this year toward the company’s goal of building a $1 trillion servicing portfolio, he also pegged that number as “an absolute minimum for where we can go” in the long run.

Jay Bray

“The opportunities we’re seeing right now are as exciting as anything we’ve looked at in recent memory, and I expect us to exit this part of the cycle as a larger, more profitable and even more dominant competitor,” Bray said on a call with investment analysts.

Loan servicers can make money in two ways — by collecting fees from the investors who actually own the mortgages they collect payment on and by providing loans when homeowners are ready to refinance.

When interest rates rise, loan servicers make less money refinancing, but the value of their mortgage servicing rights increases, because borrowers are less likely to refinance out of their servicing portfolio.

Bray said Mr. Cooper — which slashed more than 1,000 jobs last year as originations dwindled — thinks it can trim at least $50 million in annual expenses from its call centers by using artificial intelligence to handle customer calls.

Mr. Cooper has made a “massive investment” in interactive voice response (IVR) to take customer calls using AI, Bray said.

“If you think about what we’re trying to do, it’s really to replicate the Amazon model,” Bray said. “I’m sure everyone on this call uses Amazon and yet I doubt anyone has ever spoken to anyone at Amazon. That’s because you don’t have to.”

Bray said Mr. Cooper spends “several hundred million dollars a year” on call center operations and expects to achieve $50 million in annual savings at the outset of what is expected to be “a multiyear project.”

“We have a lot of work ahead of us, but we think it’s a big opportunity, big opportunity not just to eliminate expense but to make the experience much, much better for our customers,” Bray said.

Loan originations dwindle

Mr. Cooper mortgage originations by channel, in billions of dollars | Source: Mr. Cooper regulatory filings

Another way Mr. Cooper expects to profit from its growing mortgage rights servicing portfolio is by providing loans when homeowners are ready to refinance or buy their next home — earning fees as the loan originator and keeping the borrower in the company’s servicing portfolio.

Mr. Cooper acquires mortgages originated by correspondent lenders, and also “recaptures” borrowers by offering refinancing directly to homeowners from which it’s collecting payments. Marshall said Mr. Cooper’s recapture rate is about double the industry rate.

“For someone who has already done a transaction with us that we’ve already refinanced, we capture approaching 80 percent,” he said.

While Mr. Cooper’s mortgage originations business has largely dried up — the $2.7 billion in first quarter originations represented an 89 percent drop from two years ago — the company expects lending to pick up when the economy cools and interest rates come back down.

“You’ve seen us demonstrate industry-leading recapture rates quarter over quarter, year after year, and you know that at the right point in the cycle, we can generate origination profits well over $1 billion,” Bray said. “A key part of our strategy is to keep investing in our direct-to-consumer platform so that we’re in a position whenever the cycle turns, to do even more.”

Xome REO inventory and sales climb

Xome inventory and sales, by quarter | Source: Mr. Cooper regulatory filings

In addition to servicing and originating mortgages, Mr. Cooper’s Xome subsidiary operates an auction platform for foreclosed and real-estate-owned (REO) properties.

During the first quarter of 2023, inventory on the platform climbed 48 percent from a year ago to 27,003 homes. Sales were up 26 percent from a year ago to 1,494, surpassing the 2022 peak of 1,285.

Marshall said Xome is on track to become profitable in the second half of the year as properties flowed onto the platform at a record pace in March.

“Part of this is services getting more comfortable with their compliance processes, but our team has also been actively selling to new customers,” Marshall said. “And as a result, our market share of Ginnie Mae foreclosures is now rising above the 40 percent target we laid out for you a year ago.”

While Marshall has said in the past that Mr. Cooper has been in discussions with prospective investors about spinning off Xome, he didn’t provide further insights on Wednesday’s call.

Noting that the 37 percent quarterly growth in Xome sales was in line with our projections, he said Mr. Cooper expects that number to grow again in the second quarter.

“We’re seeing more investor activity on the exchange, which includes more visits to our website, stronger bidding activity, more bids per asset and improving pull-through rates,” Marshall said.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.