In these times, double down — on your skills, on your knowledge, on you. Join us Aug. 8-10 at Inman Connect Las Vegas to lean into the shift and learn from the best. Get your ticket now for the best price.

A “tough real estate market” appears to have weighed on portal giant Zillow this spring, with the company revealing that despite a slight uptick in revenue its net losses jumped in the second quarter of the year.

In total, Zillow pulled in $506 million in revenue between April and June, according to a newly published earnings report. That’s up from $504 million during the same time last year. However, the revenue improvement notwithstanding, Zillow also lost $35 million in the quarter, a reversal from the $8 million in profit it made during Q2 of 2022.

The report nevertheless struck an optimistic tone, noting that the company outperformed its own forecast as well as industry trends.

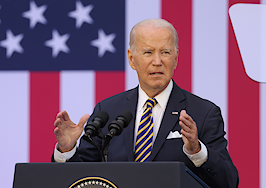

Rich Barton

“Zillow outperformed the broader industry for the fourth consecutive quarter as we navigate a tough real estate market,” CEO Rich Barton said in the report. “I’m pleased with our steady progress on improving and integrating our customer and partner experiences, especially in touring, financing, and renting.”

In a call with investors Wednesday afternoon, Barton added that the outlook for the housing market “remains frustratingly foggy,” with “stubbornly low” sales volumes. But he also said that he expects sales to gradually rise, eventually reaching around 6 million a year.

“We continue to have confidence that this is not a new normal,” Barton added during the call, referring to the current slower market.

Later in the call he said that despite a “terrible macro,” internally Zillow is “quite excited by our relative performance.”

Though Zillow’s losses mounted in the second quarter, it’s also worth noting that the same period last year was still at the beginning of the rate-driven market slowdown that has continued through the present.

Zillow’s second quarter 2023 results were also middling compared to Q1. The company beat the first quarter’s revenue haul of $469 million but underperformed compared to the $22 million it lost between January and March.

Wednesday’s report further shows that most of Zillow’s various segments, such as its residential and mortgage businesses, saw revenue fall year over year in the second quarter. The exception was rentals, which saw revenue rise 28 percent year over year to $91 million.

A shareholder letter from Barton and Chief Financial Officer Jeremy Hofmann said Zillow’s rental business growth was “driven by organic efforts — signing up more multifamily properties and attracting more single-family listings.

“In May 2022, Zillow regained its spot as the No. 1 most visited rentals platform, according to Comscore, and we have widened our lead since then, putting us in a strong position for future revenue growth,” the letter reads.

Barton added during Wednesday’s investor call that when it comes to rentals, Zillow plans to “differentiate our marketplace on quality of experience.” That will include building tools for landlords and creating a “seamless experience” for users.

Heading into Wednesday’s earnings report, shares in Zillow were trading in the $54 range. That was down slightly for the day but up compared to both a week and a month ago. It was also up compared to the beginning of 2023 when shares were fetching just over $30.

Following the publication of Wednesday’s earnings report, Zillow shares fluctuated in after-hours trading, but ultimately ended up down slightly compared to their price when regular trading ended.

Credit: Google

Zillow had a market cap of about $12.6 billion when markets closed Wednesday.

In addition to financial results, Wednesday’s report also shows that Zillow averaged 226 million average monthly unique users to its various sites. That’s a 3 percent year-over-year dip. The company received 2.7 billion total visits in the second quarter, down 8 percent year over year.

During the investor call, Barton said that more than 80 percent of Zillow’s web traffic comes directly to the company’s sites, “which is rare and good.” He also said nearly half of Zillow’s traffic takes place via its app.

Other initiatives Barton touted in the call include the expansion of the company’s “enhanced markets” program that involves a post-pay version of Premier Agent, the growth and future potential of the company’s mortgage operations and efforts to offer seamless real-time home showings to would-be buyers. He also noted that first-time buyers make up a higher share of the market than they did in the past, which benefits Zillow due to the demographics of its user base.

Wednesday’s shareholder letter ultimately concludes that “2023 is a crucial year for Zillow and is all about execution.” It also emphasized the company’s commitment to its still-in-the-works “housing super app.”

“Our ultimate goal,” the letter notes, “is to deliver the housing super app — a seamless experience for our customers as they move from dreaming and shopping into buying, selling, renting and financing, with Zillow products and services to choose from along the way.”

Update: This story was updated after publication with information from Zillow’s earnings report, as well as with commentary from the company’s investor call.