No one can predict the future of real estate, but you can prepare. Find out what to prepare for and pick up the tools you’ll need at Virtual Inman Connect on Nov. 1-2, 2023. And don’t miss Inman Connect New York on Jan. 23-25, 2024, where AI, capital and more will be center stage. Bet big on the future and join us at Connect.

Although it “vehemently” denies the allegations, the nation’s oldest community bank has agreed to invest and spend at least $9 million to improve access to mortgage credit in minority neighborhoods in Rhode Island to resolve redlining claims brought by the U.S. Department of Justice.

From 2016 through 2021, only 2 percent of the mortgage loans made by Westerly, Rhode Island-based The Washington Trust Company were in majority-Black and Hispanic areas, the Justice Department alleged in its Sept. 27 complaint. That’s about four times less business than Washington Trust’s peers did in minority areas, the government alleged.

Kristen Clarke

“This settlement should send a strong message to banks regarding the Justice Department’s firm commitment to combat modern-day redlining and ensure that all lenders are providing equal access to home loan opportunities to communities of color,” Assistant Attorney General Kristen Clarke said in a statement Wednesday.

It’s the latest in a series of settlements the Justice Department has reached since announcing an initiative to combat redlining in October 2021. The settlements have generated $98 million in relief, including a record $31 million settlement with City National Bank in January over allegations that it engaged in redlining in Los Angeles County.

Washington Trust said in a statement that it “vehemently denies the allegations and entered into this agreement solely to avoid the expense and distraction of potential litigation,” pointing out that the settlement does not include any civil monetary penalties.

“We believe we have been fully compliant with the letter and spirit of fair lending laws, and the agreement will further strengthen our focus on an area that has always been important to us,” Washington Trust Chairman and CEO Edward O. “Ned” Handy III said in the statement.

Edward O. “Ed” Handy III

The settlement, outlined in a consent order submitted for approval to the U.S. District Court for the District of Rhode Island, calls for Washington Trust to invest at least $7 million in a loan subsidy fund to increase access to mortgage credit for residents of majority-Black and Hispanic neighborhoods in Rhode Island, and to spend another $2 million on community partnerships, advertising and outreach.

Washington Trust also agreed to open two new branches in majority-Black and Hispanic neighborhoods in Rhode Island, ensure at least two mortgage loan officers are dedicated to serving these neighborhoods, and employ a director of community lending to oversee continued development of lending in communities of color.

“This resolution will provide critical relief to impacted Black and Hispanic communities, enabling them to buy a home, keep their home or access the equity in their home,” Clarke said. “Ending redlining and providing relief to communities of color impacted by this unlawful practice is a necessary step in ongoing efforts to reduce racial wealth and homeownership gaps across our country.”

No branches in majority-minority census tracts

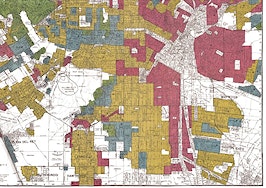

Redlining occurs when lenders discourage loan applications, deny equal access to home loans and other credit services, or avoid providing home loans and other credit services to neighborhoods based on the race, color, or national origin of the residents of those neighborhoods.

In its complaint, Justice Department investigators concluded that Washington Trust “does not have, and has never had, a branch in a majority-Black and Hispanic census tract despite the fact that nearly 16 percent of the residential census tracts in the State of Rhode Island are majority-Black and Hispanic.

After launching an investigation in November, 2021, the Justice Department concluded that Washington Trust which operates 25 branches in Rhode Island and one branch in Mystic, Connecticut — had made only 142 mortgage loans in minority areas over the last six years. Half of the loans the bank did make in minority areas were to white borrowers, compared to 29 percent of those made by competing “peer lenders” — similarly-sized and situated financial institutions.

As early as 2011, “Washington Trust was aware that its operations were creating a risk of redlining,” the Justice Department alleged, but the bank “took no meaningful action in response to these reports indicating that it was underserving Black and Hispanic borrowers.”

Washington Trust disputes that it took no meaningful action, citing a community lending program offering “a variety of creative affordable loan opportunities,” financial literacy and educational programs, and the bank’s employment of multilingual and minority community outreach and loan officers.

“We care about all of our communities across Rhode Island, and we demonstrate our commitment through a number of proactive state-wide and corporate initiatives,” Handy said in a statement.

The Justice Department acknowledged that Washington Trust “purportedly attempted to take measures to address its redlining risk,” such as developing a loan product for low-to-moderate income borrowers.

But the bank “failed to adequately monitor, document, or evaluate whether such measures ensured that the bank was providing equal access to credit to majority-Black and Hispanic neighborhoods in Rhode Island,” the government alleged.

“In fact, the data showing Washington Trust failed both to draw applications for and to provide home loans and residential mortgage services to residents in majority-Black and Hispanic neighborhoods demonstrate that the Bank failed to serve those portions of its assessment area,” the complaint said.

During the period investigated, “Washington Trust’s marketing strategy focused on raising brand awareness and failed to include any efforts to market and advertise to majority-Black or Hispanic areas,” the government alleged, and “only two of the mortgage loan officers employed by Washington Trust spoke Spanish fluently, with one leaving the position after serving less than one year.”

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.