No one can predict the future of real estate, but you can prepare. Find out what to prepare for and pick up the tools you’ll need at Virtual Inman Connect on Nov. 1-2, 2023. And don’t miss Inman Connect New York on Jan. 23-25, 2024, where AI, capital and more will be center stage. Bet big on the future and join us at Connect.

Demand for mortgages hit the lowest level in 28 years last week as mortgage rates continued a relentless rise fueled by a selloff in bond markets that fund government borrowing and most home loans.

The Mortgage Bankers Association’s Weekly Mortgage Applications Survey showed applications for purchase loans were down by a seasonally adjusted 6 percent last week compared to the week before, and 21 percent from a year ago. Requests to refinance were down 10 percent week over week, and 12 percent from a year ago.

“Applications decreased to their lowest level since 1995, as the 30-year fixed mortgage rate increased for the sixth consecutive week to 7.70 percent – the highest level since November 2000,” said MBA Deputy Chief Economist Joel Kan, in a statement.

Federal Reserve policymakers haven’t raised the short-term federal funds rate since July, and are expected to take a wait-and-see approach at their next meeting, which concludes on Nov. 1. But the Fed doesn’t have direct control over long-term interest rates, and mortgage rates have been chasing 10-year Treasury yields steadily higher as investors demand higher premiums to compensate them for risk.

10-year Treasury yields at highest since 2007

Yields on 10-year Treasury notes, a barometer for mortgage rates, continued to surge to a new 2023 high of 4.93 percent Wednesday, a level not seen since July 2007 on the eve of the 2007-2009 Great Recession.

Rates on 30-year fixed-rate conforming mortgages averaged 7.69 percent Tuesday, according to daily rate lock data tracked by the Optimal Blue Mortgage Market Indices. That’s a new 2023 peak, and the highest rate Optimal Blue has recorded for conforming loans in records going back to 2017. Freddie Mac records dating to 1970 show mortgage rates last week hit levels not seen since December 2000.

Mortgage rates follow Treasury yields higher

With analysts at Bank of America Global Research calling it “the greatest bond bear market of all time,” real estate and housing finance industry groups including the MBA and the National Association of Realtors (NAR) have pleaded with the Fed to declare that it’s done hiking rates. NAR and two other lender groups also want the Fed to resume purchases of mortgage-backed securities that helped push mortgage rates to historic lows during the pandemic.

But if Fed policymakers were to announce at their next meeting that they’re done hiking rates, “the ensuing stock and bond rally, and drop in the dollar, would constitute a significant immediate easing,” economists at Pantheon Macroeconomics said in a note to clients Monday. “It’s better from the Fed’s perspective to keep investors guessing, at least until the inflation and labor market data make that stance untenable.”

Mortgage rates tend to track 10-year Treasury yields closely, since investors view bonds and mortgage-backed securities (MBS) as similar investments. But the “spread” between 30-year fixed-rate mortgages and 10-year Treasury yields has grown wider over the last two years, making it more expensive for homebuyers to take out a mortgage.

Some of the increase could reflect prepayment risk — MBS investors’ fears that mortgage borrowers will refinance when rates come down. But NAR, the Independent Community Bankers of America and the Community Home Lenders of America say the Fed could help bring the “30-10 spread” down by halting quantitative tightening that currently allows $35 billion in maturing MBS to roll off the Fed’s books each month.

“Our groups thoroughly respect the independence of the Federal Reserve but believe it should take this structural issue into consideration when evaluating strategies to attain the Fed’s desired 2.0 percent inflation target,” the trade groups wrote the White House and Treasury Department last week. “While federal regulators do not have direct influence on many local construction issues, they can affect affordability for homebuyers and homeowners through the 30-10 spread.”

Bond market investors are keeping a close eye on inflation data to get a sense of whether Federal Reserve policymakers will follow through on promises to implement a “higher for longer” interest rate strategy. But other factors — including war in Ukraine and the Middle East, gridlock in Congress and the potential for a government shutdown in November, rising U.S. borrowing, and the potential for the economy to tip into a recession next year — have investors demanding a larger “term premium” to compensate them for the risk posed by rate volatility.

Dallas Federal Reserve President Lorie Logan said last week that her “back-of-the-envelope” estimates suggest more than half of the total increase in long-term yields since the Fed’s last rate hike in July reflects rising term premiums. If that’s the case, bond market investors may be helping the Fed cool inflation, leaving less need for further Fed rate hikes, Logan said.

In voting not to raise rates on Sept. 20, most Fed policymakers indicated that they expected to implement one final rate hike this year, which would bring the short-term federal funds rate at 5.5 to 5.75 percent.

The CME FedWatch Tool, which tracks futures markets to predict the Fed’s next moves, puts the odds of another rate hike on Nov. 1 at just 3 percent, down from 34 percent a month ago.

Although futures markets tracked by the CME FedWatch Tool predict a 41 percent chance that the Fed will hike rates one last time in December, the conversation has largely shifted to how long the Fed will keep rates elevated next year.

The so-called “dot plot,” which shows where Fed policymakers expect rates will need to be to fight inflation, indicates that most members expect to bring rates down by only half a percentage point next year as the Fed carries out its “higher for longer” strategy.

But rising term premiums and the increase in the 30-10 spread could mean that the selloff in bond markets is overdone. Once inflation is in check — or the economy tips into a recession — some economists think rates could come down more abruptly next year.

Economists at Pantheon Macroeconomics think the economy is already cooling, and are forecasting a sharp drop in rates next year that would bring 10-year Treasury yields into the low 3 percent range.

“Higher for longer does not mean higher forever, no matter how hard Fed officials push the idea that they aren’t yet thinking about easing,” Pantheon economists said in their Oct. 16 U.S. Economic Monitor bulletin.

The inflation story is now “mostly a question of what happens to housing costs—the biggest single component of the core CPI—and wages, which drive much of core non-rent services inflation,” Pantheon economists said.

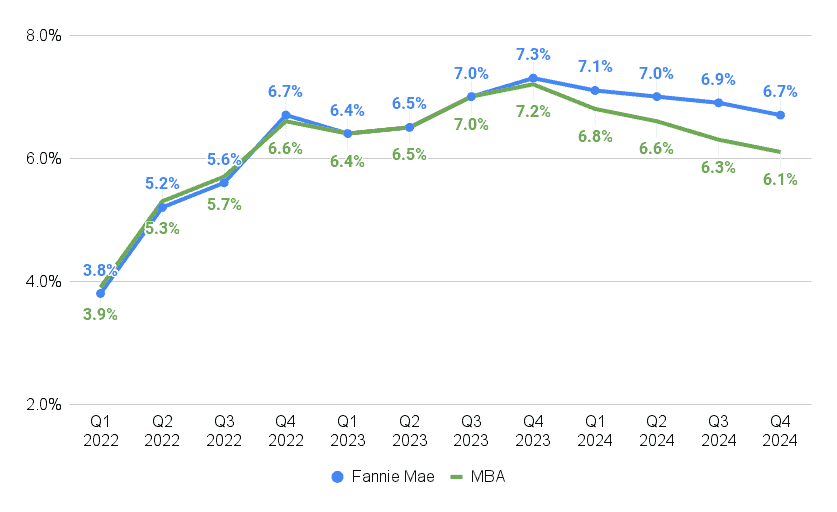

Mortgage rate forecasts diverge

Source: Fannie Mae, Mortgage Bankers Association forecasts.

In their latest forecast, MBA economists said they expect mortgage rates to come down by a full percentage point next year, to an average of 6.1 percent during the fourth quarter of 2024. In September, MBA forecasters had predicted mortgage rates would fall well below 6 percent next year, to an average of 5.4 percent during Q4 2024. The MBA’s latest forecast doesn’t envision rates getting to that level until Q4 2025.

Economists at mortgage giant Fannie Mae are even more cautious in their outlook, predicting rates on 30-year fixed-rate mortgages will only come down by about six-tenths of a percentage point over the next year, to an average of 6.7 percent during Q4 2024.

Fannie Mae economists think the Fed is done hiking rates, but “continue to take the Federal Reserve at its word that rates will be ‘higher for longer’ until annual inflation stabilizes at the two-percent target,” Fannie Mae Chief Economist Doug Duncan said.

Editor’s note: This story has been updated to correct that the National Association of Realtors, the Independent Community Bankers of America and the Community Home Lenders of America are the groups that have urged the Federal Reserve to resume its purchases of mortgage-backed securities. The Mortgage Bankers Association and National Association of Home Builders signed an earlier letter on Oct. 9 urging the Fed to make clear that it will not “sell off any of its MBS holdings until and unless the housing finance market has stabilized and mortgage-to-Treasury spreads have normalized.”

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.