- The hot Bay Area real estate market is normalizing, according to Pacific Union and John Burns Real Estate Consulting.

- As more babyboomers retire over the next decade they will be looking for a new kind of housing.

- Only 29 percent of U.S. households have children living in them, according to 2014 U.S. Census figures.

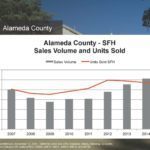

The San Francisco Bay Area real estate market is experiencing a “normalization” and a slowing, said Pacific Union CEO Mark McLaughlin and John Burns, CEO of John Burns Real Estate Consulting, at the annual Pacific Union Housing Outlook event held in San Francisco on Wednesday night.

“The press is out there saying that the housing market is crashing — it’s not; it’s slowing, it’s normalizing,” said McLaughlin, talking not only to a San Francisco audience but streaming to a Chinese one in Beijing.

McLaughlin and Dean Wehrli, Senior Vice President at John Burns, gave presentations on all the main markets of the San Francisco Bay Area and showed in all instances that household growth was not keeping up with extremely bullish employment growth.

Sales at the upper end of the Bay Area housing market had slowed in September and October, added McLaughlin.

“The San Francisco Bay Area is on our watch list for a correction. While we strongly believe that San Francisco has become a permanently more expensive place to live and should be one of the most expensive places to live in the world, the recent increases in home prices and rents have also been fueled by speculation,” said Burns.

Taking a look at the nationwide real estate market and the economic influences, Burns said that while the short-term economic outlook looked very good, the strong growth would abate by 2018.

“Eleven out of the last 12 recessions going back to the 1920s were caused by some sort of speculative investment often fueled by debt — the game ended, and assumptions did not work,” said Burns.

There was plenty of evidence of excessive debt, he added, including $1.2 trillion of student debt compared with $500 million from eight years ago.

“I think that is costing the resale market 8 percent of volume,” he told the audience of agents.

The research expert meanwhile highlighted an important change in nationwide demographic data which called into question the type of housing currently available.

“A surge in retirement will slow U.S. economic growth and create unprecedented levels of housing demand for 65 plus year olds,” he said. The 65-plus population will grow by 18 million people in 10 years — a 38 percent increase — and will need housing, he added.

A growing trend for multi-generational living was likely, he said. New-home builders would see an increasing demand for two master bedrooms to accommodate this change.

Three-bedroom, single-story homes with small yards would also become more in demand, he added.

Small yards are already in demand from people with no children but with pets, he said.

To agents always conscious of marketing homes with information about school zones, this information is currently relevant to a minority of homebuyers, according to Burns, drawing on 2014 U.S. Census data.

“Only 29 percent of households now have kids, leaving 71 percent for whom good schools and traditional family-friendly floor plans are not relevant,” said Burns.

He also cited women breadwinner numbers showing that 38 percent of women earned more than their husband and that real female incomes are up 36 percent while male incomes are down 5 percent.

The rise of women breadwinners is impacting where they live, said Burns.

“Women are saying, ‘We are not going to work 45 minutes away from where the kids go to school,’” he said.

Urban and suburban areas would far outgrow rural towns, he said.

“There will be big first-time homebuyer demand and big retirement housing demand,” said Burns.