- We are still growing, despite negatives in manufacturing and exports, and low energy prices still seem to be doing more harm than good.

- There have been slim gains in wages -- but very low unemployment, suggesting increases ahead -- and falling productivity.

It was a short holiday week last week, but the argument quietly raged: How fast will the Fed raise the overnight cost of money, and what will happen as a result, especially to mortgages and housing?

New economic data confirms little change

New economic data have been a help, if only confirming little change in the U.S. economy. Fourth-quarter 2015 GDP (gross domestic production) was revised upward again, the final up to 1.4 percent. It’s a message from Jurassic Park, but it does give us the complete 2015 picture: GDP up 2.0 percent versus 2.5 percent in 2014. Not even a Fed hawk can find acceleration there.

We are still growing, despite negatives in manufacturing and exports, and low energy prices still seem to be doing more harm than good. There is always some GDP wobbling from building inventories and running them down — one main cause of revision.

The economy is being pulled ahead by consumer spending, up 3.1 percent in 2015. Why is GDP growing only two-thirds of spending? Buying stuff made elsewhere, is how. GDP is gross domestic production.

Now, we can’t do that forever, as in GDP accounting, one way or another, we’re borrowing from overseas the money that consumers are using to buy foreign stuff.

But a troubled world is delighted to loan money to the only country likely to make the payments. Funding is not the problem.

Falling productivity bolsters ‘stagflation’ argument

The tack under the Fed’s saddle is this combination: Slim gains in wages, but very low unemployment suggesting increases ahead, and falling productivity.

Productivity is the way we raise our standard of living, and increased productivity is the result of increased savings and investment. We don’t have either of those. Nor do we have corporate profits which might be used for investment, nor much motivation for investment because the world is drowning in excess production and capacity.

The very hardest of Fed heads are worried that even 2.0 percent GDP growth is too fast, risking inflation if productivity gains are zilch — in a productivity-zilch situation, any wage gains are inflationary. That’s the old “stagflation” argument.

There is a counter-argument, not soft-headed, but non-traditional. Like this: Productivity is down because labor is substituting for capital in a key part of the world, forcing employment gains beyond demand. China. Not inflationary — deflationary, and destructive to investment.

One hard-head had the governing principle right this week, Philly-Fed Prez Patrick Harker: “There is a growth potential out there, and the best that monetary policy can do is to help achieve that potential, but it cannot affect the potential itself.” The only problem with his true statement: Today, what is our potential rate of growth?

Harker and other hawks, all regional Fed-heads (Lacker, Lockhart, Mester, George, Williams…), and even doves now chant, “Normalize, normalize, normalize…,” referring to the Fed funds rate, the overnight cost of money.

Normally (historically) normal is about 2 percent above the rate of inflation. Reach the Fed’s 2 percent inflation target, take funds to 4 percent. Most of us out here think that a 4 percent funds rate would not only squelch any threat of inflation, but will have us living in caves.

That thought is widespread in the bond market, and the perverse reason that the 10-year T-note and mortgages are still almost a half-percent lower today than at New Year’s.

You Fed people think you have to hike to prevent inflation. We think that if you hike much at all, you’re going to abort whatever recovery we have. The more hawkish you are, the better the reason for us to buy bonds — which, even, at these ridiculous yields will do well in the next recession.

The normal, neutral Fed rate may be no higher than the rate of inflation.

One last note about Fed-chatter: the regional Fed presidents get a lot of ink, even though every speech recites, “I am speaking only for myself….”

The farther you get from them, and the closer to Chair Yellen, the more important global issues become. The weaker over there, the slower and lower the Fed.

At home, brace for employment stats next Friday, April Fools’ Day. :-)

The 10-year T-note is stuck, waiting for something to happen. Next Friday, it will.

The 2-year T-note is also stuck, but Fed-defiant. These traders are convinced the Fed will hike only once more this year.

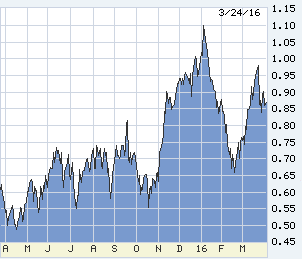

Maybe the drop in profits is merely the effect of falling energy prices and the strong dollar. Maybe not. Great chart!

The Fed’s “damned dots” versus market expectations. The dots have been wildly mistaken since introduced in 2012, always far too optimistic for the economy and for steep tightening. Some even inside the Fed wish it would drop the dots, as does everyone outside. Better not to be transparent at all, if the view through the window is destructive to confidence.

A tidbit from the Census Bureau. That migration to urban homes? Actually not.

Lou Barnes is a mortgage broker based in Boulder, Colorado. He can be reached at lbarnes@pmglending.com.