- The degree of current Fed accommodation is “moderate.”

- Gradually moving toward balance makes sense, but accelerating the process does not.

- Overseas currency moves will suppress U.S. inflation and growth.

It’s a little early to call an interest-rate top. Maybe two or three or four years too early.

However, looking back at the bond wreck since the election, it’s worth putting panic aside and to think for a minute or two.

The Fed’s Wednesday meeting

Working in reverse, the newest panic began after the Fed’s Wednesday meeting. The commentariat consensus has been a “hawkish” surprise in the Fed’s words and charts, in particular the scattergram showing a three-hike 2017 instead of two.

A harrumphing “B.S.!” to that. Nothing changed. Fed intentions are as gradual as ever. The forecast attached to its post-meeting statement — GDP (gross domestic product), inflation, unemployment — all as-were.

The scattergram of the future location of the Fed funds rate has been grossly misinterpreted. Dot-voters include all 12 regional Fed presidents: two are wild hawks with no business within 100 miles of a central bank; two more are permanent hawks; and another pair are newly fledged without compelling reason.

At minimum, toss out the top four dots and you get a much gentler future cycle. (Also toss out the super-dove, Bullard, who seems to think all of this is funny.)

Fed Chair Janet Yellen’s statement and post-meeting grilling by the press were well-done exercises in saying nothing about President-elect Donald Trump. The one useful inclusion: The degree of current Fed accommodation is “moderate.”

Gradually moving toward balance makes sense, but accelerating the process does not. The exact location of balance lies somewhere between maybe another 1 percent of hikes — or more and a recession.

Missing from the press conference — shame on you all! — not one question about the bond wreck to date.

We can assume the Fed takes some pleasure from long-term rates at last rising and the market chopping wood for the Fed. However…holy smokes, however…from a steady 1.50 percent 10-year last summer to 2.60 percent today? Yellen?

Also, might one of you have asked if the transition team has contacted the Fed? Eh?

What about the bond wreck?

The bond wreck is now global, triggering widespread currency and debt wrecks, while the sillies here admire a “strong dollar.”

The currency moves will suppress U.S. inflation and growth. The yen has lost 10 percent of its value, a theoretical help to Japan if the slide stops here, 117/$.

If it stops. Many nations, China included, are right on the edge of destabilization. The outside world does limit Fed action, which the Fed understands, spillovers from here to there causing unpleasant spillbacks from there to here.

The yield curve is always a guide, but it’s crucial during Fed tightening cycles. The Fed-sensitive 2-year T-note since summer has risen a half-percent, now pricing-in the Fed’s next hike. The 10-year T-note has risen twice that far.

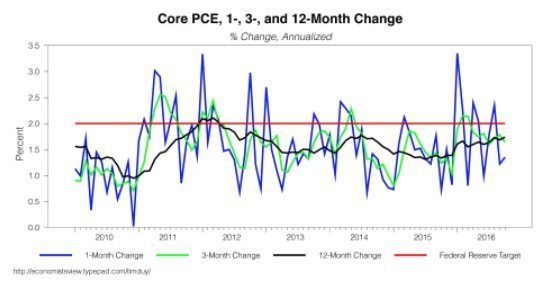

New signs of inflation did this? Growth? There are no such signs. Twits insist that rising rates reflect rising expectations for inflation, but that is circular nonsense.

More significant, the 30-year T-bond has risen only 0.60 percent, and 10s have closed the 10s/30s spread from underneath (10s at 2.60 percent on Friday, 30s at 3.19 percent). One nearly perfect marker of an end to Fed tightening: when 30s stop moving and 10s close altogether from below.

Now all the way back to the election. Just exactly what happened by dawn the following day to cause this wreck?

Bonds were leaning the wrong way, a little. The ECB (European Central Bank) and BOJ (Bank of Japan) last summer mumbled intentions to let their bond yields rise a little, to restore some yield curve to benefit banks, pension funds and insurance companies, so less of their cash is spilling to our bonds. The election surprise pulled those things forward.

But this explosion? Danger in the world pushes money to bonds, not away — risks of war or default or depression.

Trump is a new kind of risk. A wild card. No way to measure the risk he brings. His stimulus proposals have poor chances in Congress — a big deficit add, zero.

The stock market is right that the easy stuff, deregulation and a business-friendly cabinet will add to profits. But growth, jobs, and incomes…? Hardly. That’s a long, difficult, productivity-enhancing road.

This bond wreck is overdone. Not a cycle top, but past halfway to one, and maybe a lot past halfway.

The 2-year T-note in the last year, showing the last leg up this week. Trump did this? No way. Nothing else did it, either. Feels panicky.

The 10-year T-note in the last year. Compare to 30-year bonds, next chart following.

30-year bonds — a bad month, but less magnitude than 10s, and no damage at all in the last week.

The “damned little dots.” Erase at least the top four, and you get a very different picture.

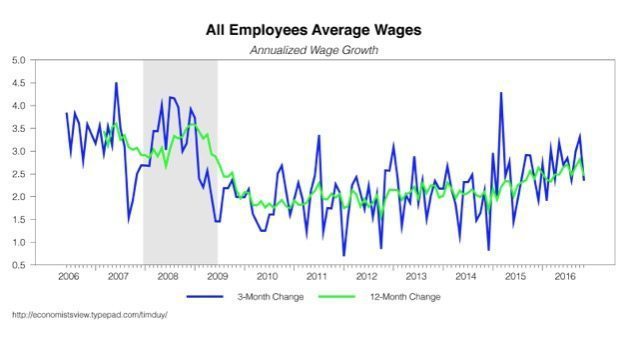

Wages are doing ever-so-slightly better, but there is nothing hazardous here.

The Fed may be acting as though 2 percent is a cap instead of a target. There is no sign of inflation crossing 2 percent.

Lou Barnes is a mortgage broker based in Boulder, Colorado. He can be reached at lbarnes@pmglending.com.