I recently conducted a wide-ranging analysis of real estate portals around the world, and released the results in the Global Real Estate Portal Report for 2017.

It is a 100-plus slide, evidence-based presentation looking at best practices, emerging trends, growth strategies and common insights and challenges among the top portals.

What we have below is a quick look at the U.S. market leader, Zillow Group. I’ve pulled out some of the most interesting highlights that show how the business really compares to its international peers.

A global comparison: revenue, growth and profitability

To begin with, Zillow is the largest real estate portal in the world in terms of revenue, as shown by the chart below.

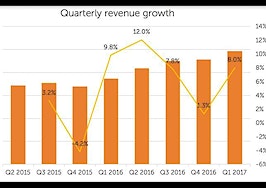

Not only does Zillow generate the most revenue of any real estate portal around the world, it is also growing that revenue incredibly fast. In fact, when compared to mature players in mature markets, Zillow’s growth rate is almost double.

However, the story starts to change when looking at comparable profitability rates. Internationally, real estate portals are very profitable businesses, with EBITDA (earnings before interest, tax, depreciation and amortization) margins well above 50 percent and 60 percent.

Zillow stands out at the bottom of the crowd. It’s not a very profitable business — in fact, if you measure net profit, it has always lost money. Quite a stark difference compared to every other real estate portal in similar markets.

A history of heavy investment

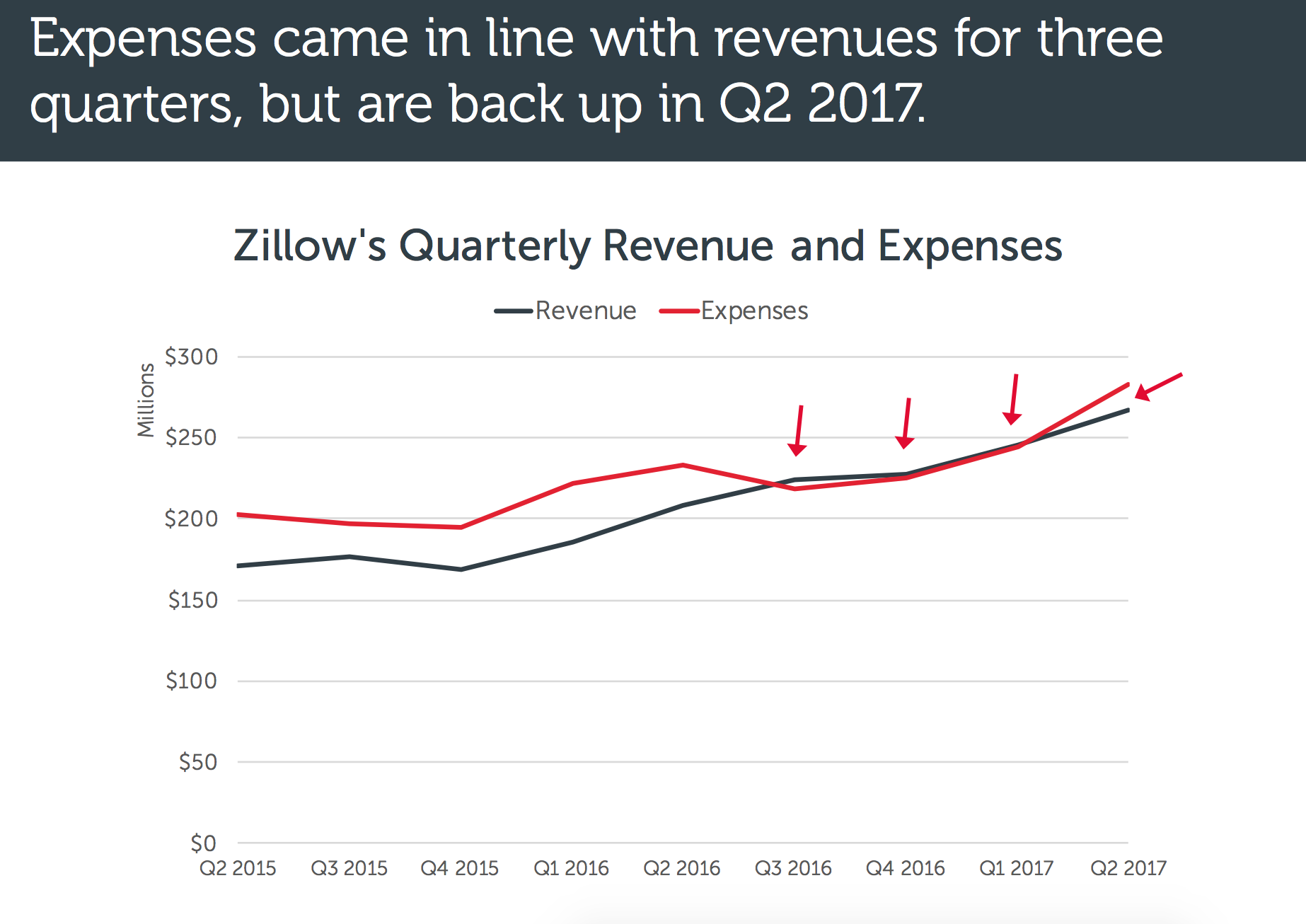

As I mentioned above, Zillow has always lost money. Since inception it has spent more money than it has made.

This story changed (briefly) for a few quarters earlier this year, when expenses finally came in line with revenues, showing good cost control.

But last quarter, it was again spending more money than it made. Again, this is in stark contrast to its global peers, which are all comfortably profitable. That’s the challenge for Zillow: when will it turn a profit?

Zillow often talks about its profitability in terms of “adjusted EBITDA,” which is a manufactured number that doesn’t paint an accurate picture of the business.

Specifically, it excludes the cost of stock-based compensation, which goes against the generally accepted accounting practices. To compare Zillow to its global peer set, I’ve included those numbers (and also backed out the one-time litigation expense from last year).

How big can Zillow become?

Zillow often talks about the incredible market opportunity here in the U.S. The fact that its enterprise value is far higher than its global peers reflects a belief that:

- The business will continue to grow strongly

- It will start turning big profits

Another way to look at the market potential — compared to global peers — is the revenue per capita. That’s the amount of revenue that each real estate portal generates per person in each country.

Zillow sits right in the middle of its peer group. If it were to continue growing and bump that number up another dollar, we’d be looking at $1.25 billion in annual revenues, slightly higher than it’s guidance for this year.

This is a quick look at some of the illuminating numbers that come from the international comparison. If you’re interested in the global space and want to get a sense of where the industry is heading, check out the full Global Real Estate Portal Report for 2017.

Mike DelPrete is a strategic adviser and global expert in real estate tech. Connect with him on LinkedIn.