How do you thrive in today’s luxury market? Don’t miss Inman’s Luxury Connect, October 15-17, 2019, in Beverly Hills, California. Walk away with the marketing, technology and luxury intelligence to grow your business while expanding your referral network with built-in networking sessions. Join 500 of the most notable names in luxury real estate. Reserve your spot here.

Kids are back in school, college football starts next week, happy vacations still in mind — maybe a week of traditional mid-August “silly season” news?

Dang. Instead, serious again — all week long, well-nigh indescribably serious.

Setting the scene

The Fed last met on July 31, cut the cost of money by 0.25 percent and signaled more cuts. The next day President Trump on his own announced new tariffs on China, and that threat to the global economy triggered market panic, especially a fight to U.S. Treasurys.

The 10-year T-note cascaded from 2.02 percent to 1.53 percent by Aug. 15. In the days since that, bottom markets have frozen.

The Fed conference

In late August each year since 1978, the Kansas City Fed has sponsored a conference of global central bankers in Jackson Hole, Wyoming. Jackson Hole is a gorgeous place, the Snake river in the foreground, and the Tetons as the backdrop, looking like a mural we might reach out to touch.

In winter, it’s more like Greenland, but don’t go there.

Back in Chairman Alan Greenspan’s days, the central bankers in dark suits looked like uncomfortable guests who had not gotten word that the party would be in costume. The central bankers are loosening up, seen in blue jeans and running shoes these days.

As the conference began, Fed officials chatted with reporters and gave personal indications of future policy. Then in early afternoon, the Fed released minutes of its July 31 meeting.

The net result: The Fed is as divided as any time in 30 years (the meeting after which Paul A. Volcker, chairman, resigned). About half of the 12 presidents of regional Feds are dug in against deeper cuts unless and until the U.S. economy weakens.

These hawks do not comprehend “overseas,” their writings blind to the outside world.

As Thursday wore on, market interest rates rose — not a lot, but to 10-day highs and above trend. The Fed hawks might go along with a cut at the Sept. 18 meeting for the sake of unity and because markets so deeply expect it, but that would be it, unless trouble spreads here.

Federal Reserve Chair Jerome H. Powell’s long-awaited speech early Friday morning was excellent, calming to markets.

A brief lesson in Fed history

These reassuring lines: “In 1993, core inflation … first fell below 2.5 percent and has since remained in the narrow range of 0.9 percent to 2.5 percent. Thus, after a decade of progress toward maximum employment and price stability, the economy is close to both goals.”

Most important, Powell understands the threat from overseas and tariffs and is fully prepared to act: “As the year has progressed, we have been monitoring three factors that are weighing on this favorable outlook: slowing global growth, trade policy uncertainty and muted inflation.”

The stock market rose a few dozen points, despite bond yields rising also, the 10-year T-note up to 1.65 percent from two weeks in the 150s. Maybe not as much easing ahead as hoped, but the Fed is on guard.

All hell breaks loose

China announced new tariffs on U.S. goods, which will do damage here. China knew Powell’s speech schedule, not an accident that China would announce immediately after, just as Trump had announced the day after the last Fed meeting.

The stock market began to slide, interest rates less so but going down.

Then came the presidential tweets: “My only question is, who is our bigger enemy, Jay Powell or Chairman Xi?” and “Our great American companies are hereby ordered to immediately start looking for an alternative to China, including bringing our companies HOME and making your products in the USA.”

And then threatened retaliation of some kind Friday.

Some China-watchers interpret China’s new tariff as the inevitable answer to Trump’s action on Aug. 1. They say that China could not re-enter negotiations without such counteraction. History is filled with lousy endings to such moves and insults and countermoves.

U.S. stock markets quickly dived 2.5 percent in value, with the 10-year T-note working on a breach of 1.50 percent. The economic issues are bad enough, but the president has had an unstable week. “Hereby order … ” does not play well as a cap to his other adventures. This instability itself is in play, not just the policy aspects, and it will be on display again.

This weekend saw the meeting of the Group of Seven (G7), in Biarritz, France, (probably not for sale). The leaders of Canada, France, Germany, Italy, Japan, the United Kingdom and the U.S. convened with markets watching.

Markets have learned not to overreact to the president, and even to ignore him, but there are limits, which we are testing now.

Roundup

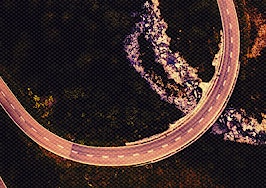

The 10-year T-note in trading just this week. The moments of China’s tariff announcement and tweets following are clear:

The Atlanta Fed GDP tracker is still happy:

The ECRI using completely different methodology than the Atlanta model sees the economy at a little more risk but steady.

Reserve your spot at Luxury Connect here. Thinking of bringing your team? There are special onsite perks and discounts for team who register together. Just contact us to find out more.