As of Friday, we sat waiting, asking ourselves: Will the Sept. 1 tariffs take effect, or will China or the White House blink? If they take effect, how soon the effect on rates? Will the world’s central banks follow through with a cascade of cuts? Will overseas weakness spread to the U.S.? Should the Fed cut before?

In order, no blink, effects soon, ECB Sept. 9 and Fed 18th probably spread, and nobody knows.

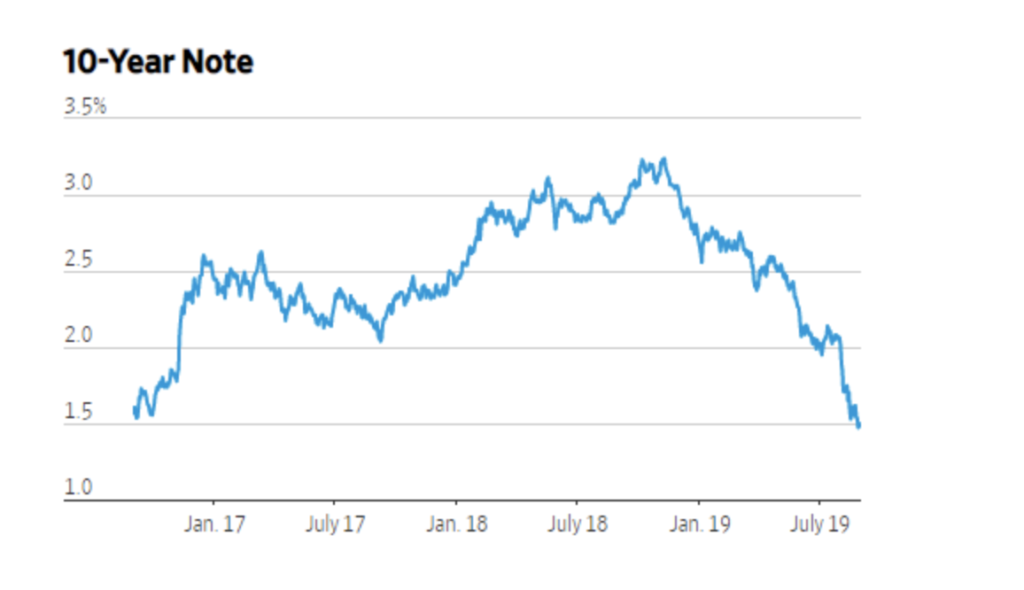

The U.S. 10-year T-note was the same as the close last Friday, after the bilateral fit of tariffs: 1.50 percent and mortgages are scattered all over the high-threes. Those rates are a half-percent below Aug. 1, the date of the previous tariff spasm, but the Dow is almost unchanged, happy at the prospect of Fed rate cuts, a perverse problem for the Fed.

Economic data … if and when the first news of infection from overseas, then no bottom to rates here. But there is no such sign, not yet. The core PCE measure of inflation is ticking up, not down, 1.6 percent year-over-year.

Housing looks strange, but mostly because of poor reporting and analysis. For example: This week the Realtor association found a surprise 2.5 percent drop in pending contracts of sale. Is that a sign of faltering demand that precedes recession?

No. Housing falters when the Fed pushes up rates, not when they fall to three-year lows.

Slim sales and new construction are the result of an extraordinary migration from the countryside, which is short of economic opportunity and entertainment. Cities have scads of IT jobs and fun. Housing is problematic.

Cities are short of housing, and developable land is exhausted, thus urban areas are in slow and politically excruciating rezoning to higher densities. Demand? Seldom better. Credit? Cheap and unlimited for the qualified.

What impact will the trade war have?

How will this trade war hurt the outside world, and then spill over to the U.S.?

First by deglobalizing. Trade is one of the few economic patterns that can make everyone richer. Trade creates specialization, efficiency, product improvement and low cost. It has negatives, putting out of work the poorly efficient who must redeploy, but they must anyway, sooner or later.

We have not seen a trade war since the last throes of the gold standard in the 1920s. But trade wars were common before. Historians and diggers have found that after the fall of Rome, and the demise of Pax Romana, which had facilitated trade all over Europe, North Africa, and Mesopotamia, the quality of manufactured goods and the size of farm animals fell precipitously.

Trade running in reverse does the same to the quality of life.

Enter black comedy.

Central banks can see this coming, underway in several places. But they have another problem: very little room to cut rates, and desperately frightened of the “zero bound.” Thus a continuous argument worthy of Monty Python: Do we fire our limited ammunition now or save it until it’s ugly? But, if we don’t fire now, then it may get so ugly that firing won’t help.

This conversation is the replacement of the one at the Fed, 2015-2018: Should we raise rates so we have more room to cut? But if we raise, we might make things worse and not have room to cut?

Adrian Orr, governor of New Zealand’s central bank after cutting a half-percent said it best (thanks to The Wall Street Journal and Nick Timiraos): “when you’re [faced with] uncertainty in monetary policies — when you’re in a dark room, there’s an alligator in the room and you kind of walk very, very carefully, but you are certainly going to jump when you feel something.”

Except, of course, instead of rate cuts, which might bloat assets and not help in other ways, we could just stop the tariff war.

Stanley Fischer (bio here) 77 years old and one of the most wise central bankers snapped at a respected younger one who had tried to blame our difficulties on the global monetary system: “The problem is not in the [international monetary system]. It is in the president of the United States.”

Bill Dudley, retired president of the NY Fed, tried this week to say the same thing but bungled so badly that he made life worse for the Fed. Jim Mattis’ WSJ essay (and book, soon) speak directly to the shortfall in U.S. leadership.

Will President Trump blink?

He is not in this fight for economic gain or resolution of true difficulties with China. He does not understand or want to understand, self-surrounded by crackpots (Navarro, Lighthizer) and shills (Kudlow, Mnuchin).

Trade deficits in themselves are not necessarily harmful. President Trump likes to defeat an adversary in public (and from a safe distance) ideally an important adversary who can’t get away and can’t hit back (Chair Powell, for example).

Trump knows nothing of China’s humiliation at the hands of the West, how much of its current misbehavior has been entitled by that experience and that China will suffer anything to avoid repeated Western humiliation. Nor does he understand that China can and will hit back.

We can negotiate better commercial behavior by China — with allies and in private and with patience. But, blinking? Now? On either side? This looks like 1914.

The black comedy extends to the president’s misunderstanding of all economics, except that low rates are good for real estate developers. Wednesday’s presidential tweet: “Our Federal Reserve cannot ‘mentally’ keep up with the competition — other countries. At the G-7 in France, all of the other Leaders were giddy about how low their Interest Costs have gone. Germany is actually ‘getting paid’ to borrow money — ZERO INTEREST PLUS! No Clue Fed!”

Um … everyone at the G7 and every central banker is terrified by the advent of negative rates, that they might not work, and by the economic conditions causing them.

Friday’s twerp: “The Euro is dropping against the Dollar “like crazy,” giving them a big export and manufacturing advantage … and the Fed does NOTHING!”

In reality the euro has dropped below 110/dollar because of new Brexit worries, nothing to do with the Fed.

And on to Brexit

So, at that point drop all previous threads, and in the spirit of schadenfreude (enjoying someone else’s troubles), touch on Brexit.

The first thing: Americans are charmed by UK accents and hence cannot imagine political combat more extreme than any here — and often feelings to match, driven there by deep and multifaceted classism (education, accent, line of work if any) and nationalism (Irish, Scot, Welsh and the ancient hostilities within England).

Be very skeptical of all media discussions, heavily biased to the upper crust and one-worlders.

Prime Minister Boris Johnson, not a Trumpist, might prove to be an effective PM, is not highjacking the UK by suspending parliament, and is above all else forcing the UK to decide after two years of fruitless screeching like packs of baboons. The UK voted to leave.

Did it mean it? A ComRes/Telegraph poll two weeks ago found 54 percent to 46 percent agreement that Johnson should deliver Brexit on any terms. No one would know that from the U.S. media.

Every element of the descriptions above points to lower rates, except insofar as they have already fallen.

Roundup

The 10-year T-note in the past three years:

The Atlanta Fed GDP Tracker … slipping to 2 percent changes nothing:

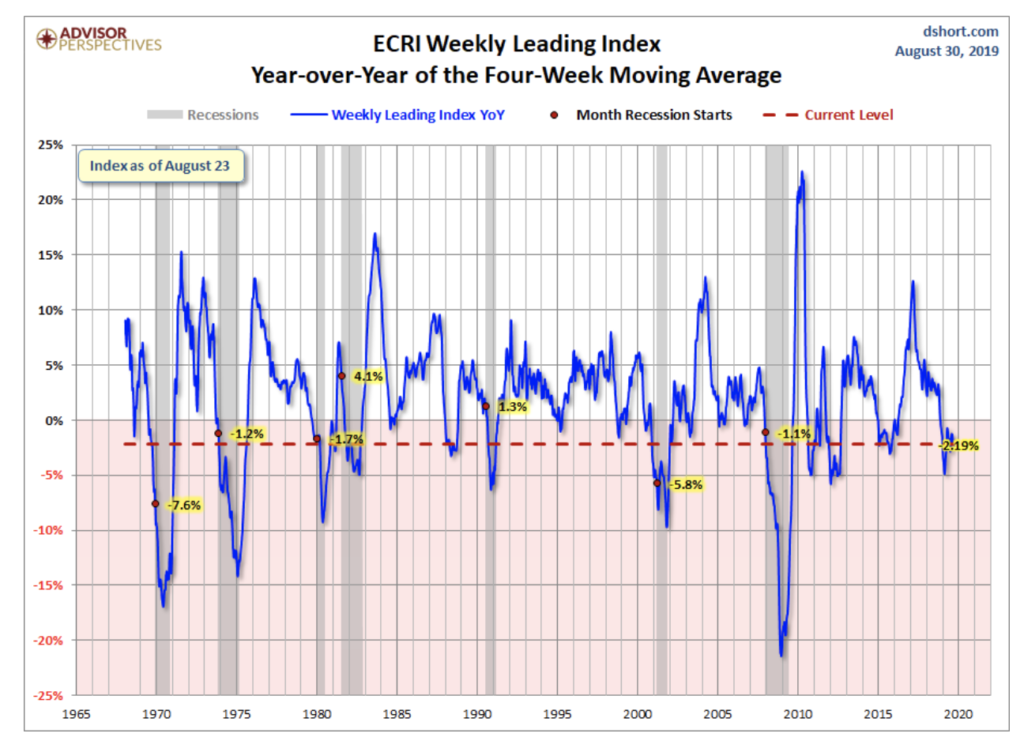

Atlanta uses real-time GDP components to make its forecasts. The ECRI uses a different, elaborate algorithm but gets the same answer. Steady: