Embattled co-working startup WeWork reportedly posted a loss of $1.25 billion in the third quarter, as the company scrapped an initial public offering ahead of a takeover by top investor SoftBank. The new disclosure of a $1.25 billion loss and $934 million in revenue, as the company fails to rein in its spending, came in a report to debtholders obtained by the Wall Street Journal.

WeWork’s mounting losses were first reported in the company’s S-1 document, filed prior to its attempt to go public. That document revealed the company lost $1.9 billion last year, while posting revenue of $1.8 billion. In the third quarter of last year, WeWork posted a loss of $497 million.

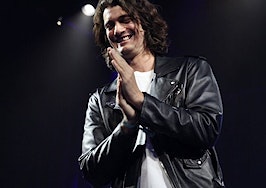

WeWork came under 80 percent ownership by Softbank last month while the firm’s former CEO, Adam Neumann, will receive up $1.7 billion to relinquish his voting rights. Neumann stepped aside as CEO in September shortly after the failed initial public offering.

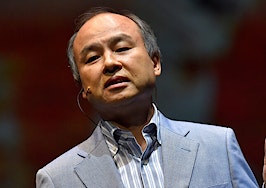

Meanwhile SoftBank itself just posted a net loss of slightly more than 700 billion Japanese yen – or approximately $6.4 billion – in the second quarter of the fiscal year ending March 31, 2020. During an investor conference, SoftBank CEO Masayoshi Son addressed WeWork’s plummeting valuation, which saw SoftBank lose approximately $4.6 billion in its WeWork stock value from that valuation decline.

“The impact of the Vision Fund due to WeWork and also to SoftBank group was quite a large impact that we’ve been seeing,” Son said, through an interpreter. “That’s my judgment. The investment was not right in many ways. I regret [it] in many ways.”