Amid an ongoing pandemic-inflected housing market, Keller Williams saw its number of North American transactions and new listings dip slightly in the third quarter of this year, though strong price appreciation helped buoy the franchisor’s sales volume above last year’s numbers.

Those numbers came in the company’s latest earnings report, which offered some insights into recent operations but didn’t answer the biggest question everyone has been asking about Keller Williams for the last year: Will it go public?

Because the company is not publicly traded, KW is not required to report revenue, profits or losses in its earnings reports, and indeed opts not to do so.

The report, published Wednesday, does reveal that between July and September, Keller Williams agents in the U.S. and Canada closed 371,700 transactions. Agents in anglophone North America also took on 204,600 new listings and wrote 393,600 contracts, the latter of which indicate projected closings in the near future. In total, these numbers mean that year-over-year transactions were down 0.8 percent, new listings were down 1.8 percent and new contracts were down 3.5 percent.

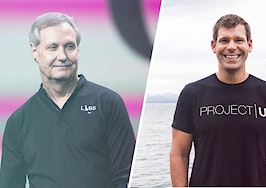

Jason Abrams

In the report, Jason Abrams, head of industry for parent company kwx, indicated the year-over-year dips in those numbers had to do with the unique market dynamics of the pandemic in 2020.

“We are pleased with our productivity metrics in the U.S. and Canada, while we declined slightly resulting from the base effect of Q3 last year,” Abrams said in the report. “Unprecedented for our times, the COVID shutdowns in late Q1 and in Q2 ’20 allowed for a significant influx of pent-up housing demand to hit our agents in Q3 of 2020.”

In other words, Abrams is indicating that the fall of 2020 didn’t see the normal seasonality that usually slows the market down in the final months of a given year. That makes it a challenging baseline against which to compare 2021, when some seasonality returned.

However, despite those numbers, the report also notes that sales volume in the third quarter of 2021 jumped 17.7 percent year-over-year to $150.0 billion — apparently a reflection of the appreciation that has sent home prices soaring in much of the U.S. over the course of the pandemic.

The report further notes that as of the end of September, Keller Williams had a total of 188,244 agents across the world, including 174,155 in the U.S. and Canada. That’s up 8.3 percent year-over-year, and also represents a jump of more than 3,500 agents compared to the previous quarter.

Marc King

Speaking about Keller Williams’ agent count, President Marc King said, “In Q3, we’ve netted substantial agent gains, which is best positioning us to reap dividends in market share going forward.”

Keller Williams additionally said that its market share currently stands at 10.6 percent in the U.S.

Overall, Keller Williams also reported gains in year-to-date numbers as compared to 2020. Total transactions in 2021 by the end of September were up 16.1 percent compared to the same period in 2020, while sales volume was up 39.1 percent and new listings were up 4.5 percent.

The company also saw gains in its worldwide numbers, with transactions in the third quarter up 36.3 percent compared to 2020 and sales volume up 74.5 percent.

Again, Keller Williams is not a public company, and thus not required to report the same figures, such as profit or loss, as other major names in real estate such as Realogy, Compass or eXp Realty. Or at least, it’s not required to report those figures for the time being.

In fact, for more than a year industry observers have speculated that Keller Williams is, or should be, preparing to go public. The company has undertaken strategic moves that have fueled this speculation, such as organizing a holding company and making a variety of leadership hires. And earlier this year, CEO Carl Liebert indicated there might be news regarding an IPO near the end of the summer.

But that timeframe came and went, and so far the company has not publicly committed one way or another.

After reviewing this week’s earnings report, Inman reached out to ask the company if it had any news regarding an IPO. In response, a company spokesperson replied in an email that “we understand there’s a lot of speculation.”

“Right now, we are focused on creating alignment, scale and efficiencies across the KW ecosystem,” the email noted. “Over the short term, we’ll continue to have more exciting developments to share on our momentum. We remain focused on continuing to deliver and innovate on our world-class customer experiences at scale, while keeping the agent at the center of the real estate experience.”