After a 20-month run-up in the price of rent, there are signs that this market, too, is shifting.

After a brief lull during the onset of the pandemic, rent began to spike in December 2020 at rates much higher than the historical average.

That breakneck increase continued for nearly two-straight years, outlasting a similar spike in home sales prices, which peaked in May. Last week, Apartments.com issued a report that included a possible warning to investors and builders.

“We’re seeing a complete reversal of market conditions in just 12 months, going from demand significantly outstripping available units to now new deliveries outpacing lackluster demand,” said Jay Lybik, the national director of multifamily analytics for CoStar Group.

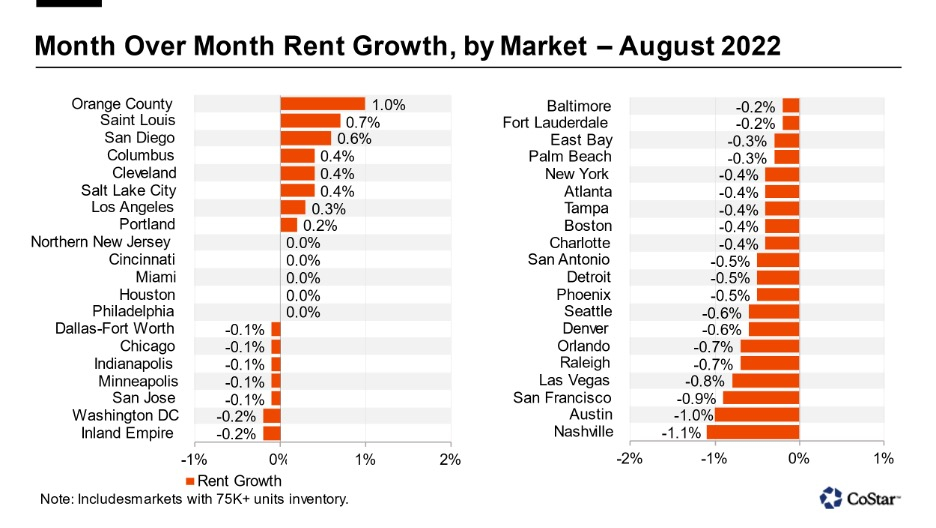

CoStar found signs of a “deterioration” in the apartment rental market, with rent actually dropping month over month in Nashville, Tennessee; Austin, Texas; San Francisco and other major markets.

So is the nation seeing what CoStar called the early signs of a “deteriorating rental market?”

A number of economists confirmed reports show the breakneck run-up in rental prices month after month has begun to slow.

“Rent growth has slowed back down in 2022 after peaking this February, as high rent prices have now discouraged some renters and sent many back to money-saving techniques like living with roommates or family,” said Jeff Zucker, senior economist with Zillow. “Once rental vacancy rates begin to rise, that will further cool the pace of rent growth.”

But what may be happening with rents nationally is a return to cyclical patterns around renting that are closer to historical norms. Basically, the market may finally be settling down after a long adjustment period brought on by the early days of the pandemic.

“We’re still showing prices are increasing, but the rate of increase is coming down,” said Brian Carberry, senior managing editor with Rent. “I don’t think we’re going to get to a point where all of the sudden we’ve reached that plateau and prices plummet.”

Rent. is preparing to release its figures for rent changes in August, which will show a deceleration of rent prices that Carberry said is more in line with the normal slowdown that happens after the summer.

“We’re still showing prices are increasing,” Carberry said, “but the rate of increase is coming down.”

Economists will know within a few months whether the nation is returning to what Carberry called a traditional cycle of rent remaining relatively flat through the winter and rising in the spring and summer.

Rent remains up year over year, and long-term, the changes may depend on the rate of homebuilding, changes in inflation and broader economic trends.

National Association of Realtors Chief Economist Lawrence Yun said the lack of rental housing supply was helping to drive up prices at “extraordinary” rates.

The number of people looking for homes to rent still far outnumbers the number of homes for rent, and record high home prices paired with a rapid rise in mortgage rates has blocked would-be buyers from leaving the rental market.

“There is a housing shortage on both rental and ownership,” Yun said. “It’s good to see that supply is catching up on apartments. However, there are still not enough single-family homes on the affordable side.”

At the onset of the pandemic, rent prices largely remained stable. That changed at the end of 2020. Historically, rent prices climb between 3 percent and 8 percent annually.

In some markets, like across Florida and New York City, rent has pushed above 40 percent year over year. Others began to show signs of slowing mid-summer.

Looking ahead, Zillow Senior Economist Jeff Zucker says there will be competing factors that will determine the cost of rent.

“Rent growth will be under competing pressures: it is being pushed up by people delaying homeownership due to affordability challenges, but also being moderated by so many renters hitting an affordability ceiling with rents,” Zucker said.

“Together these forces will still leave rent growing in 2023 at a much slower pace than in 2021 or early 2022, but renters should not expect to see rents actually decline measurably on a year-over-year basis,” he said. “Saving up for a down payment is the biggest hurdle facing first-time home buyers and rising rents will continue to add to that challenge.”

Get Inman’s Property Portfolio Newsletter delivered right to your inbox. A weekly roundup of news that real estate investors need to stay on top, delivered every Tuesday. Click here to subscribe.