In May, we’ll go deep on money and finance for a special theme month, by talking to leaders about where the mortgage market is heading and how technology and business strategies are evolving to suit the needs of buyers now. A prestigious new set of awards, called Best of Finance, debuts this month too, celebrating the leaders in this space. And subscribe to Mortgage Brief for weekly updates all year long.

Mortgage giants Fannie Mae and Freddie Mac remained profitable and continued to build their net worths during the first quarter, even as the volume of mortgages they backed dropped to levels not seen in years.

Fannie and Freddie — which don’t make loans themselves but guarantee payments to investors who fund most U.S. mortgages — acquired $127 billion in single-family mortgages during the first three months of the year, a 72 percent decline from a year ago.

A sharp uptick in interest rates sharply curtailed mortgage refinancing last year. But Fannie and Freddie have also seen their purchase mortgage acquisitions shrink, as inventory shortages driven in part by the “lock-in effect” created by higher rates limit home sales.

Fannie and Freddie’s new mortgage business shrinks

The $57 billion in single-family purchase loans Fannie Mae acquired during the first quarter represented a 45 percent drop from the same time a year ago. In reporting first quarter results, Fannie Mae said refinancing volume shrank by 92 percent over the same period to $11 billion.

On a call with investment analysts, Fannie Mae Chief Financial Officer Chryssa Halley said it was the company’s slowest quarter for mortgage acquisitions since the third quarter of 2000.

Chryssa Halley

“We expect home sales activity this year will continue to decline compared to 2022 due to elevated mortgage rates, continued low home affordability” and a “modest” recession forecast for the second half of 2023, Halley said.

Freddie Mac reported new single-family mortgage business totaled $59 billion during the first quarter, a 72 percent drop from a year ago and the lowest volume since 2014. Of the 190,000 mortgages Freddie backed, 54 percent were affordable to low- to moderate-income families and 72,000 were taken out by first-time homebuyers, the company said.

Michael DeVito

“Freddie Mac’s solid performance in the first quarter helped promote sustainable homeownership and rental opportunities across the nation,” CEO Michael DeVito said in a statement. “In an uncertain economic environment, we remain focused on our mission and will continue to serve as a stabilizing force for the housing finance system.”

While the mortgage industry as a whole shrank last year as interest rates climbed, the end of the refinancing boom did cut into Fannie and Freddie’s market share. The mortgage giants backed about 53 percent of all originations last year, down from 59 percent in 2021, according to figures compiled by Inside Mortgage Finance and the Urban Institute’s Housing Finance Policy Center.

But much of the market share lost by Fannie and Freddie was picked up by government-backed FHA and VA loan programs, which grew their market share from 16.5 percent in 2021 to 19.8 percent in 2022. Portfolio lenders like banks that keep mortgages on their books rather than selling them to investors, accounted for 23.7 percent of mortgage originations last year, up from 21.8 percent in 2021.

Mortgage giants boost Q1 profits

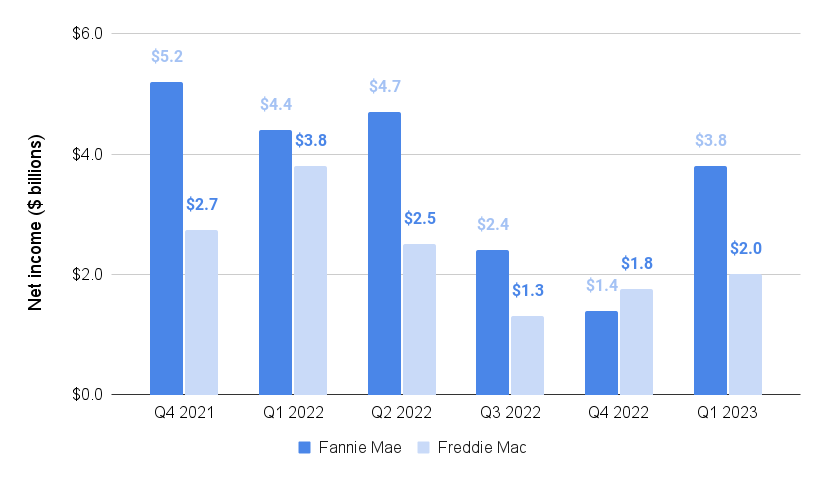

Despite the continued decline in mortgage acquisitions, Fannie and Freddie both managed to boost profits during the first quarter, thanks in large part to the strong performance of loans in their portfolios.

Fannie Mae saw net income grow by $2.3 billion from the fourth quarter to $3.8 billion, primarily due to a $3.2 billion decrease in provision for credit losses. Freddie Mac reported $2 billion in net income, up 13 percent from the fourth quarter.

But compared to the same time a year ago, profits at Fannie and Freddie posted double-digit declines. Fannie Mae’s net income was down 14 percent from a year ago, while profits at Freddie Mac were down 47 percent from a year ago on lower net revenues and a credit reserve build.

“Our single-family serious delinquency rate as of the end of the first quarter was 59 basis points,” Halley said. “While this is the lowest level we have seen since 2005, based on the macroeconomic environment, we expect the credit performance of the loans in our single-family guaranty book will decline compared to recent performance, which could lead to higher delinquencies or an increase in our serious delinquency rate.”

Fannie and Freddie’s portfolio growth flatlines

The slowdown in new purchase loan and refinancing business meant Fannie and Freddie haven’t grown their mortgage portfolios this year — Fannie Mae’s single-family book actually declined by approximately $300 million compared to the fourth quarter of 2022, as old loans were paid off faster than new ones were acquired.

At a combined $6.62 trillion, the mortgage giants have grown their portfolios by just 3 percent over the last year.

Fannie and Freddie’s combined net worth surpasses $100 billion

With income still flowing in from guarantee fees and mortgages performing well, the mortgage giants boosted their combined net worth to just over $103 billion.

Fannie Mae’s net worth — the stockholders’ equity was up 24 percent from a year ago to $64 billion as of March 31, thanks to the $3.8 billion in comprehensive income during the first quarter. Similarly, Freddie Mac grew its net worth by 23 percent over the same period to $39.1 billion.

Priscilla Almodovar

“We have been able to generate these strong results — and to be there for America’s homeowners and renters — because of how we effectively managed the risks of our business,” Fannie Mae CEO Priscilla Almodovar told investment analysts.

The government-sponsored enterprises (GSEs) have come a long way since being placed into government conservatorship in 2008, as potential losses from the subprime mortgage meltdown threatened to put them out of business. Once they’ve built up enough capital, they could conceivably be released from government conservatorship — if policymakers ever agree on just how to do that.

Former Freddie Mac CEO Donald Layton has estimated that Fannie and Freddie could be considered recapitalized when their combined net worth hits $150 billion.

But the actual amount needed would depend on how the mortgage giants might be structured when released from conservancy and how much of a backstop the government would provide.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.