In these times, double down — on your skills, on your knowledge, on you. Join us August 8-10 at Inman Connect Las Vegas to lean into the shift and learn from the best. Get your ticket now for the best price.

With the approval of shareholders, struggling iBuyer Offerpad will execute a reverse stock split Monday in a bid to save the company from being delisted from the New York Stock Exchange.

Offerpad received a noncompliance notice from the exchange on Nov. 15 after the closing price of the company’s shares fell below the required $1 average over a consecutive 30-day trading period.

Shares in Offerpad had briefly surged above $1 in February after the company announced a plan to raise $90 million from existing investors, including CEO Brian Bair, Roberto Sella and First American Financial Corp. But shares in the pioneering iBuyer failed to maintain the minimum $1 average over 30 trading days.

Offerpad’s board of directors announced the 1-for-15 reverse stock split on June 8, the same day investors approved the move at the company’s annual shareholder meeting. After markets close Monday night, every 15 shares of outstanding Offerpad common stock will be automatically converted into one share.

The stock split affects all stockholders uniformly and doesn’t alter any shareholder’s percentage interest in the company. So in theory, at least, each share in Offerpad will be worth about 15 times as much when the New York Stock Exchange opens on Tuesday.

Shares in Offerpad, which over the last year have traded for as little as 37 cents and as much as $3.80, closed at 52 cents Monday, down 19 percent from Friday’s close of 64 cents.

There’s no guarantee that Offerpad’s share price will get a boost from the reverse split that’s exactly proportional to the reduction in outstanding shares. But Monday’s closing price implies that each share in Offerpad should be worth more than $7 on Wednesday — well above the New York Stock Exchange’s $1 minimum threshold.

Offerpad’s board of directors recommended the reverse stock split in an April 24 proxy statement, saying it “could be” an effective means of regaining compliance with the exchange’s minimum share price requirements.

“The board believes that continued listing on the [New York Stock Exchange] provides overall credibility to an investment in our stock, given the stringent listing and disclosure requirements of the NYSE,” investors were told. “Notably, some trading firms discourage investors from investing in lower-priced stocks that are traded in the over-the-counter market because they are not held to the same stringent standards.”

In addition, a higher stock price “could help generate investor interest in the company and help attract, retain, and motivate employees,” the board advised investors. Some potential employees “are less likely to work for the company if we have a low stock price or are no longer listed on the [New York Stock Exchange], regardless of the size of our overall market capitalization.”

Valued at $2.7 billion when the company went public in a September 2021 SPAC merger with Spencer Rascoff-led Supernova Partners Acquisition Company Inc., Offerpad’s market capitalization is closer to $200 million today.

Offerpad stems losses

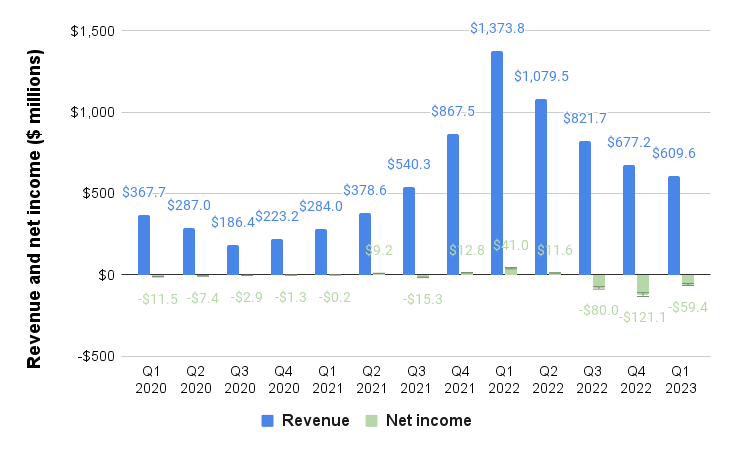

Source: Offerpad regulatory filings

After bringing in record revenue ($1.37 billion) and profits ($41 million) during the first quarter of 2022, Offerpad has posted four consecutive quarters of declining revenue and hasn’t been profitable since the second quarter of 2022.

Other iBuyers also struggled last year as rising mortgage rates and home prices took a toll on home sales. But Offerpad managed to trim its Q1 2023 net loss to $59.4 million, about half of the $121.1 million net loss it racked up in the previous quarter.

To weather the downturn, Offerpad has laid off half its workforce and sold 99 percent of its “legacy” inventory during Q1 2023, acquiring just 364 homes.

For now, Offerpad has pivoted to primarily providing “asset light” services that streamline transactions and facilitate sales directly to buyers, rather than buying and selling houses itself.

Offerpad’s Direct Plus service connects institutional buyers with sellers, and the company is also providing renovation as a service. The company also sees opportunities to build its bottom line by bundling ancillary services, such as mortgage, title and renovations.

In reporting first-quarter earnings, Offerpad said it expects to sell 400 to 550 homes during Q2 2023, with expected revenue of $140 million to $200 million and an adjusted loss of between $25 million to $40 million.

While the $90 million private placement announced in February diluted existing investors’ stake in Offerpad by 65 percent, it extended the company’s cash burn runway by six months to a year, according to analysts at Keefe, Bruyette & Woods (KBW) led by Ryan Tomasello.

“Closing a $90 million private placement when the macro environment posed substantial hurdles to accessing capital was a significant accomplishment,” Offerpad Chairman and CEO Brian Bair said in a letter to shareholders prefacing the company’s 2022 annual report. “In addition, participation by current and new shareholders demonstrated continued confidence in our strategy and our ability to drive long-term value for our customers and shareholders.”

Bair said Offerpad is “now ready to move forward and capitalize on future opportunities with a 2023 strategic plan that incorporates things we have learned from past experience and seeks to expand upon our existing strengths.”

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.