A large Southern California real estate broker was recently on a listing presentation for a $7 million home when the seller said, “Now let’s talk about your commission. You just aren’t worth $350,000.”

A large California real estate broker was recently on a listing presentation for a multi-million dollar home when the seller said, “Now let’s talk about your commission. You just aren’t worth $350,000.”

The veteran and respected broker woefully thought to himself, “He is right. I am not.”

Commission compression is common in a seller’s market, but something else may be at work as the Internet makes consumers smarter and emboldens them to challenge almost every aspect of a real estate transaction.

Read the special report in its entirety.

Further muddling the picture for the traditional brokers is a horde of new hybrid brokerages, which expressly offer lower commissions as part of their business models.

“The noise doesn’t help,” said the California broker.

Hybrid brokerages provide an alternative to the traditional broker commission and service model, offering everything from discounted listing fees and buyer rebates to innovative technology and salaried agents.

Inman did a deep dive into this burgeoning segment of the industry to get a fix on their prospects for success and how they work inside and outside the traditional broker model. Our extensive report also offers insights into how agents and brokers might compete with or work with these new business models.

Many agents say the latest hybrid brokerages are destined to bite the dust, arguing that they look no different from discount brokerages that have faltered in the past, according to a new Inman survey. See full survey results here.

Yet a meaningful share also said that hybrid brokerages are on the rise, and stand a better shot at succeeding than past industry upstarts.

As consumers continue to find real estate information online, hybrid brokerages use discounts, technology and new business practices to grab more market share than their predecessors.

The most successful hybrid brokerages, like Redfin, seem to end up embracing some traditional practices — like providing hands-on agent service and rewarding agents for productivity. Likewise, many traditional brokerages have thrived, in part, by adopting technology and business practices from hybrids.

The new hybrids may be where the twain meet for the new and old real estate industry. These new broker models use agents, though often in a different capacity. And older brokerages are quickly adopting technology and reorganizing their people resources, such as using teams to become more efficient.

“I look at them [hybrids] for ideas that I can incorporate into my traditional brokerage to enhance our productivity and customer service,” said one survey respondent about hybrid brokerages. “In a way, they are the R&D division of the real estate industry. I will use the good ideas and ignore the bad ones.”

Indeed, the relationship between hybrid and traditional brokerages may be more symbiotic than adversarial: The two types of brokerages are feeding off each other, breeding new business models that offer something from both worlds. Until some breakthrough technology is unleashed, do-it-yourself for-sale-by-owner (FSBO) models are not getting traction — but some of the hybrids may have legs.

Even the rhetoric has toned down. Once an industry trash talker, Redfin’s CEO Glenn Kelman now says, “The market needs Redfin and it needs Coldwell Banker; neither are going away.”

See a timeline capturing the rise of hybrid brokerages.

Last month, Realogy hosted its FWD Innovation Summit where it picked 15 emerging technology companies and selected three finalists — including SOLOpro, a new online marketplace that connects homebuyers with buy-side agents offering unbundled services and a buyer rebate, which equates to discount commission.

“We are business model-agnostic. We don’t tell you how to cook the fries; there is room for everyone,” said Alex Perriello, president and CEO, Realogy Franchise Group.

Learn more about the SOLOpro business model.

But the relationship between hybrid brokerages and their traditional counterparts can still be fraught.

Survey respondents said that hybrid brokerages put downward pressure on commissions and force traditional agents to do more than their fair share of work in a transaction. This was one reason why agents commonly discriminate against hybrid brokerages, respondents reported.

Kelman says a new crop of hybrid brokerages “are a growing segment of the industry.” They represent his new competition, not traditional brokers.

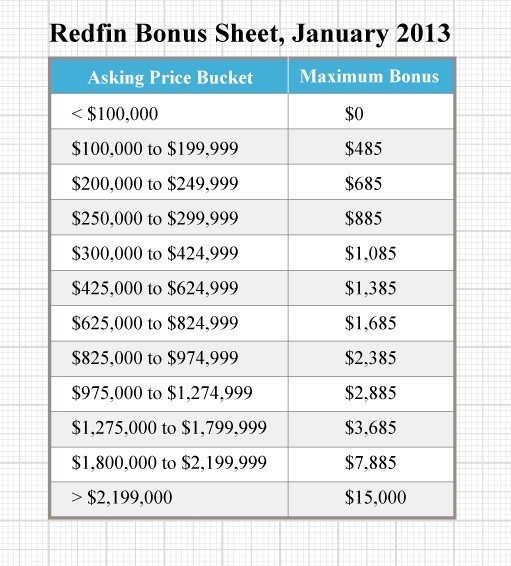

The 10-year-old company is the leader of the hybrid brokerage pack, operating in 72 markets. Its real estate agents earn bonuses based partly on customer satisfaction, not just commission. The firm also gives part of the buyer’s broker’s commission split back to the buyer in the form of a refund.

Redfin charges sellers a listing fee of 1.5 percent, instead of the typical 2.5 to 3 percent, and advises clients to offer a standard commission split (also typically 2.5 to 3 percent) to brokers for bringing a buyer to a sale. So sellers who work with Redfin usually pay 4 to 4.5 percent in commission, compared with the going rate of 5 to 6 percent.

Some technologies that Redfin uses and that are increasing the efficiency of traditional and hybrid brokerages and empowering consumers include: Property and neighborhood search websites, transaction, task and contact management systems, instant-offer and showing-scheduling tools, 3-D home tours, property search websites, online lead generation, automated valuation and comparative market analysis (CMA) tools, digital lockboxes and interactive education resources.

Nearly half of respondents to Inman’s survey said that hybrid brokerages aren’t on the rise, with close to 65 percent saying they’ve never closed a transaction with a hybrid brokerage and about the same share claiming to have never lost a potential client to a hybrid brokerage.

Just a fad?

Brokerages that charge discount commissions typically nibble away at the business of traditional brokerages during upswings, but they tend to disappear once the market slumps, respondents say.

“Right now we are in a seller’s market. When the pendulum swings the other way, as we all know it will, there will be more [customers] who believe the commission paid to their agent belongs to them,” said Minnesota agent and Inman contributor Teresa Boardman.

The latest batch of hybrid brokerages will suffer the same fate, according to some critics. That’s because, skeptics say, they are mostly just rehashing the discount business model.

Only 2 out of 10 respondents said that the latest hybrid brokerages use business models that are substantially different from old alternative brokerage models.

Learn more about a hybrid business model from the past that boomed but then busted.

Agents also note that hybrid brokerages are only a “slice of pizza in a large pie, there is enough business for everyone,” according to one respondent.

But to dismiss hybrid brokerages might be a mistake. A significant share of respondents (34 percent) said that hybrid brokerages are on the rise, while large shares of respondents expressed uncertainty over whether hybrid brokerages were making inroads or pioneering new business models.

Today’s market conditions work in favor of hybrid listing brokerages.

“Sellers are realizing that almost anywhere in the country, we’ve got a really hot seller’s market,” said Jude Rasmus, a top-rated 25-year real estate vet who recently co-founded the hybrid brokerage Virgent Realty. “It’s a great time to launch a brokerage like this.”

Virgent Realty is the type of hybrid brokerage that respondents say is most likely to excel: It offers a typical commission split to buyer’s brokers, not a below-average split, like some other hybrid brokerages that many see as less promising.

Left to right: Xi Li, Don Griffin, Jude Rasmus, Kenny Selmon and Kim Pope of Virgent Realty

Learn more about the Virgent business model.

Critics of hybrid brokerages abound, but many agents also see a silver lining to their emergence. About 35 percent say hybrid brokerages will push traditional agents to provide a higher level of service, and close to half (46 percent) say they will spur agents to adopt innovative technology.

The reason why no hybrid brokerage has disrupted the industry so far may be because traditional brokerages have been adept at borrowing technology and business practices from hybrid brokerages.

For example, traditional brokerages may have neutralized the threat of hybrid brokerages in the mid-2000s by adopting the business practice that differentiated hybrid brokerages at the time: publishing MLS data online.

Just as some traditional brokerages have sharpened their competitive edge by cherry-picking business practices from hybrid brokerages, hybrid brokerages have also been able to improve their service models by taking cues from traditional brokerages.

Redfin has gradually drifted towards a more conventional business model, scaling back its rebates to buyers, rewarding agents more for their productivity and requiring full-time agents to spend more time working with clients in person.

Learn more about how Redfin’s Kellman thinks about the hybrid trend.

Source: 2013 numbers provided by a former Redfin employee. Redfin said it was not able to confirm the veracity of the numbers. Redfin told Inman News it increased its bonuses in 2014.

Redfin CEO Glenn Kelman said he has learned over the years that consumers often need personalized, hands-on care to navigate the emotional twists and turns of many real estate transactions.

Many respondents said hybrid brokerages don’t address that need, which could account for why 6 out of 10 survey participants said hybrid brokerages could provide value to only a small minority of consumers.

Even though consumers will increasingly be drawn to buying and selling homes online, “There will still need to be an element of personal contact and relationship building,” one respondent said.

Compass, a New York City-based brokerage that has poured millions into developing proprietary technology for its agents and clients, is another example of a hybrid brokerage that has embraced traditional practices.

Compass’ lavish Manhattan office offers a wide array of amenities, including a pool table (pictured above), pingpong table and video game room.

The brokerage stopped paying agents salaries and bonuses after executives realized that Compass could attract top talent only by paying agents commission.

And it stopped offering a discount listing fee after customers indicated that “that they preferred to work with experienced agents at market commission rates than inexperienced agents at discount rates,” Compass CEO Robert Reffkin told Inman.

Learn more about the Compass business model.

New York City-based TripleMint hasn’t ditched its original compensation model. The hybrid brokerage pays agents salaries, equity and bonuses based on customer satisfaction. But it’s scrapped the rebates it used to offer to buyers.

“Given our higher-end brand and client base, anything we can do to help our clients buy apartments for less or sell them for more is more valuable than any rebate,” said TripleMint CEO David Walker.

“No one wants to wait through phone prompts to speak with someone overseas or in another state about a problem,” one respondent said about hybrid brokerages. “If you don’t have a dedicated agent, things will get lost in the process. Time kills deals.”

And forget that hogwash about millennials being more rational than their parents, added another.

“I work with millennials on a regular basis and have been in business for over 30 years and I find millennials to be just as emotional about the process as any other generation and probably even more so,” the respondent said.

But Redfin believes the market may be approaching a tipping point with hybrid brokers — not putting traditional brokers out of business, but getting meaningful share because of a new generation of consumers.

Although hybrid brokerages may not be keeping most agents up at night, around half of respondents said they believe hybrid brokerages will negatively impact traditional agents overall, put downward pressure on commissions and spur traditional agents to adopt new technology.

Hybrid chutzpah

David Eraker, a co-founder of Redfin, claims the real estate industry has been operating as a “quasi-cartel,” charging fees that dwarf those paid by consumers in many other countries.

His brokerage, Surefield, prequalifies buyers by asking them to explore a virtual 3-D model of each of its listings before requesting a showing.

That results in cost savings that the brokerage passes on to clients in the form of a 1.5 percent listing fee, Eraker says.

The brokerage also offers just $2,000 in compensation to brokers who bring a buyer to the closing table, claiming that the ubiquity of listings online and its 3-D models justify that offer.

Surefield has listed only 25 homes since launching in April 2014, and it might or might not succeed. But the firm embodies the chutzpah of the hybrid brokerages that industry veterans would be wise to recognize — if only for their rhetoric.

Learn more about the Surefield business model.

Ten years ago, San Diego discount broker iPayOne was flying high.

The firm promised to trim agent commissions to just 1 percent with a model that area agents say was built around making mortgage loans to consumers. Backed by loads of investor cash, it spent heavily on marketing, including a five-year, $2.5 million contract in 2005 for naming rights to the San Diego Sports Arena.

In early 2007, the firm had 74 active listings of the 16,900 in the local multiple listing service and abruptly stopped taking on new business.

Learn more about the history of iPayOne.

Small footprint, big funding

Hybrid brokerages haven’t picked up much market share so far.

Two exceptions would be Redfin and Compass, the venture-backed New York City brokerage that has invested heavily in developing technology for its agents and clients.

Redfin says it employs more than 1,000 salaried agents in 72 markets.

Compass, which has largely morphed into a traditional brokerage and no longer offers a discount listing fee, said it’s ranked sixth by listing volume in New York City and Washington, D.C. The brokerage is also setting up shop in Miami, Boston, Los Angeles, Chicago and San Francisco, according to CEO Robert Reffkin.

Investment capital is playing a big role in these new ventures.

Take Xome, for example. Nationstar Mortgage Holdings, a publicly traded company valued at $1.9 billion, acquired another firm for $18 million to render the asset into one of the many gears powering the end-to-end home-shopping platform.

Learn more about the Xome business model.

Opendoor, which has been described as a “big data home flipper,” has raised $30 million in two rounds of funding. It only launched in December of 2014.

Learn more about the Opendoor business model.

Redfin has spent $100 million to carve out its national footprint.

And don’t forget Compass.

Just a year after bursting on the real estate scene, the hybrid brokerage, which quickly scrapped some unconventional business practices in favor of traditional ones, had raised $73 million at a valuation of $360 million.

Hybrid brokerage types

Most hybrid brokerages claim to reduce costs by combining innovative technology and business practices, then passing those savings on to consumers in the form of reduced fees.

Common business models of hybrid brokerages include:

1. Discount buyer’s brokerages

These brokerages, typified by Redfin, refund a portion of their commission split to buyers.

2. Discount listing brokerages that recommend offering a typical commission split to buyer’s brokers (for example, 2.5 to 3 percent)

This type of hybrid brokerage, also exemplified by Redfin, charges a discount listing fee, but advises clients to offer a typical commission split to buyer’s brokers.

3. Discount listing brokerages that recommend offering less than a typical commission split to buyer’s brokers (for example, 1.5 percent or a flat rate of $3,000)

These discount listing brokerages advise seller clients to offer less compensation to buyer’s brokers for bringing a buyer to the closing table. Your Home Direct, which made waves in the early 2000s, then was bought by Foxtons before going under when the market tanked, took this approach. Brassy discount brokerages Surefield and Trelora also employ this business model.

4. Online end-to-end home-shopping and selling platforms

The newest breed of hybrid brokerage, these firms promise a wide range of real estate services online. They can provide in-house or partner agents, transaction management platforms and ancillary services including mortgage financing and title insurance.

Xome, Owners.com, Auction.com and Opendoor are among brokerages pioneering variations of this type of business model. (Many traditional brokers provide transaction management systems to clients and indirectly offer or connect consumers with ancillary services as well. The difference is that home shopping and selling platforms are trying to help consumers access those services seamlessly through a single dashboard.)

5. Agent-matching services

These businesses don’t act like brokerages, but they represent a relatively new and evolving type of real estate service. They typically get brokerage licenses to qualify for membership in the MLS, and then use MLS data, like agents’ transaction histories, to match agents with consumers.

(Note: Inman Publisher Brad Inman founded an agent-matching service 15 years ago, which he sold to Classified Ventures in 2005.)

Listing side seen as most promising for hybrids

Hybrid brokerages that serve sellers stand the best shot at impacting the industry, according to Inman’s survey.

More than two times the number of respondents said that hybrid brokerages are likely to succeed serving sellers than respondents who said hybrid brokerages would succeed serving buyers.

Entrepreneurs have caught on: Agents reported seeing listing hybrid brokerages much more than buyer’s hybrid brokerages.

One reason why listing hybrid brokerages are most likely to succeed, agents say, is because sellers are more commission-conscious than buyers. Unlike buyers, sellers pay commissions directly.

Another reason is that sellers don’t need as much assistance as buyers, according to some agents.

It’s “much easier to do work behind a screen for a seller than a buyer,” said one respondent.

Redfin’s Kelman says, “For whatever reasons, homebuyers do not get the connection between the seller-paid commission and any costs that buyers might indirectly be paying for with the typical commission setup.”

That is why Redfin is increasingly emphasizing its discount listing fee.

Hybrid staples: technology, teams and salaries

Virgent Realty charges sellers a flat fee of $5,000.

Part of the reason why the brokerage says it can afford to charge that rate is because it uses proprietary software to maximize efficiency, according to Rasmus. The brokerage’s pricing tool, for example, lets a seller set an initial price based on comparable homes and then finalize that price through a discussion with a Virgent Realty agent.

Other ways that Virgent Realty allegedly reduces business costs include paying agents salaries and using teams of two to process transactions.

The idea of employed agents as an efficiency strategy has been tried many times and has mixed results. For example, ZipRealty, a hybrid broker that launched in 1999 and was sold to Realogy last year, started out with employed agents and moved to commission-based agents fairly quickly in its in up-and-down history. However, Redfin still believes in the model of agent employees.

Plenty of other hybrid brokerages employ similar business practices, including Redfin and Denver-based Redefy. Many traditional brokers uses these business practices and technology as well. They also could be bending their commissions without explicitly advertising that fact.

Learn more about Redefy’s business model.

Another hybrid brokerage, SQFTx, is offering tech-based referral partnerships with some traditional brokerages to offer a limited-service option to sellers. Brokerages that have partnered with SQFTx offer sellers access to SQFTx’s platform and a restricted set of traditional services for a listing fee of 1 percent. SQFTx and its partner brokerages split the fee evenly between themselves.

Despite Virgent Realty’s promise of offering savings to consumers, the brokerage still advises sellers to offer a typical commission split to buyer’s brokers to attract agents and buyers on the other side.

Learn more about SQFTx’s business model.

Offering savings at buyer’s brokers’ expense

Discount brokerages like Denver-based Trelora, on the other hand, generally offer less generous commission splits to buyer’s brokers. Such brokerages ranked as the third most likely type of hybrid brokerage to impact the industry, according to the Inman survey, behind end-to-end home-shopping and selling platforms.

Learn more about the Trelora business model.

Offering below-average commission splits to buyer’s brokers can reduce the commission fee that listing brokers charge sellers, but critics argue the practice can also limit a listing’s exposure to potential buyers. Buyer’s agents, they say, are less inclined to show listings that don’t pay as much.

Your Home Direct, a brokerage that made waves in the early 2000s, showed that listing brokerages can still make inroads even if they thumb their noses at buyer’s brokers. The brokerage, which originally offered no compensation to buyer’s brokers whatsoever, had 5,000 listings in March 2003 before going bankrupt in 2007. (Your Home Direct’s founder says the housing crash and the company’s eventual decision to offer more compensation to buyer’s brokers were its undoing.)

Trelora says its nine agents sold 464 homes in 2014. Charging a $2,100 listing fee to sellers, Trelora said that 65 percent of seller clients followed its recommendation of offering only $3,000 to buyer’s brokers. So each of those sellers would have paid a total commission of $5,100.

Watch a video explaining Trelora’s business model.

End-to-end platforms

But end-to-end home-shopping and selling platforms are more likely to make a splash than listing brokers like Trelora, according to survey respondents. Only discount listing brokerages that offer typical commission splits to buyer’s brokers were deemed more likely to succeed.

Brokerages offering such platforms are not new, but they come with a new twist: a single point of entry to close. Xome, launched by Nationstar Mortgage Holdings, may have made the most headway so far.

Consumers can use the home shopping platform to search for a property, connect with an agent, acquire a loan from Nationstar’s mortgage lending wing and get title services from the firm’s title division.

A screenshot from Xome’s site.

Opendoor, which employs salaried listing agents, is tackling the end-to-end challenge from a different angle. The startup generates instant offers for sellers based on automated home valuations and claims to be able to close transactions in as little as three days.

Opendoor’s home shopping platform lets buyers make offers on its listings and visit them at anytime using a smartphone. A natural next step for the company would be to offer financing to buyers through a partner lender, or even originate mortgages for buyers itself. The firm’s CEO told Inman that he’s thinking those options over.

Opendoor CEO Eric Wu won’t disclose the number of transactions Opendoor has completed, but he did say that the firm is buying and selling about two homes a day in Phoenix, Arizona. Opendoor displays 55 listings, pending listings and sold properties to buyers who visit its property search page, which shows only Opendoor listings. Like most of these startups in the beginning, their transaction volume does not map to their fundraising success.

Wu said the firm has tentative plans to expand to Dallas and Portland this fall.

If there’s any type of hybrid brokerage that could reshape the industry, it would likely be firms like Opendoor, some industry observers say.

Opendoor’s “how it works” website section.

Industry reaction

Sissy Lappin, broker-owner of Lappin Properties, a traditional brokerage, said she recently received “a voice mail just short of a death threat” from the CEO of a major real estate franchise.

Lappin said the CEO told her, “You need to stop this. The commission is already spiraling out of control. You’re just making the situation worse; we all need to make a living.”

The CEO is referring to ListingDoor, a for-sale-by-owner service recently launched by Lappin to help sellers price, list and market their homes without any help from real estate agents.

Lappin says that her traditional brokerage — which she will operate alongside ListingDoor and has been ranked No.1 in most expensive homes sold by the Houston Business Journal — will continue to offer value to homeowners who don’t have time to sell their homes independently.

The ListingDoor team.

But changes over the last five years have paved the way for hybrid brokerages to gain much more traction than alternative brokerages of the past, she said.

Many more consumers file their taxes, trade stocks and buy insurance online than before the housing recovery kicked into gear. “We are becoming accustomed to doing things on our own, and people are liking it,” she said.

At least a handful of brokers and agents are looking at “joining instead of fighting” the hybrid broker model. Broker Rob Myers said, “The old business model needs to change; we just switched to a flat-fee listing service.

“We are providing a full-service experience, but with technology we save money, so why not pass that on to the consumer,” he added. “Our industry needs to accept technology is changing everything — change with it or get left behind.”

Further empowering consumers, the growth of listing portals and education resources have made it much easier for buyers and sellers to find all the information they need to buy or sell, Lappin said.

Many respondents shared that view: 59 percent said that hybrid brokerages might be on the rise because listing portals have given consumers more confidence that they can transact with less help or no help from agents.

Another change that may favor today’s hybrid brokerages is the shift in MLS data — it is easier to access and publish MLS data than in the past. Thirty-five percent of respondents cited this as a reason why hybrid brokerages may be on the rise.

This was in part made possible by a 2008 settlement of a lawsuit with the National Association of Realtors and the U.S. Justice Department, which freed up listing data to alternative business models.

The other top reasons cited for why hybrid brokerages may be gaining traction aren’t rooted in changes but instead reflect some enduring perceptions of discount brokerages: that they attract business by charging lower fees (53 percent) and misrepresent the complexity of a real estate transaction (38 percent).

Many hybrid brokerages say their technology sets them apart from mainstream competitors.

But few respondents think that technology could be driving growth of hybrid brokerages. Only around 1 in 5 respondents said technology offered to consumers by hybrid brokerages and technology used by hybrid brokerages to increase efficiency might be fueling the rise of hybrid brokerages.

If hybrid brokerages are gaining steam, the survey suggests, evolving consumer habits and online real estate information are the engines stoking that momentum.

Discrimination

Asked if hybrid brokerages would negatively affect traditional agents, 44 percent of respondents said they would, while 41 percent said they wouldn’t. Sixteen percent said they weren’t sure.

Though most agents say they neither worry about hybrid brokerages nor consider them to be a growing force in the market, a majority of respondents said (55 percent) that hybrid brokerages will put downward pressure on commissions by spurring more agents to compete on price.

Two explanations for those seemingly contradictory findings might be:

1. Even if hybrid brokerages don’t gain significant market share, their relative growth would still expose more consumers to lower commission offers, potentially leading more consumers to seek lower fees from traditional agents.

“Large-scale brokerages like Redfin at a minimum can change consumer expectations, even if the model may not have long-term positive [effects],” said one respondent.

“I don’t fear them but hate them for causing damage to incomes [because] they won’t be around for too long to feel the downward pressure on commissions,” said another.

2. Hybrid brokerages, some of which tend to burst onto the scene with aggressive marketing campaigns, sometimes denigrate traditional agents in the process of promoting themselves.

“The consumer already thinks we don’t work,” said one respondent. Hybrid brokerages “will make it worse.” Hybrid brokerages “give the perception that we are overvalued and can do more for less,” said another.

The “constant devaluation of services,” by hybrid brokerages, one respondent added, “impacts all agents.”

Those are two reasons that may account for why 4 out of 10 respondents said they are generally less inclined to cooperate with a hybrid brokerage than a traditional brokerage, and why 56 percent said that many agents discriminate against hybrid brokerages.

Fewer (17 percent) respondents admitted to actually having advised a client against buying from or selling to another person represented by a hybrid brokerage.

Many agents also say they prefer not to work with hybrid brokerages because agents at such firms tend to saddle traditional agents with most of the work in a transaction.

Some agents even worry that they risk inadvertently representing the interests of both the buyer and seller in a transaction involving a hybrid brokerage.

And of course, a turnoff to traditional buyer’s agents are the substandard commission splits offered by some hybrid brokerages that may not map to their workload.

I “don’t want to end up doing both ends of the transaction and get paid for one end,” said one survey participant.

Kelman said attitudes towards hybrid brokerages have improved over the years. And indeed, the industry may be more ripe for innovation compared to the early and mid-2000s before NAR’s settlement with the DOJ.

Kelman argued that a growing segment of the consumer base for real estate is eager to have on-demand services. Redfin at one time believed that having a single point of contact with the same agent throughout the process was critical to delivering good customer service. But many younger buyers are not attached to the idea of a deep agent relationship.

To respond to this need, he said brokerages must rethink how to organize resources. “We’re learning how to do that to meet the need for on-demand, and traditional firms need to do it as well. It is about how we use all of these human resources in real estate.”

And the success of fast-growing Keller Williams, with its emphasis on agents and organization around teams, represents a strategy that blends both worlds.

Read the special report in its entirety.

Inman reporter Paul Hagey contributed to this special report.

Inman Connect San Francisco is right around the corner — register now and save $200!

Start Inman Connect SF off right! Choose from three powerful events on Aug. 4. Reserve your spot now for Agent Connect, Broker Connect and Tech Connect.

![How hybrid brokerages are changing real estate [Special Report]](https://assets.inman.com/wp-content/uploads/2015/07/hybridreportheader-1984x880.jpg)