Hundreds of real estate professionals who serve on the board of directors of the National Association of Realtors will descend on the Windy City tomorrow to consider the future of the trade group’s official website, realtor.com.

At NAR’s midyear conference in May, the 785-member board authorized a special, closed meeting in Chicago to contemplate whether to update the agreement between NAR and realtor.com operator Move Inc. to give realtor.com more freedom to compete with rivals such as Zillow and Trulia.

The board said NAR’s leadership team would work with Move and its subsidiary RealSelect to develop recommendations “to enrich and broaden the user experience” on realtor.com and present them to the board at the closed meeting Wednesday.

Dale Stinton, the trade group’s CEO, has said that, due to Move’s status as a public company, NAR directors attending the meeting will be asked to sign nondisclosure agreements, and will not be allowed to bring in electronic devices.

Laurie Janik, NAR’s general counsel, has advised board members not to speculate about what changes the association’s board of directors might make to the realtor.com operating agreement at the meeting.

Indeed, several board members contacted by Inman News either declined to comment or did not respond to requests for comment for this story. Move also declined to comment.

But NAR board member Danny Frank, who’s also the chairman of the Houston Association of Realtors, said getting realtor.com back to No. 1 as the most-visited real estate website should be the top priority at the meeting.

Realtor.com started losing its grip on that title in 2010, and last year was surpassed by Zillow and Trulia in rankings maintained by Experian Hitwise.

“They (realtor.com) are the public-facing portal of Realtors. They control our brand. When people think of real estate do you want them to think of Zillow or do you want them to think of … realtor.com?” Frank said.

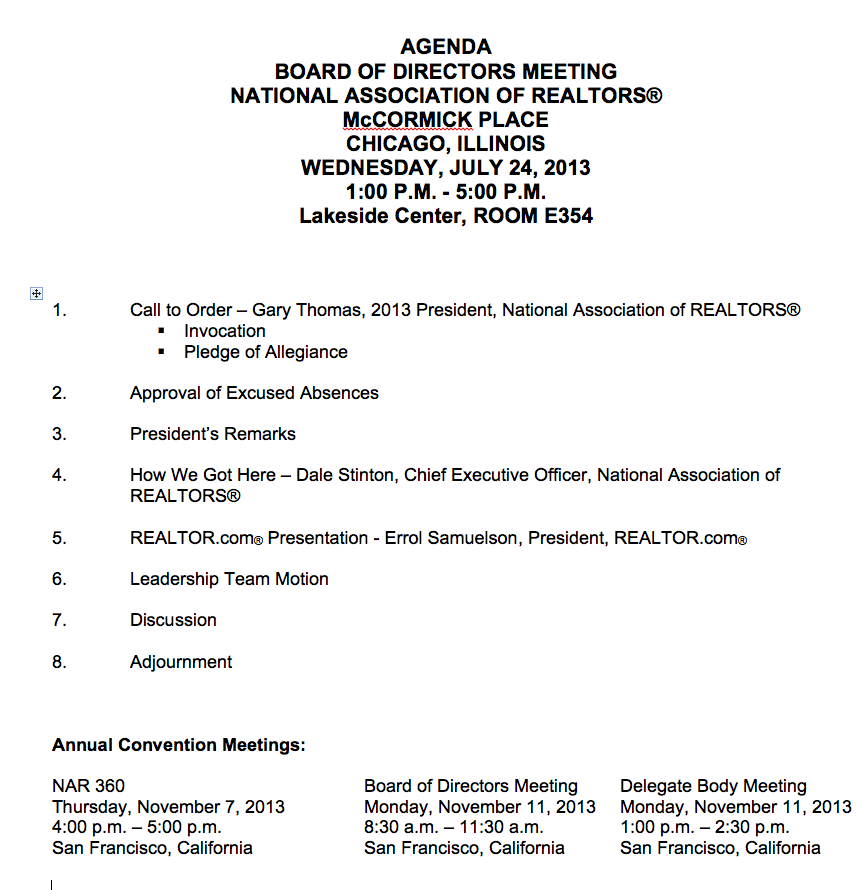

He said he has not been told what proposals will be discussed at the special meeting and received a very limited agenda from NAR. NAR’s executive team will meet in the morning before the board meeting, he said. At the meeting, NAR CEO Dale Stinton will speak, followed by a presentation from realtor.com, an as yet undisclosed motion from the leadership team, discussion of the motion and adjournment, Frank said.

“So NAR is going to make recommendations and have us discuss it. They’re probably going to limit it to that one topic. You can’t go sidetracked; it’s against Robert’s Rules of Order,” he said.

A meeting agenda posted on the industry blog Vendor Alley confirms Frank’s assessment.

“They absolutely want to control the agenda, and that’s OK, but I still think things should be allowed to be talked about from the floor,” Frank added.

NAR spokeswoman Stephanie Singer declined to comment on the proposals to be brought before the board, saying they “are still in development” and that members of the board will review the proposal or proposals when the meeting begins.

“(F)or NAR, the salient issues are about ensuring that consumers continue to have an outstanding user experience on realtor.com and that Realtors continue to be at the forefront of innovation in online real estate,” Singer said.

NAR is covering directors’ expenses to attend the meeting.

The realtor.com operating agreement dates to 1996 and was last amended in 2010.

NAR and Move characterized changes made to the agreement in 2010 as having paved the way for innovation, by streamlining the process for developing improvements to realtor.com.

Some details of the amendment were kept confidential, but became clear when Move announced the following year that it would run lead forms for buyer’s agents on realtor.com listing detail pages not unlike those employed by rivals Zillow and Trulia.

The “Connection for co-brokerage” program proved controversial.

Although brokerages can opt out of the program, HomeServices of America Inc. subsidiary Edina Realty Inc. announced in 2011 that it was pulling listings from realtor.com altogether, in part because it objected to the lead forms. (Edina stopped providing listings to realtor.com last year.)

Frank said whether he brings up any ideas himself at the board meeting will depend on what is discussed.

“If they want to talk about openness and letting (realtor.com) be competitive and restructuring the whole deal, let’s take baby steps and make it happen,” he said. “I just want there to be open dialogue, truthfulness, honesty. No hiding behind the shield of NAR. Let’s give the consumer what they want. That’s a novel idea, huh?”

Consumers want to know where all properties are, not just some of them, Frank said, and therefore he’d like NAR leadership to consider allowing rentals, apartments, new construction and “maybe even” for-sale-by-owner properties on realtor.com.

“(Consumers) can go to other sites and get that, why not have have that on a site that’s for Realtors?” he said.

Jim Harrison, president and CEO of MLSListings Inc., agreed.

“They have slipped in the ratings because they don’t have the content consumers find on competing sites. Certainly Realtor.com’s data quality is better, but they need comprehensive rental data for every type of property and comprehensive new-home data as well,” he said in a Facebook post.

Harrison said he would like realtor.com to be able to gather content from any “responsible source, like their competitors do” and be able “to create and act on a consumer strategy which wins the hearts and minds of the public.”

Last week, Frank wrote an open letter to Stinton asking him to send a report written by industry consultant Todd Carpenter to every board member and broker in advance of the special meeting.

Frank said the report, “Why online consumers love Zillow and Trulia more than you,” was a “wake-up call” for the real estate industry and reminded him that the consumer is the key and future of the business.

“We, as leaders, must never forget that the reason we are in business is to satisfy the consumer, both the buyer and the seller,” he said.

Carpenter has previously held positions as NAR’s director of digital engagement and senior manager of industry engagement at Trulia.

Although the report doesn’t specifically address realtor.com, it details the various types of content that can be found on third-party sites but is often not available on industry websites, including nontransactional content such as home valuation estimates, tax data, school information, crime activity, amenities and transit data.

While NAR licenses such data for its Realtors Property Resource national database, RPR is available only to Realtors, not to the public at large, Carpenter said.

Zillow and Trulia also host user-generated content through their advice pages, blogs, ratings and recommendations pages, and professional profile pages.

“These platforms facilitate discussion between consumers and real estate professionals and have created a long tail of data about local neighborhoods, market conditions and real estate agents,” Carpenter said.

“Consumers and real estate professionals have manually contributed more than 24 million pieces of content to Zillow.”

While opponents of the portals often argue that Zillow and Trulia would die without listings, Carpenter noted that the portals top search rankings for properties regardless of whether they are on the market because of the abundance of content they offer.

“When the property goes on the market, very little changes in the eyes of Google’s crawlers. There’s a listing price, some extra pictures and a short description of the house written by the agent, but all of the other data that Zillow and Trulia have already provided and updated for years remains,” Carpenter said.

“For a search engine, the portals remain a trusted and relevant resource to which it can direct its searchers. The fact that a real estate agent is temporarily marketing the property does not give him or her permanent ownership of that information.”

The portals also offer open marketplaces for mortgages that allow consumers to compare rates between multiple lenders — without fear of a lender soliciting them directly, Carpenter said. And with home remodeling platform Zillow Digs, Zillow will establish itself as a “holistic resource” for all aspects of homeownership, Carpenter said.

“While traditional real estate companies focus primarily on transactions, Zillow has positioned itself as a place where consumers can estimate what their home is worth, search for a new home, manage their home financing, and make smart decisions on home improvements,” he said.

Industry pundits suggest that most of Zillow’s and Trulia’s traffic is not “transaction ready,” and they are right, Carpenter said, but Zillow and Trulia have a more comprehensive approach to to engaging consumers before they are ready to buy.

For instance, both companies have made significant investments in rentals with the intent of appealing to younger audiences and catering to them from the beginning of their real estate “life cycle,” Carpenter noted.

“As long as real estate companies only focus on transactions, they will continue to lose audience to these portals,” he said.

Trulia and Zillow have also made significant investments in creating the best consumer experience in the industry, including daily testing and quarterly updates to their desktop and mobile applications, Carpenter noted.

“When the competition is delighting consumers with a polished, engaging user experience, the argument from a real estate broker that ‘IDX data is more accurate, so visit our IDX vendor-provided real estate site’ isn’t particularly compelling,” he said.

In contrast to industry websites, where search rankings favor ranking by list price, both Zillow and Trulia deliver results at least partially based on what they think consumers want to see given their past activity on the site and push suggested results based on consumers’ “favorites” to their email or mobile applications, Carpenter said.

Investment in mobile apps will be essential to competing against Zillow and Trulia, both of whom maintain more than a dozen apps across platforms, he added.

“For years, Zillow and Trulia have been criticized for their (search engine optimization) tactics. Soon, SEO will be irrelevant to their success. Consumers install these apps before they begin to search,” Carpenter said.

“Even if a company becomes fully competent in every other core proficiency listed in this report, if they aren’t fully dedicated to an extensive, internal, mobile development and marketing program, they will lose to Zillow and Trulia.”

Realtor.com has five mobile apps, two of them dedicated to rentals.

Frank said he thought Carpenter’s report was “very spot on, engaging and thought-provoking.”

“The reason I posted that letter is I want all the Realtors that are going to be voting to be informed. What I don’t want NAR to do is say, ‘Here’s what we’re going to do — what do y’all think?’ I want them to know all the facts,” he said.

In the letter, Frank noted that Houston is the only market in the top 100 in which a multiple listing service site, HAR.com, has more market share than any third-party aggregator.

“(S)o HAR understands what needs to be done. Let’s team up and make NAR and realtor.com the member/consumer champions we both know they can be,” Frank said.

Frank said Stinton had not responded to his letter.

“NAR has held back realtor.com from being the voice of the Realtor. They are our brand. If we stifle our brand, we stifle our ability to be realtors. If NAR and realtor.com got together they could be the public portal for the consumer,” Frank said.

For instance, he envisions adding the content on NAR’s homeownership website, HouseLogic, to realtor.com.

“If there’s (information) that we as Realtors want to get out to the consumer, whether it be private property rights, taxes, FHA loans, it would be a portal we can use to show the consumer where we stand and what might be a better idea,” Frank said.

NAR spends tens of millions on HouseLogic, but the site is not popular with consumers, he said.

“HouseLogic is a loser. Without repeat customers you don’t have anything. It’s the age we live in. Let realtor.com become the portal for the consumer,” Frank said.

The industry needs to offer content beyond listings, he said.

“I think it could be huge if NAR and realtor.com could team up and play together instead of being two separate entities. Just imagine if we were to take HouseLogic and give all the information to the consumer through the site where all the listings are.”

Realtor.com should be the public voice for Realtors, but resistance from NAR has stifled that voice, Frank said. For instance, he has previously noted that NAR does not allow realtor.com to have a chief economist.

“Right now, when a news organization — CNBC, Fox, ABC — when they want stats (and) want to know what’s going on with the economy, they go to these other chief economists. I don’t remember seeing (NAR Chief Economist) Lawrence Yun anywhere. They go to Zillow and Trulia, which are advertising companies, not real estate companies,” Frank said.

“If realtor.com were allowed to have that, I believe they would start to come and the word ‘Realtor’ would be out there.”

Frank noted that a recent HAR study found that eight out of 10 consumers either don’t know or are unsure about the difference between a Realtor and a real estate agent.

“Who has failed in that the consumer doesn’t know what the Realtor is? I’d have to say that’s NAR. They haven’t kept the brand alive,” he said.

An industry source who asked to remain anonymous confirmed that there had been discussions between NAR staff and Move’s executive leadership in recent years regarding whether to appoint a chief economist for realtor.com.

“Consider all the information and the data that passes through realtor.com by nature of all the agreements with the MLSs. To watch market trends, to adequately analyze and interpret that type of data, and to also understand the responsibility to be the steward of that type of data, you really need an economist who is trained and skilled to work with it. It’s very natural and very logical for realtor.com to seek to engage an economist to be a part of that effort,” the source said.

“You can have more data than you would ever know what to do with, but if you don’t have the right educated and credentialed professional interpreting it, you cannot get the full value of the data and you also can’t guarantee that it’s going to be an accurate interpretation,” the source added.

In the past, realtor.com has worked with a “well-regarded” economist on the East Coast to help review and analyze key datapoints, but that economist has not been on staff at Move and did not function as a spokesperson for realtor.com, the source said. The source was not sure if Move was still working with the economist.

The source declined to comment on NAR’s rationale for not allowing realtor.com to have a chief economist, citing confidential information.

“When decisions like that are being made, it’s really important to consider all stakeholders, all the constituents, what is the best thing for everyone involved. Sometimes you don’t know,” the source said.

In Facebook posts, Realtors’ views were mixed on the role of realtor.com and how it could be improved.

Eric Axelson, associate broker at Kurfiss Sotheby’s International Realty, suggested spending money to lure away a “heavy hitter” from Silicon Valley to “truly innovate.”

“Rather than try to be Zillow/Trulia, why not do something completely revolutionary and shake up the industry? That will get Realtor.com noticed,” he said.

Some Realtors expressed feelings of betrayal in regards to the relationship between NAR and realtor.com.

“Realtor.com dramatically raised our rates and does a mediocre job for Realtors who refuse to pay them tribute. The NAR gave an exclusive to people who did not deserve our trust and have greatly harmed Realtors and the real estate industry,” wrote Richard Schennberg, an exec at Schennberg Realty.

In response to Frank’s call to “let Realtor.com soar,” Leslie Ebersole of Baird & Warner said, “The only way Realtor.com is going to soar is with wings from our wallets.”

“The only way that Move can fund massive investment is to sell more advertising (which they’re aggressively doing) or to have NAR invest. Perhaps the huge (and possibly misguided) investment in RPR can be redirected. The money needs to come from somewhere,” she said.

Ebersole also doubted realtor.com could eventually compete.

“I just don’t want the NAR leaders to go off on a tangent that requires investment in Realtor.com or makes false assumptions about the site’s ability to compete. Zillow and Trulia aren’t going to sit still and wait for Realtor.com to catch up,” she said.

“Another thing to consider is that the big MLSs and brokers are also aggressively competing against all three third-party sites with consumer apps and new products. I’m pretty sure that we don’t want to pay even more in fees and dues to create sites to compete against us.”

But Leigh York, a Realtor at Century 21 Judge Fite Co., said, “Again, it’s not about us. It’s about the consumer. Realtor.com isn’t giving them what they want and that is because we have not let them compete.”

Beth Braznell, a NAR director and broker at Re/Max Results, said she was bound by confidentiality but had a concern she believed she could voice freely.

“If the agreement is modified, does Move have the people, vision and money to compete with Z&T?” she asked, referring to Zillow and Trulia.