Takeaways:

- A merger between two major multiple listing services could be the impetus for broader consolidation across the real estate industry.

- If successful, the new initiative could encompass 10 percent of the Realtor population.

- MLS mergers typically result in fewer costs and hassles for their agent and broker members.

MRIS and TREND, two of the largest multiple listing services in the nation, plan to merge and hope to entice other MLSs to join them in what they say will be “the next era of MLS.”

If successful, the new combined organization could reduce the costs and headaches of belonging to multiple MLSs for more than 100,000 agents and brokers.

MLSs have paid lip service to broker demands for consolidation for years, but there remain some 850 MLSs across the country. Today, two MLSs announced they’re putting their money where their mouth is.

Rockville, Maryland-based Metropolitan Regional Information Systems Inc. (MRIS) and King of Prussia, Pennsylvania-based The Delaware Valley Real Estate Information Network Inc. (TREND) have signed a nonbinding agreement formalizing their intention to consolidate.

“There’s so much happening in the industry today that to believe the notion that we can just sit with blinders on and be oblivious to what’s going on around us doesn’t seem like the prudent course of action,” Jonathan Hill, MRIS’ vice president of marketing and communications, told Inman.

MRIS and TREND say the merger will benefit brokers, agents and consumers in their markets.

“When it comes to doing business across those markets, you end up with multiple fees to join multiple MLSs, having to enter listings in multiple [MLSs], understanding multiple systems, multiple rules and regulations, and paying for multiple IDX fees,” Sharon Lukens, TREND’s director of design and communications, told Inman.

“All of this confusion and cost needs to be reduced.”

Both MLSs noted that MLS boundaries don’t correspond to how consumers and brokerages see their markets.

“If [consumers] are looking for properties in the contiguous border between Philadelphia and Baltimore, right where the MRIS/TREND boundary is, they don’t understand why they can’t see properties on both sides,” Hill said.

“[Agents and brokers] want to serve the market regardless of which MLS is there.”

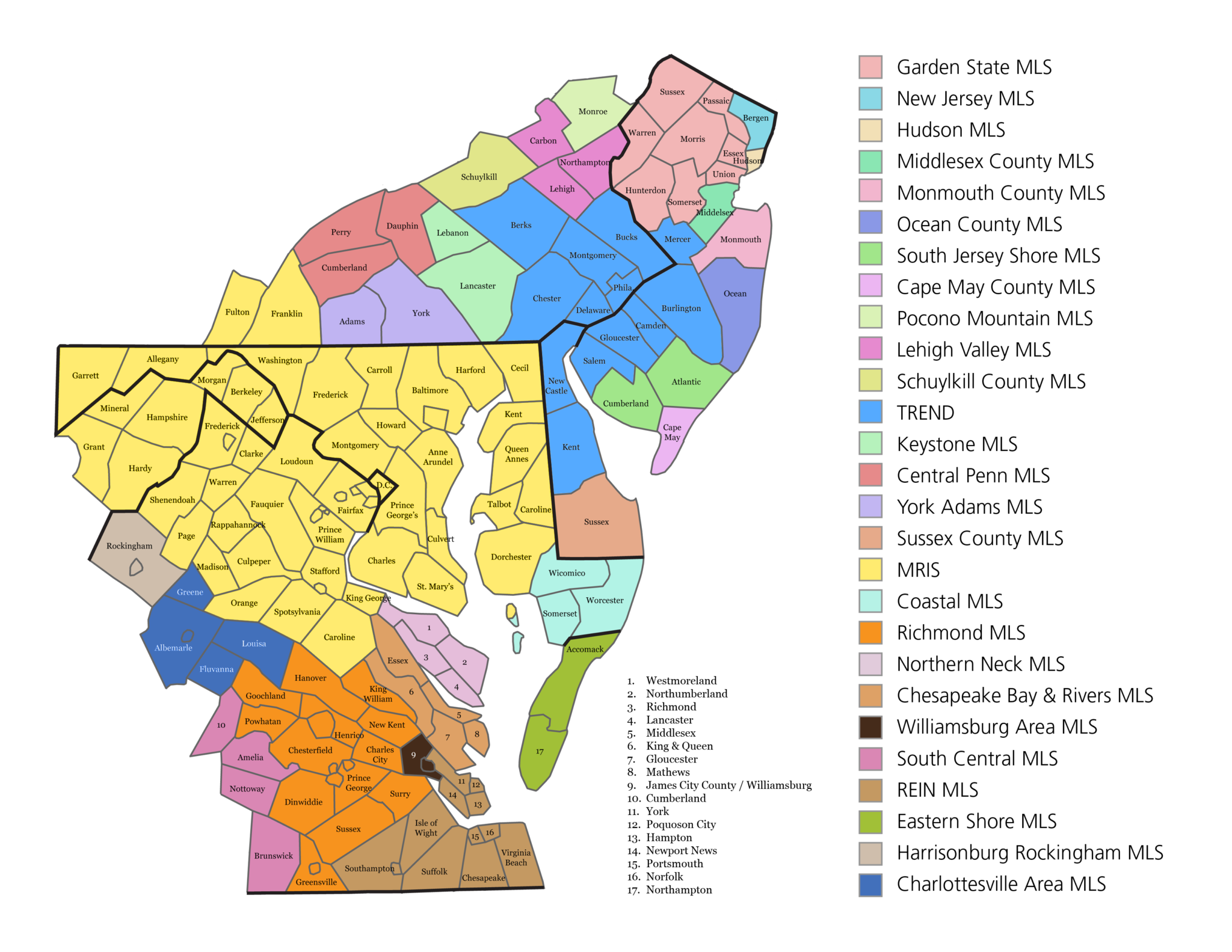

MRIS has just over 40,000 members in the Mid-Atlantic region, including Maryland, Virginia, Washington, D.C., and parts of Pennsylvania, Delaware and West Virginia.

TREND has about 28,000 members and covers 13 counties in Pennsylvania, New Jersey and Delaware.

In 2014, their members combined facilitated over 200,000 transactions valued at more than $65 billion, they said in a press release.

They share borders across the Pennsylvania-Maryland and Maryland-Delaware state lines.

Invitation to join

Both MLSs have reached out to about two dozen associations and MLSs whose borders are contiguous to both TREND and MRIS to invite them to participate in the initiative.

If all choose to participate, the combined organization could have some 110,000 members — or 10 percent of the Realtor population, according to Hill.

But size isn’t the goal, Hill said. Neither is a national MLS.

“No, that’s not the vision. I think there’s an opportunity to take similar actions in other marketplaces,” Hill said.

“That 850-MLS number — we all know that that can’t continue. We hope to set an example for how [regional consolidation] is successfully achieved so we can be a road map to other MLSs.”

Still, Lukens said, “I don’t think we would necessarily exclude someone who is geographically distant.”

The new venture, whose working title is Mid Atlantic Property Services (MAPS), will likely be owned by MRIS’ 25 shareholder Realtor associations and TREND’s 10 shareholder Realtor associations at minimum, and other shareholders could come in from other associations, Hill said.

The venture will be structured as a for-profit entity. MRIS is already for-profit, but TREND is nonprofit.

“That change is really so that the organization can have sufficient funds to reinvest in the business, focus on research and development, possess resources to withstand legal challenges, have the ability to recruit the right staff and ultimately operate a financially strong business,” Lukens said.

“The for-profit model will still focus on customer satisfaction first and certainly does not suggest a model for generating unnecessary profit.”

“Our initiative is intended to eliminate physical and political boundaries, expand service and price choices, and bring in economies of scale and save money for our constituents,” she added.

Hill emphasized that MAPS has yet to decide its ownership or governance structures or member fees. That would defeat the purpose of inviting other MLSs to participate, Hill said.

He theorized that one reason other attempts at MLS consolidation have failed over the years is because those being asked to merge were presented with a finished product rather than being asked for their input.

“We hope that this time because we are starting a completely new organization that they are interested in joining us and helping us to build that new organization from the ground up,” Lukens said.

When asked whether TREND was afraid of being subsumed by MRIS, she said, “No, I don’t think that’s the case at all. We are coming to this together and looking at the opportunities that exist to serve brokerages.”

MLS and broker discord

The germ of MRIS’ and TREND’s move to consolidate appears to be a desire to remain relevant and establish a more broker-friendly MLS in the wake of enmity between MLSs and brokers.

“[T]he pace of technology is growing past the capabilities of the current MLS infrastructure across America,” the MLSs said in a paper outlining their vision.

“This has created discord between brokerage firms and the general MLS establishment that is deeply rooted in

outdated territorial cultures and practices.”

According to the paper, MRIS’ and TREND’s shared vision is “to create the next era of MLS that preserves compensation and cooperation, promotes the expansion of an orderly and efficient marketplace, and provides participating brokerage firms greater control of and access to their listing content.”

One of MAPS’ guiding principles is that the broker is the primary customer. This means, in part, that MAPS will be set up to avoid encroaching on brokers’ territory in regards to services to agents — a grievance brokers have previously laid at MLSs’ feet.

“Each subscriber would receive a basic service that includes typical products and services related to MLS. But they would also have options to add upgraded products,” the paper said.

“MAPS would be an integrator and selective developer of technology. The buying power of a new, larger organization would provide the opportunity to negotiate significantly better prices marketwide than the subscriber or a smaller entity would be able to achieve individually.

“Most importantly, MAPS would only offer products and services that do not or no longer differentiate brokers.”

Merger obstacles

Hill attributes the lack of MLS consolidation in the industry to one key question asked by MLS leaders considering a merger: “What happens to me?”

“That’s the question that has always haunted discussions of mergers,” Hill said.

When two MLSs are considering merging, there’s typically a fear that the leader of the smaller organization will lose his or her position.

Lukens said that, while she could not speak for TREND President and CEO Tom Phillips, everyone at TREND is interested in “ultimately what’s best for the constituents that we serve.”

In regards to staff cuts, she said, “We believe that we are going to need all existing staff to facilitate a smooth and effective transition to the new organization. As for long-term staffing requirements, that will have to be finalized in time and over time.”

Greg Robertson, author of the Vendor Alley blog, gave MRIS and TREND kudos for starting the consolidation process without deciding what happens to their management staff in the end.

“That takes some guts,” he wrote in a blog post.

“Just the fact that these two giants are actually putting egos aside and talking consolidation makes other much smaller MLS providers not considering consolidation look almost petty,” he added.

Data-sharing as Band-Aid

Many MLSs have dealt with calls for consolidation by sharing data. That approach is just a “Band-Aid,” according to Hill.

“It doesn’t remove the inefficiency of two separate systems to provide the same data,” he said.

TREND and MRIS, for instance, run four data centers combined (two are backups), and each has its own version of several departments, including compliance, development, and customer training and support.

“At best, [data sharing] is a stopgap measure. At worst, it impedes progress that would resolve the underlying issues,” the paper said.

MRIS’ front-end MLS system is CoreLogic’s Matrix, and TREND is converting to the Matrix system this fall, which could conceivably make consolidation easier.

TREND and MRIS do not share listing data. CURE, an MRIS subsidiary, is TREND’s vendor for its RETS (Real Estate Transaction Standard) server. When TREND brokers or vendors want listing data in the RETS format, CURE provides it with authorization from TREND.

Therefore, “part of the transition of ingesting data has already happened,” Hill said.

“[It’s] proof that technology is not the hurdle. The hurdle has always been the politics and the parochial defense of arbitrary boundaries that don’t reflect the marketplace.”

Next steps

MRIS and TREND will take the next five to six months to complete due diligence and take “a deeper look” at each other, Hill said.

He anticipates that MAPS would have a proposal to present to each MLS’ shareholder associations by spring. Any merger will have to be approved by them.

Hill declined to give a timeline for when consolidation could be complete.

“With this many subscribers involved, you can’t do it overnight,” he said. “We’re not under the gun to do it.”

The MLS community should watch this initiative with great interest, Robertson said in another blog post.

“If [MRIS CEO] David [Charron], Tom [Phillips] and the other stakeholders can execute this consolidation, and get broker buy-in, you might be seeing something entirely new, and possibly the future.”