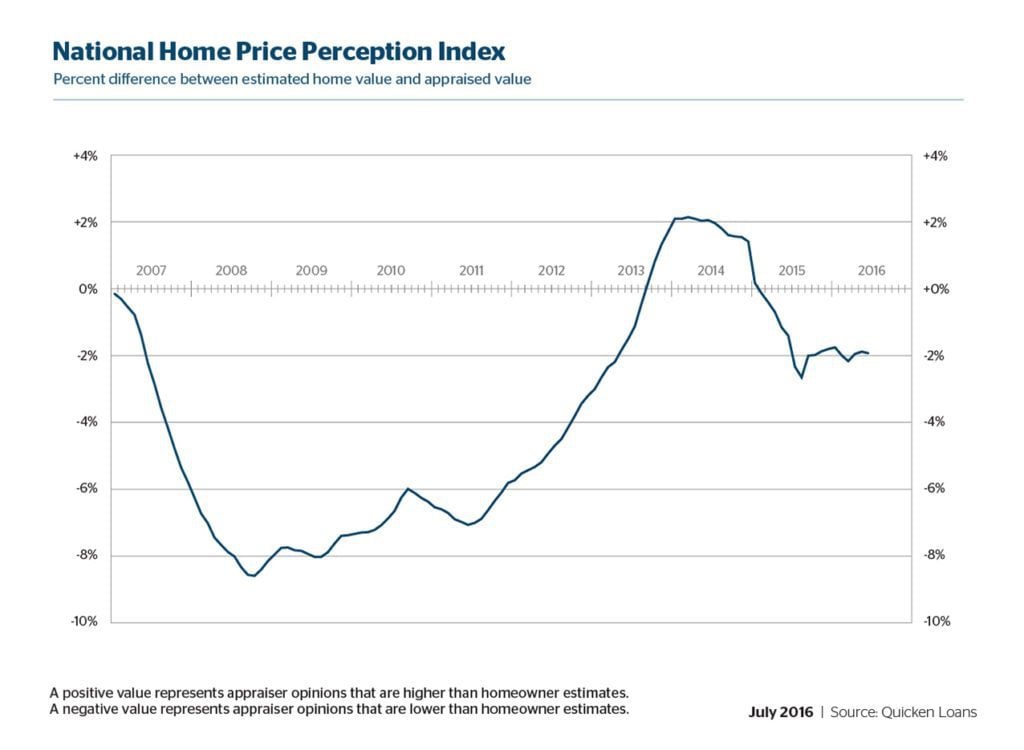

Quicken Loans released its Home Price Perception Index (HPPI) for June, finding the range between homeowner expectations and actual appraisal values continues to grow in the U.S. The retail mortgage lender recently announced average home appraisal values in June were 1.93 percent lower than homeowners’ expectations, a slight 0.4 percent increase the gap from the 1.89 percent rate in May.

“Perception is everything. It can make or break a home sale or mortgage refinance,” Quicken Loans Chief Economist Bob Walters said in a press release. “That’s why it’s so important for homeowners to realize how they perceive their home’s value could vary widely from how an appraiser views it.”

Although maybe not as fast as some homeowners like to think, home values are still rising. The Home Value Index (HVI), which measures home values across the nation, increased 0.84 percent month-over-month in June and 4.47 percent year-over-year.

As the report points out, home values and perceptions can vary widely across the country. Homeowners in markets like Denver, San Francisco and Dallas are likely to see appraisals from around 2 to 3.23 percent higher than their expectations. And although their counterparts’s expectations in Cleveland, Chicago and Detroit aren’t in line with appraisals, either, it’s on the opposite end of the spectrum, with the HPPI in those markets falling anywhere from -2 to -3 percent.

The western region of the country saw the highest increases in home values month-over-month (1.45 percent) and year-over-year (5.84 percent), while the Northeast saw the lowest increases in both, growing 0.17 from May to June and 2.07 percent annually.

The leaderboard was switched on the HPPI scale, though, with Northeastern homeowners overestimating their home values by 2.14 percent in June and those in the West by 1.7 percent, according the report.

Miami homeowners continue to experience lower home appraisals than they expect, and the gap is growing significantly on an annual basis. The negative difference between homeowner perceptions and actual appraisals in Miami was 0.15 percent in June of this year, almost a 1 percent drop from the positive 0.75 percent difference in June 2015.

The negative HPPI in Miami also grew slightly since May, when the gap was 0.14 percent.

The Quicken Loans Home Price Index and Home Price Perception Index measures the difference between appraisers’ values and homeowners’ opinions of home values. It compares estimates on homeowner-supplied refinance mortgage applications to the appraisal later performed. The national composite is determined analyzing appraisal and homeowner estimates throughout the country. Quicken’s Home Value Index is based solely on appraisal data from home purchases and mortgage refinances.