We’ll add more market news briefs throughout the day. Check back to read the latest.

CoreLogic’s Market Pulse Report for November 2016:

- The home price index year-over-year change was 6.3 percent.

- The cash sales share in June 2016 was 29.3 percent.

- The distressed sales share in June 2016 was 7.8 percent.

Mortgage rates:

[graphiq id=”b2w6fmfIyNL” title=”30-Year Fixed Rate Mortgage Rates for the Past 6 Months” width=”600″ height=”400″ url=”https://w.graphiq.com/w/b2w6fmfIyNL” link=”http://mortgage-lenders.credio.com” link_text=”30-Year Fixed Rate Mortgage Rates for the Past 6 Months | Credio”]

[graphiq id=”2NvK9Bl9HIF” title=”15-Year Fixed Rate Mortgage Rates for the Past 6 Months” width=”600″ height=”400″ url=”https://w.graphiq.com/w/2NvK9Bl9HIF” link=”http://mortgage-lenders.credio.com” link_text=”15-Year Fixed Rate Mortgage Rates for the Past 6 Months | Credio”]

Home equity rates:

[graphiq id=”kPkTJrAnX5r” title=”Average Home Equity Loan Bank Rates by State” width=”600″ height=”465″ url=”https://w.graphiq.com/w/kPkTJrAnX5r” link=”http://mortgage-lenders.credio.com” link_text=”Average Home Equity Loan Bank Rates by State | Credio”]

[graphiq id=”dP0v3iYOnH” title=”Average Home Equity Loan Credit Union Rates by State” width=”600″ height=”465″ url=”https://w.graphiq.com/w/dP0v3iYOnH” link=”http://mortgage-lenders.credio.com” link_text=”Average Home Equity Loan Credit Union Rates by State | Credio”]

Most recent market news:

- Privately-owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 1,229,000, 0.3 percent above September 2016 and 4.6 percent above October 2015.

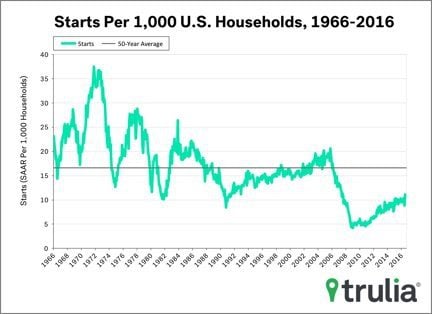

- Privately-owned housing starts in October were at a seasonally adjusted annual rate of 1,323,000, 25.5 percent above September 2016 and 23.3 percent above the October 2015 rate.

- Privately-owned housing completions in October were at a seasonally adjusted annual rate of 1,055,000, 5.5 percent above September 2016 and is 7.2 percent above October 2015.

Freddie Mac’s Primary Mortgage Market Survey for the week ending Nov. 17, 2016:

- The 30-year mortgage rate jumped to 3.94 percent.

- This is up from last week when it averaged 3.57 percent.

- A year ago at this time, the 30-year FRM averaged 3.97 percent.

Re/Max’s November 2016 National Housing Report:

- October saw near-record sales, but was still 1 percent below October 2015 sales.

- The number of homes for sale was the lowest of any month since May and of any October since 2008. The months’ supply of inventory was 3.9.

- Last month’s median sales price increased by 8.3 percentage points to $216,500.

Attom Data Solutions Q3 2016 U.S. Home Equity and Underwater Report:

- Equity-rich (loan-to-value ration of 50 percent or lower) homeowners represented 23.4 percent of all U.S. homeowners with a mortgage.

- This is an increase of 2.6 million homeowners from one year ago.

- Seriously underwater homeowners (loan-to-value ratio of 125 percent or higher) represented 10.8 percent of all U.S. homeowners with a mortgage.

Email market reports to press@inman.com.