- Homes are getting snapped up almost as quickly as they're being put on the market.

- Mortgage rates are expected to continue to rise, which could "lock in" some sellers and incentivize them to stay put.

- Equity is rising, but inventory remains a problem in many markets.

DENVER — Lawrence Yun, the chief economist at the National Association of Realtors (NAR), has been attending the National Association of Real Estate Editors’ (NAREE’s) annual conference to talk about economic trends for seven years. “The first year I came, we had a problem: not enough buyers,” he said this year. “This year we have a problem: not enough sellers.”

Yun and three other economists — Ralph McLaughlin at Trulia, Frank Nothaft at CoreLogic and Nela Richardson at Redfin — discussed their respective mid-year economic forecasts today NAREE. The consensus: A recession isn’t all that likely; we might not even be at the top of the market today.

Where’s the market today?

The housing market has been improving steadily over the past eight years, “but compared to the bubble years of easy subprime lending, we are not back up to that level,” said Yun. “The market feels frenzied because the market is moving very fast.” So, although it feels like a frenzy, the number of actual transactions is “much lower than what it was back in 2005.”

However, the homes available on the market are not always affordable to a wide range of potential homebuyers. Yun said that in California, median-income households can afford to purchase about 55 percent of homes currently on the market; in Texas, it’s 61 percent, and in places like Ohio and Indiana, it could reach as high as 70 percent or 80 percent.

“The question that well heeled buyers ask the most is ‘Am I buying into a bubble? Am I buying at the top of the market?'” said Richardson. “And the answer is no — I wish I could tell you otherwise.”

She said that markets like this are more advantageous for cash buyers or those with large down payments — “if you’re a first-time buyer and you need an FHA loan, or if you’re a veteran and you need a VA loan, you can’t compete in a market when homes are selling in six days on average,” she said, adding that in some bidding-war stories she’s heard, aspiring homeowners bid $100,000 over asking price and still lost out.

Things seem to be slowing down slightly on the coasts, noted McLaughlin, but that hasn’t yet put a damper on prices. “Why do we think home prices are continuing to grow in coastal areas?” he asked. “When inventory is low and you’re not building a lot of housing, even if demand is starting to cool a little bit, prices will continue to rise due to pent-up demand.”

What will mortgage rates do?

“Mortgage rates have trended back down under 4 percent again,” noted Yun, adding that in the 1990s rates were at about 8 percent and went down to 6 percent in the early 2000s. “So all these mortgage rates you see on the charts are historically generational low levels,” he said, “but consumers seem to be responding to even 20-basis-point or 50-basis-point changes in rates” — one-fifth and one-half of a percentage point, respectively.

Rates are likely to keep rising, though — between the Federal Reserve rate hikes and the robustness of the economy, we’re not likely to see them hovering around historic lows forever.

And when mortgage rates rise, affordability drops, noted Nothaft.

“Today we have lots of homeowners with really cheap mortgage rates; most have rates between 3 percent and 4 percent and some have rates of 3 percent or less,” he said.

“If rates go to 4.5 percent in the next year, that may dissuade at the margin those homeowners who currently have that dirt-cheap mortgage rate from selling their home.

“That means the for-sale inventory coming from existing housing stock will continue to be under pressure next year and the year thereafter,” he added. “There are homeowners who feel a little bit locked into their home once mortgage rates get up to 5 percent or higher.”

Yun added that borrowers are defaulting less and less on loans — “the overall trend has been downward,” Yun said, which is one reason why NAR included a reduction in mortgage insurance premium rates in a letter to the Department of Housing and Urban Development earlier this week.

How’s equity working?

Those climbing home prices have a welcome side effect for homeowners: According to Yun, “because of the home price increases, housing equity has doubled from the low points.”

Nothaft agreed that in general, equity was growing — but he said that there is a “great deal of variation from state to state. In some states, they haven’t seen appreciation at all — and in some they have really driven home equity gains,” he noted.

What’s happening with inventory?

A “balanced” inventory market is considered to be six months — which means that at the current pace of sales, all homes on the market today will sell within six months.

“The actual inventory has been under a balanced market for five consecutive years,” Yun noted, “and consequently home price have grown by 41 percent, four times as fast as income grew. At some point one has to wonder: Can this continue?”

Job creation is not necessarily being balanced with single-family building permits in parts of the country, which can exacerbate the imbalance.

“Naturally, if we have a shortage of supply and of for-sale inventory bumping up against rising demand because of job growth and income growth or families, that’s going to translate into upper pressure on house prices,” explained Nothaft.

This isn’t likely to put a damper on demand, said Yun. “Housing demand looks plentiful going forward,” he said.

But it’s not all good news: “Because of the housing shortage, we will be hard-pressed to see any meaningful growth in home sales,” he added.

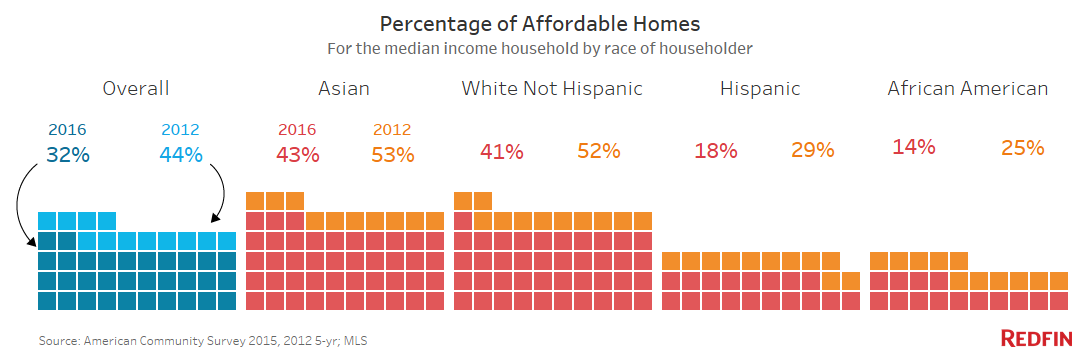

“It’s important to talk about inventory in terms of price tiers,” Richardson explained. “In 2016, a family earning the area median income could afford 32 percent of homes for sale in 30 largest metros, down from 44 percent in 2012.”

That’s even more acute for minorities, who “are being priced out of the market,” Richardson said.