- Kevin Thorpe, global chief economist at Cushman & Wakefield, thinks there's little cause to worry about a recession in the next couple of years.

- Consumer confidence is high, and although the government is experiencing gridlock in Washington, D.C., Thorpe expects at least a few of President Trump's financial policies to pass.

- There's a labor shortage that's more acute than we've seen in years, and office space is being overbuilt.

DENVER — “This is going to be the longest economic expansion in the post-World-War-II era,” stated Kevin Thorpe, the global chief economist at Cushman & Wakefield.

He was giving an assessment to a crowd of reporters at the National Association of Real Estate Editors conference, and the general message was one of growth — not risk.

Recession?

“The U.S. will not be going into recessions anytime soon,” Thorpe said.

“Recessions don’t just happen,” he added. “First we need to see imbalances somewhere in the economy — too much credit, too much exuberance in any particular sector.” Equity markets, oil prices, what the Federal Reserve does with interest rates and “wild cards” could change that, of course, but in general, Thorpe was confident that the economy is strong and will remain so for the immediate future.

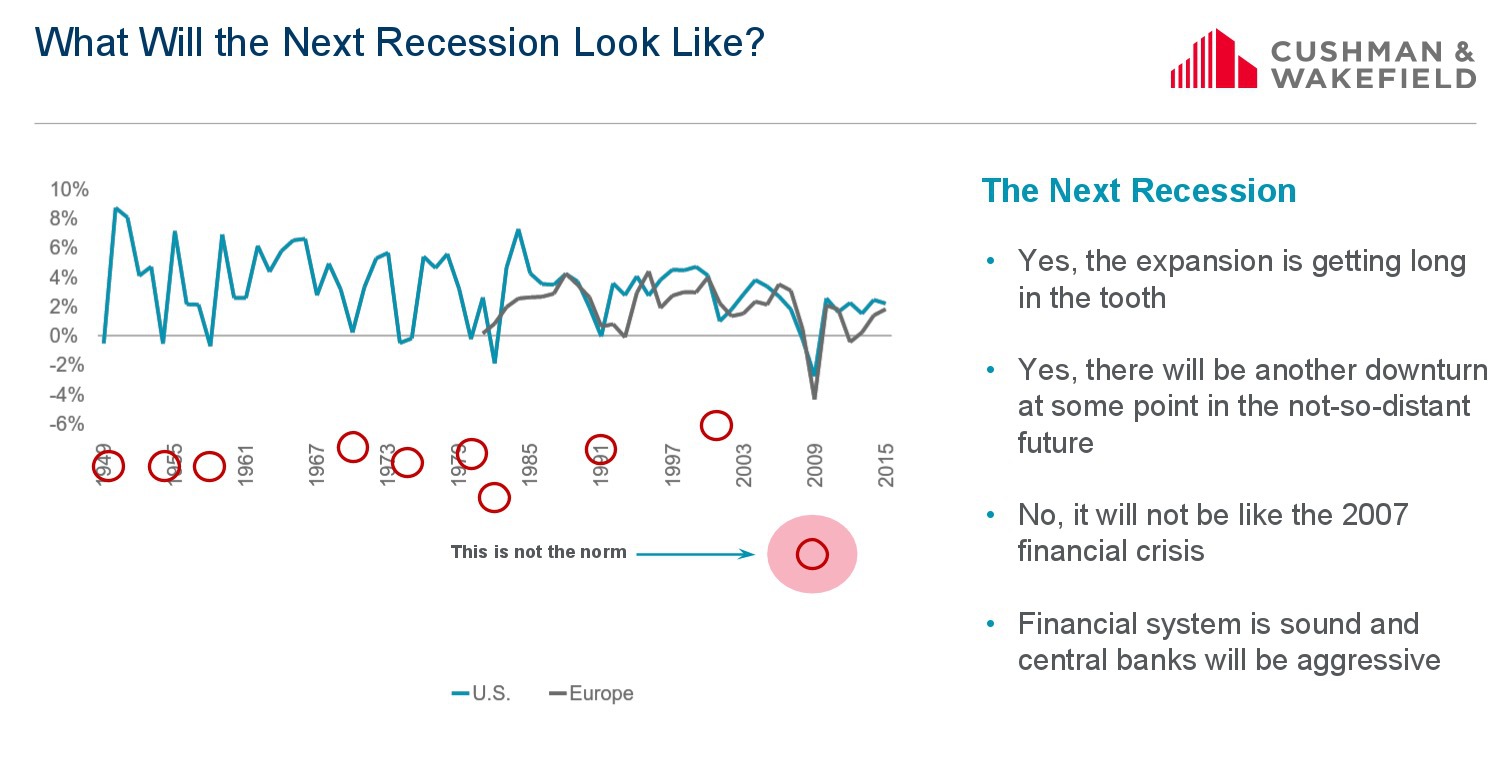

“Of course there will be another recession at some point, and the next question becomes ‘What will the next recession look like?'”

In Thorpe’s opinion, it won’t look as gnarly as the last one. “It’s not likely to be nearly as severe as the one we went through in 2008-2009,” he noted. “Big recessions don’t happen very often; every 50 years seems to be the pattern. The next recession is probably more likely to be a traditional recession, with two to three quarters of job loss.”

That’s nothing to sneeze at, and real estate could still be affected by such a recession, but in general Thorpe was optimistic about the economy.

“The U.S. financial system is about as solid as I have ever seen it,” he said. “The odds are still really good that the expansion will continue, at least for the next couple of years, and the odds are also really good that the next recession won’t be so messy.”

Consumer confidence?

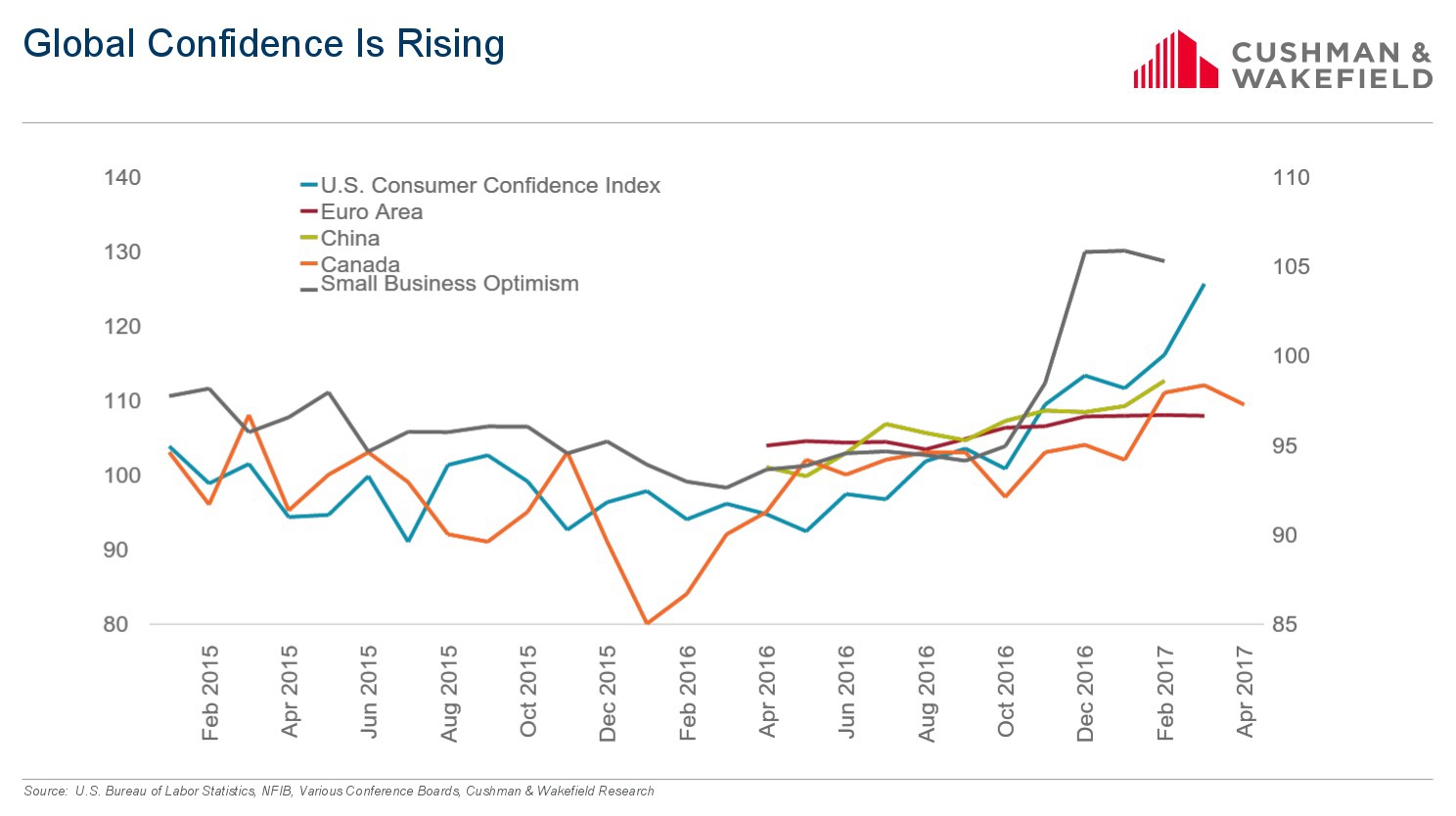

“Consumer confidence is pretty important for real estate,” Thorpe explained. After all, when consumers are confident, they’re typically spending more money — and right now, global consumer confidence is rising.

“A lot of this was a long time coming,” Thorpe said. “It’s the result of trillions of dollars of global stimulus and people and businesses working really hard to clean up their balance sheets.”

That said, he noted that last year’s growth numbers were off. “Last year was a pretty terrible year from a growth perspective; from some measures last year was weaker in terms of GDP [gross domestic product] growth than it was in 2001,” he said.

Why? Unexpected but significant events — like the Brexit vote and Donald Trump winning the U.S. Presidential election.

“I wonder if last year may go down as a mild recession, globally,” Thorpe said, “and if so, you could make the argument that we’ve reset into a new expansionary cycle.”

Trump?

“President Trump will be good for growth … possibly, maybe, I think, kind of,” was Thorpe’s official statement.

He’s basing that assessment on the economic policies that the Trump administration has attempted to implement. Although most of those policies haven’t gone anywhere, Thorpe said economists are still paying attention to them and assuming that something is going to pass, policy-wise, at some point.

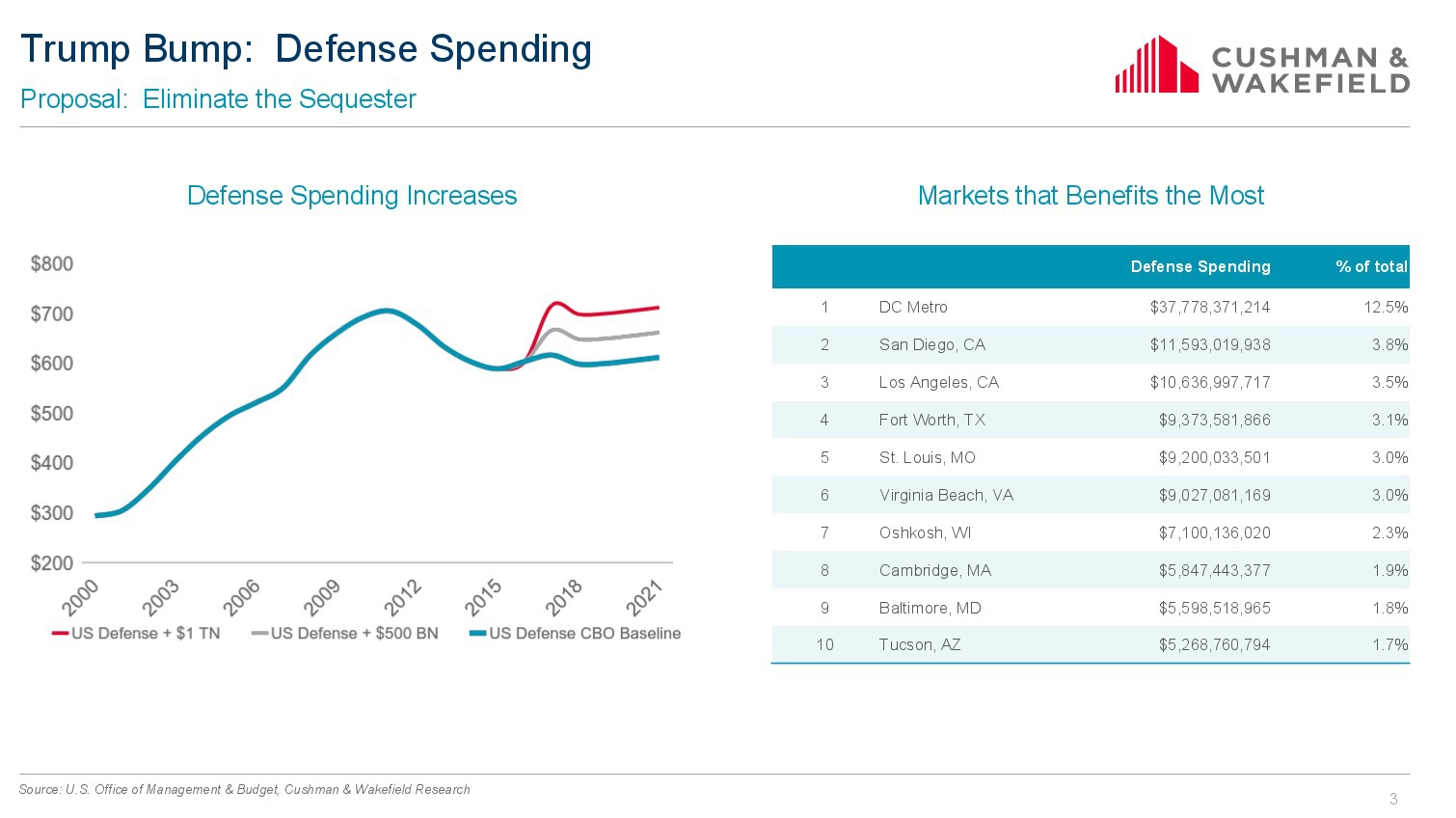

“We’re assuming there will be some corporate tax reform, some individual tax reform and some increases in government spending in the areas of infrastructure and effects,” Thorpe said, adding that “Trump’s policies should result in stronger economic growth in the near term. Most of us, including me, have upwardly revised our GDP forecast.”

However, Thorpe believes that the 4 percent to 5 percent GDP growth that’s being bandied about is “fiction.”

“I think 3-percent growth is still possible — maybe for 2018,” he said. “I would say somewhere between 2.5 percent is still possible.”

Currently, the U.S. economy has been growing at about 2 percent for the past eight years, “and that’s been pretty good for real estate,” Thorpe said, moreso for the commercial side than the residential side.

“Perhaps the biggest winner from Trump’s policies will be the defense sector,” he added, noting that a Republican Congress is likely to support defense spending changes. As a result, “instead of actually draining the swamp, Trump may in fact create an even larger swamp,” Thorpe said.

And, of course, this is all assuming that something — anything — actually gets done in Washington for the next four years.

“It’s political gridlock on steroids,” Thorpe said. “I’ve lived in Washington, D.C. for almost 20 years, and I’ve never seen anything like this. The two major parties have sort of splintered into lots of different parties.

“I’m not sure if this is an economic term, but it’s a total shitshow right now in Washington,” he added. “Without question, fiscal policy and the Trump administration in general is by far the biggest wild card.”

Labor, jobs and offices?

Thorpe predicts that the demand for property market space is going to slow. “After several years of economic expansion, labor markets have tightened up globally,” he said.

“With labor markets tightening, labor shortages are becoming a major issue in this country and other parts of the world. The number of employers who now say they can’t fill positions is truly approaching an all-time high,” he added.

This means job growth will likely decelerate in areas — and there’s also a “dirty little secret” that Thorpe says the commercial real estate industry is keeping: “We are once again building a ton of office space.”

Thorpe said that 700 million square feet of office space is currently under construction globally. “The world is going to be dropping seven Denvers’ worth of office inventory into a market where businesses are using less space per worker, into a market where demand is slowing and into a market where the cycle’s getting long in the tooth.

“That’s scary,” he said, predicting that demand will fall short of supply — although he added that because most people seeking office space want more modern properties with good natural light and other amenities, maybe those new builds will get snapped up more quickly than expected.

He said that the worst U.S. markets for overbuilding office spaces include New York, Austin, San Francisco, Nashville and Seattle.

(This could mean some good deals available for brokerages looking for new digs, though!)

What’s up with the Sunbelt?

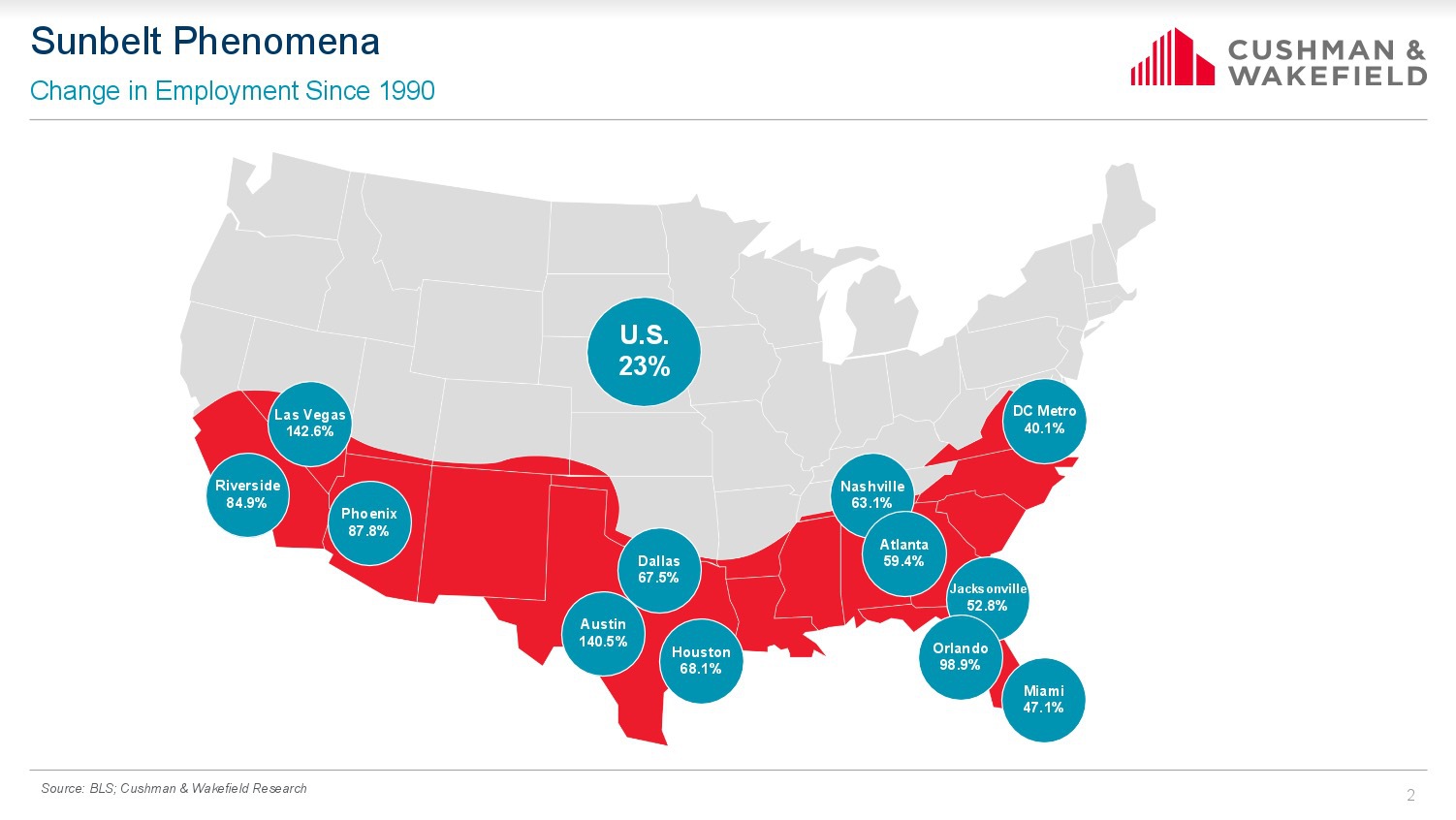

If hockey tells you to move where the puck will be, then Thorpe thinks real estate agents need to be looking to the south.

Hot weather used to be a comparative disadvantage, Thorpe noted. “One of the best things that happened to markets like Atlanta was the invention of the air conditioning unit.”

And central air conditioning further revolutionized the Sunbelt — Thorpe has seen a long-term trend of companies and businesses increasingly picking up and moving from north to south, he said.