A tech startup is trying to make it easier and cheaper to invest in privately held real estate companies, and it’s using one of the buzziest technologies in the market: blockchain.

San Francisco-based Harbor launched earlier this year with plans to “tokenize” investment, which it argues will make it easier to put money into private securities such as real estate investment trusts, or REITs. Harbor today unveiled its first offering, which is a chance to purchase shares in a company called Convexity Properties that operates student housing near the University of South Carolina.

Josh Stein. Credit: Harbor

The idea behind such offerings is that it allows private companies to raise money more easily than they might if they went public. Harbor CEO Josh Stein told Inman that going public “is a ton of expense because of a lot of regulatory requirements.” Staying private also allows companies to raise money in smaller quantities than they might if they went public.

But Stein also pointed out that investments in private securities are “highly illiquid,” or difficult to sell. So for example, if someone owns shares in a private REIT, it can take months to actually sell those shares. Worse still, the investor may have to sell at a discount.

“It’s hard for buyers and sellers to find each other,” Stein explained.

Harbor’s use of blockchain is meant to solve those problems, making investment cheaper and easier for both the companies raising money and people looking to buy. The idea is that investors buy “tokens,” or shares, in private companies, and that those transactions are recorded with blockchain, which Harbor describes as an “immutable” digital ledger. The company calls this process “tokenization.”

What makes this approach especially novel is that blockchain — which is best known as the technology underlying cryptocurrencies like Bitcoin — is decentralized and open. Whereas transactions today are typically recorded in an Excel spreadsheet and stored on a computer in a lawyer’s office, transactions recorded on the blockchain are publicly visible. And that means the tokens, or shares, can be easily traded among investors.

“With the blockchain it’s a shared ledger,” Stein said. “Everyone knows how many shares are out there and what pseudonym owns those shares.”

Harbor uses the Ethereum blockchain, which Stein described as a ledger with 10,000 synchronized copies that are stored on computers all over the world.

Using this technology has a number of benefits, Stein said. For one thing, it allows companies to draw from a larger pool of potential investors. That in turn makes it possible to lower the price point of the investments.

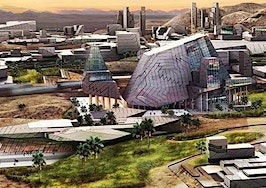

A Convexity Properties building. Credit: Harbor

Tokens in the new Convexity Properties offering, for example, will sell for $21,000, which Stein said is far lower than the typical buy-in price of conventional private securities. There is no minimum number of tokens investors have to buy.

Harbor’s role in all of this is to operate in the background, facilitating transactions, auditing, and providing investors with a digital “wallet” where they can secure their tokens. So, would-be investors in Convexity Properties will have to set up a Harbor account, which can then be used to view tokens and express an interest in trading. Stein compared the process to setting up a bank account and Harbor to “the Kayak of private investments.”

“It’s like the Amazon.com of making an investment,” he further explained.

Investors can later sell their tokens on a variety of online exchanges. Some, such as the Open Financial Exchange, already exist, while others are in the works, Stein said.

Harbor also allows investors to pay in either U.S. dollars or different forms of cryptocurrency. It makes money by charging companies, such as Convexity Properties, for the various services involved in offering and trading tokens. Stein said that in the future Harbor hopes to expand the services it offers.

It has ample funding to do so: Harbor has raised over $38 million to date from venture capitalists who believe it has the vision and technological prowess to re-invent investing for a new era.

A screenshot showing Harbor’s interface. Credit: Harbor

Though the Convexity Properties offering involves only one company, Harbor sees it as just the tip of the iceberg for blockchain investment. The company also believes other assets could be tokenized, with Stein giving the example of fine art. In that scenario, an auction house might sell tokens to investors who want to share in the profits when a piece sells. Tokenization could be applied to groups of paintings associated with particular artists or movements.

“We think there are a lot of people around the world who would want to invest in that,” Stein said. “It makes sense as part of a diversification play.”

At this point, however, about 75 percent of the interest Harbor is seeing in tokenization is focused on real estate. Stein characterized the sector as an area for potential growth and said that in the future, investors will be able to put money into a variety of specific buildings or whole neighborhoods. And blockchain, he added, will enable transactions that in the past might have been theoretically possible, but for which “the cost and friction and delay just made it impractical.”

“This tokenization is going to have the same effect on private securities that email had on written communication,” Stein said.