Lemonade, a tech-centric insurance startup that among other things uses artificial intelligence, announced Thursday it had raised $300 million in a new round of funding.

Mega investor Softbank led the Series D funding round, according to a statement from Lemonade, with a handful of other funds including Allianz, General Catalyst and GV (formerly Google Ventures) participating as well. The statement explains that the company will use the cash infusion to “accelerate its U.S. and European expansion in 2019, and explore new product lines.”

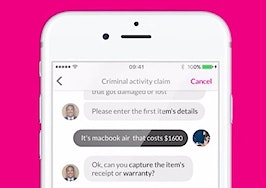

Lemonade launched in 2016 and provides insurance to both homeowners and renters. It touts its work digitizing the entire insurance process, and uses an A.I.-powered chatbot to interact with customers. Via its various innovations, Lemonade claims that it reduces both the costs and the bureaucracy associated with buying insurance and making claims.

The company said Thursday in its statement that it is now available to “most” people in the U.S.

Lemonade also has a charitable giving program that donates customers’ unclaimed money to a nonprofit of their choosing.

In a statement Thursday, CEO and cofounder Daniel Schreiber said that in the three years since launching, Lemonade has “fundamentally changed how a new generation of consumers interacts with insurance.”

Daniel Schreiber

“Looking forward,” Schreiber continued, “we aspire to create the 21st century incarnation of the successful insurance company: a loved global brand that can endure for generations; an organization built on a digital substrate, enabling ever faster and more efficient operations, and ever more delighted consumers.”

With this latest round of investment, Lemonade has raked in a total of $480 million in funding. Prior to this year, the company had most recently raised $120 million at the end of 2017. That funding round also was led by Softbank.

Lemonade did not comment Thursday on its valuation in light of the latest funding, but Forbes, citing an unnamed source, reported that the company is now worth more than $2 billion.

Softbank’s latest investment comes as it and other major investors — from both Wall Street and the venture capital community — continue to dump fortunes into companies at every stage of the real estate experience. Collectively, these investors are upending everything from rentals to agent commissions to (as in this case) insurance.

In a statement Thursday, Shu Nyatta — an executive at Softbank and a Lemonade board member — said that his fund was drawn to the insurance company while watching it both expand and transform insurance at “a shockingly rapid pace.”

“And we’re confident that the best is yet to come,” Nyatta continued. “The value Lemonade provides, together with the values baked into its model, are fast making it one of the most intriguing, differentiated and compelling brands.”