Increased buyer demand spurred by low mortgage rates caused inventory levels to plummet 9.5 percent year-over-year in November, according to a realtor.com housing trends report released on Monday.

The 9.5 percent drop translates into 131,000 fewer listings on the market compared to 2018, with entry-level homes priced below $200,000 experiencing the largest annual decline of any price tier (-16.5 percent). The number of new homes hitting the market declined 7.7 percent over the same time period, further exacerbating the shortage.

George Ratiu

“As millennials — the largest cohort of buyers in U.S. history — embrace homeownership and take advantage of this year’s unexpectedly low mortgage rates, demand is outstripping supply, causing inventory to vanish,” said realtor.com Senior Economist George Ratiu.

“The housing shortage is felt acutely at the entry-level of the market, where most millennials are looking to break into the market for their first home.”

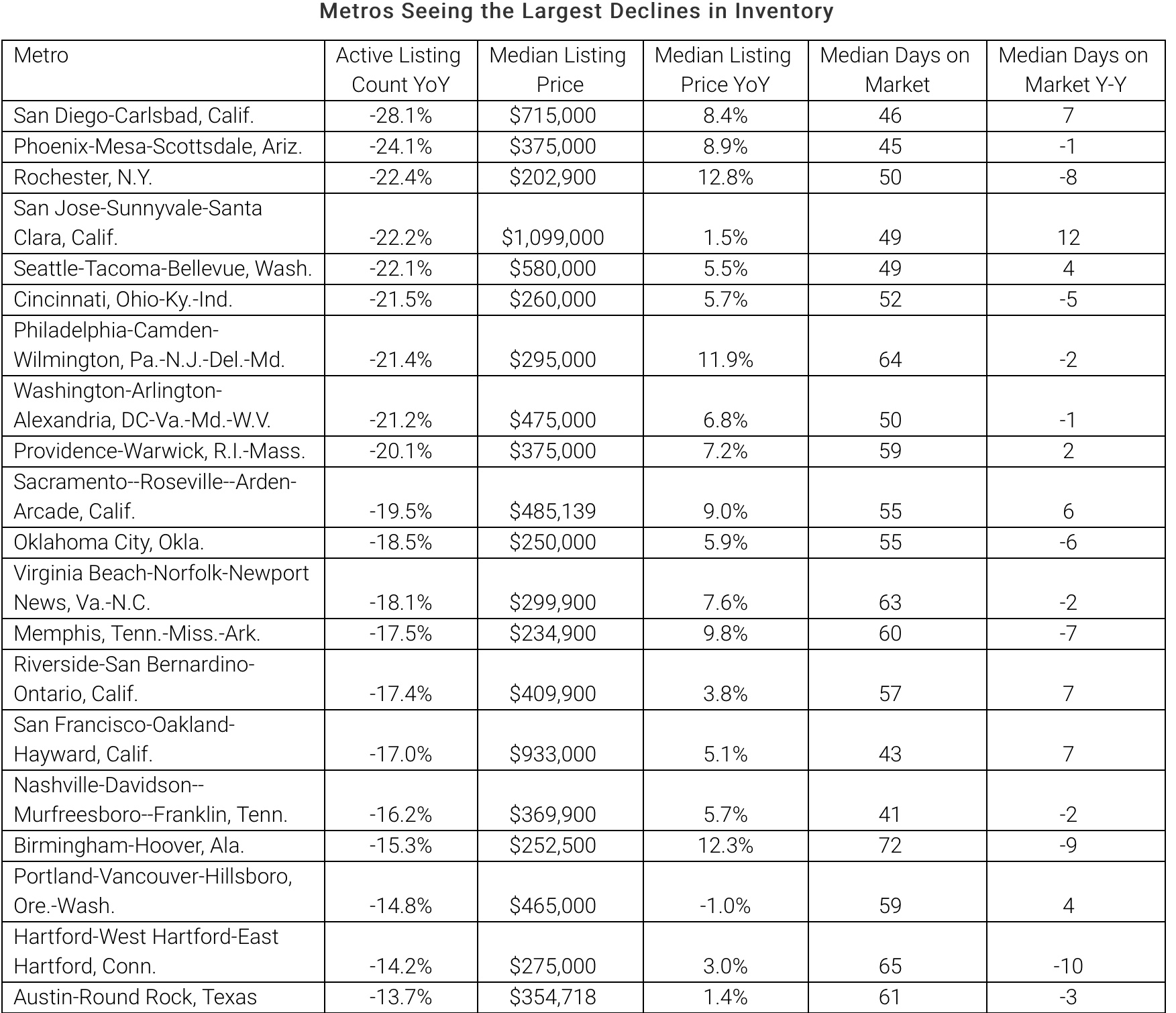

On a market-by-market basis, San Diego (-28.1 percent), Phoenix (-24.1 percent) and Rochester (-22.4 percent) experienced the greatest annual inventory declines. Conversely, Las Vegas (+14.4 percent), Minneapolis (11.5 percent), and San Antonio (+7.2 percent) saw inventory level increases that reached up to nearly 15 percent.

As inventory levels dropped at the entry-level, Ratiu said buyers began battling for listings at higher price points, driving days on market down and trigging shortages for homes priced above $200,000.

In November, homes sold two days faster (70 days vs. 72 days) with affordable, secondary markets such as Raleigh (73 days to 63 days), Hartford (75 days to 65 days), and Birmingham (82 to 72 days) experiencing the fastest acceleration in listing to close times.

At the same time, the inventory for mid-tier listings priced between $200,000 and $750,000 and luxury listings priced above $1 million declined 7.4 percent and 1.3 percent year-over-year, respectively.

“The inventory decreases seen across all value ranges could in part be attributed to a spill-over effect, as the lack of inventory has pushed buyers up the price chain to stretch their budgets and search for homes above their initial price target,” Ratiu added.

Despite the imbalance between supply and demand, home price growth slowed from 4.3 percent in October to 3.6 percent in November for a median listing price of $309,000.

However, the majority of the nation’s 50 largest metros still experienced annual home price increases with Los Angeles (+16.6 percent), Rochester (+12.8 percent) and Birmingham (+12.3 percent) leading the way.