This post has been republished with permission from Mike DelPrete.

Opendoor’s path to profitability is paved with uncertainty. A key assumption for long-term success is the ability to attach adjacent services to the transaction, such as title insurance and mortgage. Let’s look at the data around Opendoor’s traction to date.

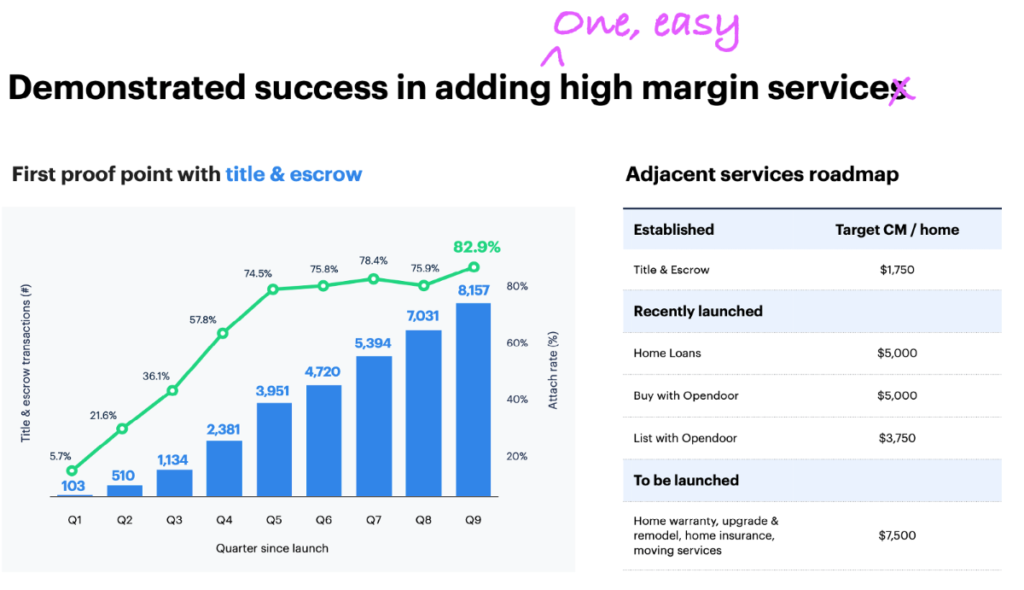

In its investor presentation, Opendoor correlates early success with attaching title and escrow services to long-term margin improvement — and profitability. The challenge is that title and escrow are the easiest ancillary services to attach by a wide margin, and success in a few markets doesn’t mean all adjacent services will be nearly this easy.

Title insurance is a complicated business, and regulations vary by state. Opendoor is seeing early success, but it’s taken years (and an acquisition of a traditional title company) to get to this stage.

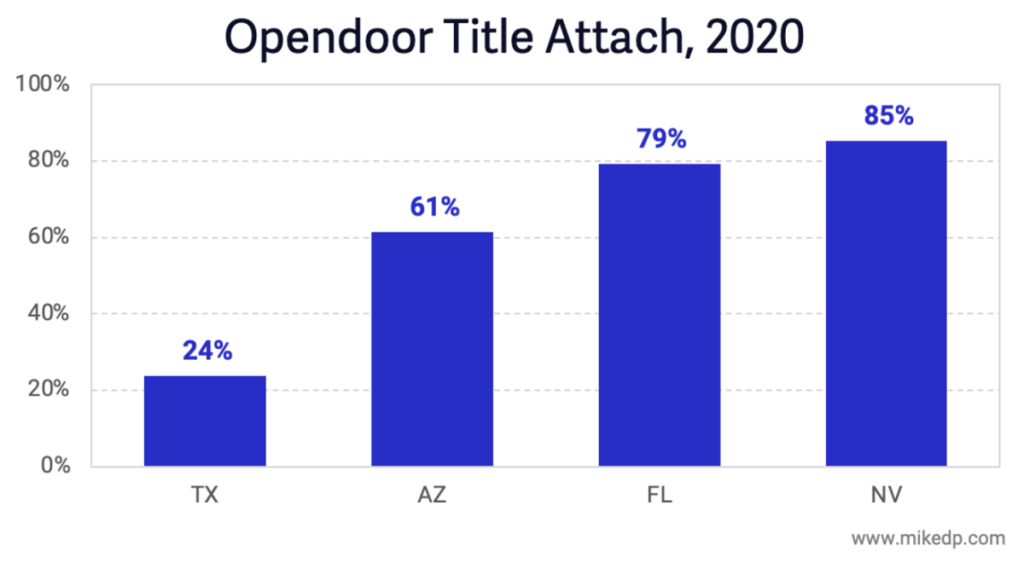

The below chart shows title attach rates on the sell side, where Opendoor is the owner and sells a home. When it comes to title and escrow, not all states are created equal, and success in one might not mean success in all.

Title insurance is just one of many adjacent services. The Holy Grail, from a revenue and profitability standpoint, is mortgage, and it’s not nearly as easy to attach. Opendoor has been in the mortgage business for about a year and is seeing much lower attach rates to its mortgage product, Opendoor Home Loans.

Compared to title insurance, which can simply be added into the transaction by the purchaser or seller of the home (Opendoor), mortgage needs to be sold directly to consumers, which is a much more difficult and complicated proposition.

An uncertain road ahead

It should be noted that what Opendoor is attempting to accomplish is not unique. Traditional real estate brokerages have been attaching title and mortgage services for years (Berkshire Hathaway’s HomeServices of America, for example). The field is crowded with large, well-entrenched businesses.

Just because Opendoor is seeing early success with title insurance, the easiest adjacent service to attach (especially when you own the home), doesn’t mean it will find similar success with more difficult services, such as mortgage.

The evidence suggests a long, difficult and uncertain road ahead — in a highly contested and crowded field of incumbents and disruptors.

Mike DelPrete is a strategic adviser and global expert in real estate tech, including Zavvie, an iBuyer offer aggregator. Connect with him on LinkedIn.