Pending-home sales grew 1.9 percent in March, breaking a two-month cycle of declines, according to a report released Thursday by the National Association of Realtors (NAR).

The Pending Home Sales Index (PHSI), which indicates future home sales based on contract signings, was 111.3 in March, up 23.3 percent from March 2020 when coronavirus lockdowns swept the U.S.

A PHSI of 100 is equal to contract activity from 2001.

The Index results from March show that despite a two-month lull, demand for housing is not waning.

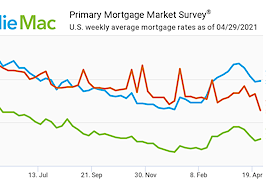

“The increase in pending sales transactions for the month of March is indicative of high housing demand,” NAR Chief Executive Lawrence Yun said in a statement. “With mortgage rates still very close to record lows and a solid job recovery underway, demand will likely remain high.”

Yun added that although low inventory continues to make navigating the market more challenging all around, the problem may be alleviated a bit in upcoming months by increased new home construction and the federal mortgage forbearance program coming to an end.

“Although these moves won’t immediately replenish low supply, they will be a step forward,” Yun said.

The PHSI increased across every region during March except for in the Midwest, where the index fell 3.7 percent from the previous month to 98.6. But, the Midwest’s PHSI was still up 14.1 percent from March 2020.

The Northeast PHSI saw the greatest month over month growth, increasing 6.1 percent to 97.9, a gain of 16.7 percent year over year.

The Index in the South increased 2.9 percent from the previous month to 137.2, up 27.9 percent from the year before. In the West, the PHSI also rose 2.9 percent month over month to 94.5, up 29.8 percent from the previous year.

NAR’s report further added that existing-home sales are expected to increase 10 percent in 2021 to reach 6.2 million. Meanwhile, the median home price is projected to increase 9 percent in 2021 to $323,900.

Housing starts are also expected to hit 1.6 million in 2021 and 1.7 million in 2022, adding more inventory to the market. Mortgage rates, too, are projected to gradually increase over the next two years to 3.2 percent in 2021 and 3.5 percent in 2022, due to increased inflation as the economy continues to strengthen and fiscal spending increases.