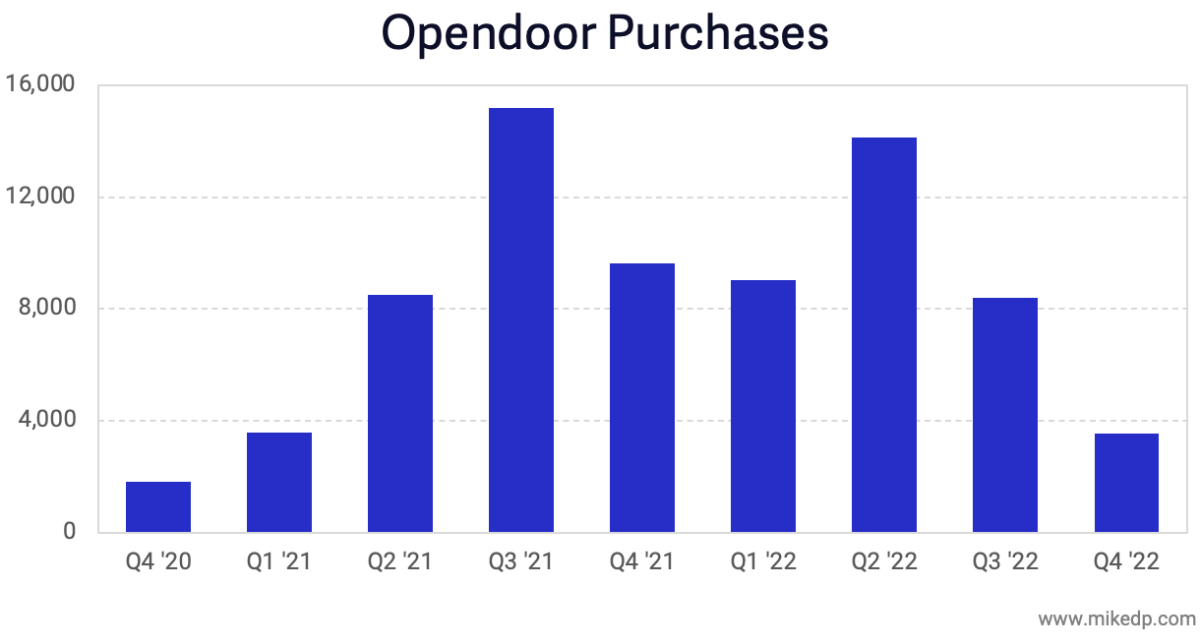

After a brutal Q3 in a rapidly shifting market, Opendoor has significantly slowed down its pace of home acquisitions.

After a brutal Q3 in a rapidly shifting market, Opendoor has significantly slowed down its pace of home acquisitions.

Why it matters: Profitable or not, an iBuyer must buy homes to generate revenue and remain relevant.

- Opendoor’s drop in purchase volume was rapid and extreme, but not dissimilar to changes in the past.

- Opendoor has demonstrated an ability to quickly ramp up and down — a sensible feature, and not a bug, of iBuying.

Lower purchase volumes mean less homes coming to market, resulting in fewer sales generating less revenue.

Lower purchase volumes mean less homes coming to market, resulting in fewer sales generating less revenue.

But Opendoor’s bigger challenge is being able to resell its homes for a profit.

But Opendoor’s bigger challenge is being able to resell its homes for a profit.

- It’s difficult to imagine a sustainable business model selling homes for less than it bought them for, regardless of fee.

- The rubber hits the road with Opendoor’s buy-to-sale premium, and the following chart from Datadoor.io shows that, improving purchase cohorts or not, Opendoor continues to sell homes at a loss.

A four-year view of the same buy-to-sale premium, this time from YipitData, shows that Opendoor is well and truly in uncharted territory (and not in a good way).

A four-year view of the same buy-to-sale premium, this time from YipitData, shows that Opendoor is well and truly in uncharted territory (and not in a good way).

What to watch: With a rapidly changing market, reeling from unprecedented financial losses, and operating under new leadership, Opendoor is undergoing a transformative moment in its history.

What to watch: With a rapidly changing market, reeling from unprecedented financial losses, and operating under new leadership, Opendoor is undergoing a transformative moment in its history.

- It appears to be buying fewer homes while shifting towards more asset-light models, such as Opendoor Exclusives and Power Buying (Buy with Opendoor and Opendoor Complete).

- All of which raises an interesting side question: If Opendoor is buying significantly fewer homes and is guiding more consumers to its Power Buyer products, why would Zillow want to partner with them?

The bottom line: Homes are the fuel that powers the Opendoor machine.

- As Opendoor dramatically slows down its purchase of homes, it will lose less money — but it also loses its ability to make money.

- Think about it: If a coffee shop loses money on each coffee it sells, the solution is not to sell less coffee; it’s figuring out a way to sell coffee profitably.

Mike DelPrete is a strategic adviser and global expert in real estate tech, including Zavvie, an iBuyer offer aggregator. Connect with him on LinkedIn.