There’s not an overabundance of spreadsheets or charts (there are some) but instead a series of clean dashboards that track payments, outgoing expenses, revenue streams and tenants.

Are you receiving Inman’s Agent Edge? Make sure you’re subscribed for the latest on real estate technology from Inman’s expert Craig Rowe.

PayProp is property management software with a focus on financial oversight.

Platforms: Browser; mobile-responsive

Ideal for: Property managers, agents who work with investors, renters; small landlords

Top selling points:

- Intricate per-property insights

- Banking integrations

- Vacancy tracking

- Payment process automation

- Small property manager focus

Top concern:

While PayProp is designed to assist the property manager, I was surprised it isn’t integrating common payment tools such as Venmo and Zelle for tenants.

What you should know:

PayProp is yet another very solid, well-designed and purpose-driven software offering to help the rental property owner and any property manager or agent put in place. The software uses a minimalist front-end design to simply communicate the numbers, trends and economic wherewithal of rented real estate assets.

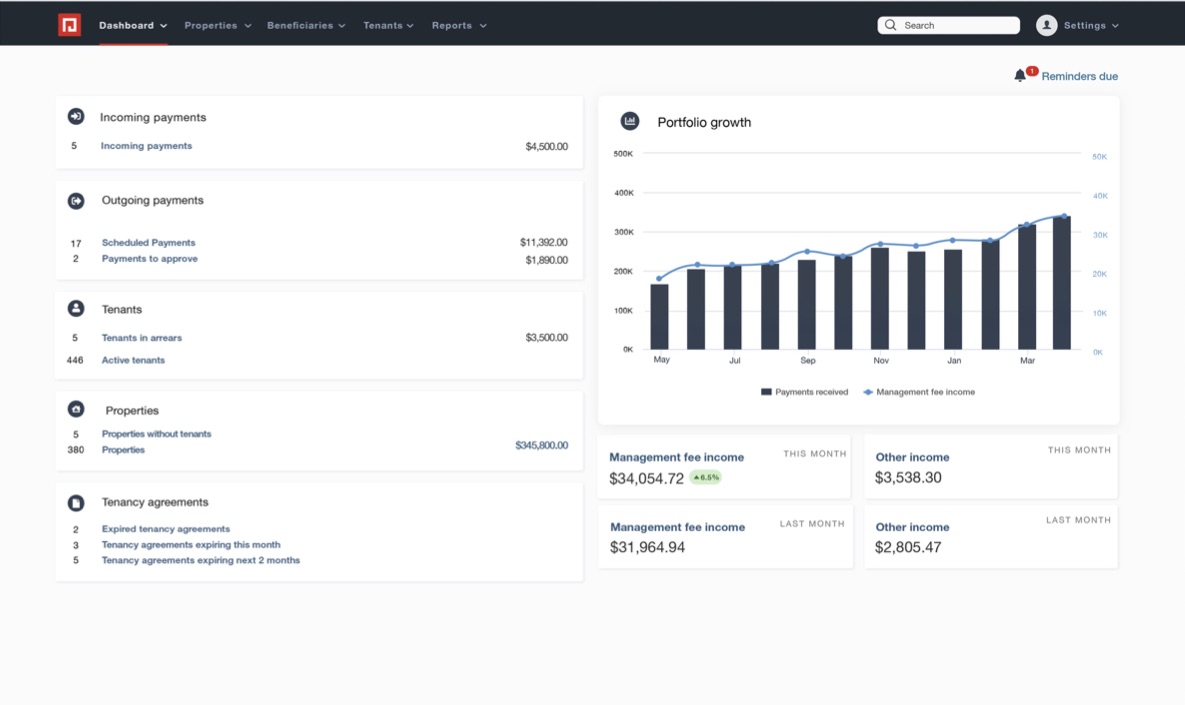

There’s not an over abundance of spreadsheets or charts (there are some) but instead a series of clean dashboards that track payments, outgoing expenses, revenue streams and tenants. It can invoice, communicate with tenants, verify funds immediately and offer long-term portfolio insights. It sounds like a lot, but it’s all collapsed nicely into an organized menu structure and easy-to-understand features.

When I say a software product is purpose-driven, I mean everything clearly revolves around its stated promise to the user. The mission of making it easier to manage the finances of owning investment property is clear from log-in to move-out. No feature steps away from that intent.

Thus, the aspiring customer can have the confidence they’re going into business with engineers and product managers that know the space, and laser-guided toward improving it. This isn’t a project management solution selling to six different verticals. This stems from PayProp’s existing success, as it’s been working in the U.K. for close to a decade.

PayProp’s dashboard breaks down actions by incoming payments, outgoing payments, tenants, properties and tenancy agreements. Each category appears only new activity dictates it should, helping minimize the user’s workspace, encouraging you to get in, get out.

You can view management fee income by month, as well as track forms of income over time.

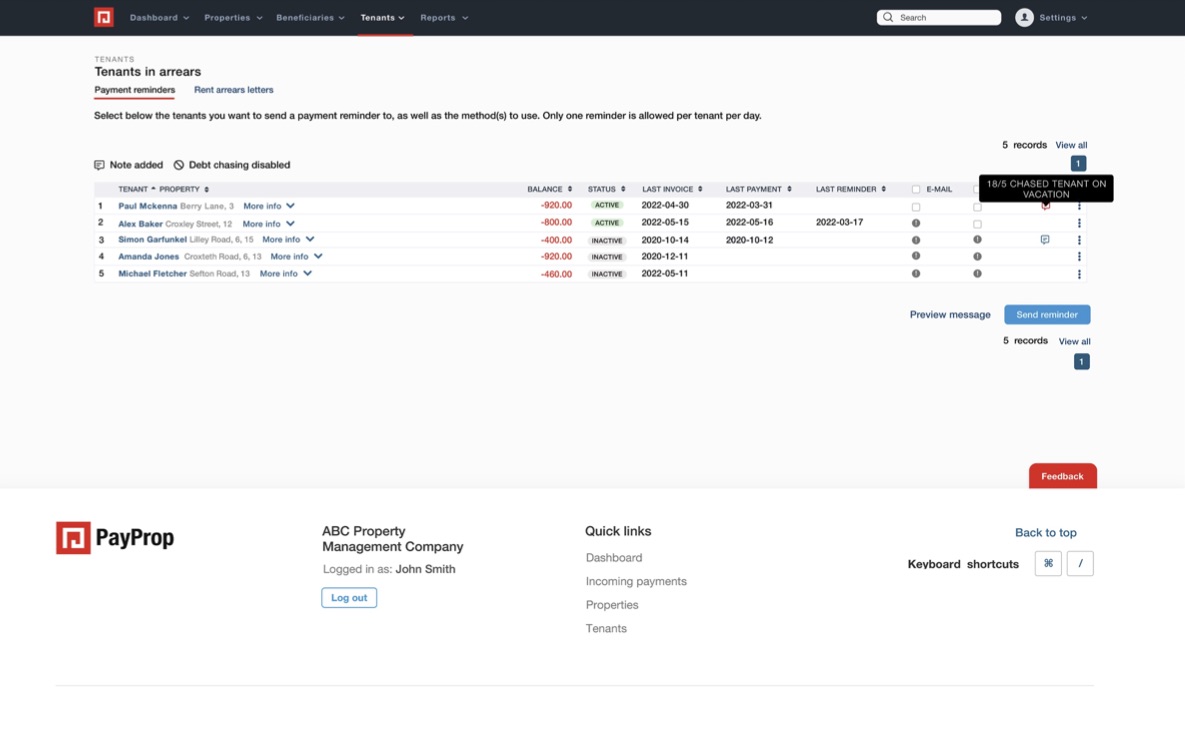

Tenancy agreements keeps you in the loop on what’s expiring when and who is in arrears, and gives you an email manager to send notifications directly from the system, and siloed under their specific unit. It’s all organized, not spread wide around multiple email accounts, which can happen easily when small landlords create business identities around individual LLCs and properties they’re marketing.

I’d like to see them adjust “tenancy agreement” to “leases” for the U.S. market. Minor.

Payments from tenants are filed the same day, using an invoicing system and by not batching deposits. This gives the user a shorter time period in which to determine if a tenant didn’t pay, or their payment isn’t in full or in some way can’t be fulfilled. Being able to react faster to lack of payment gives property manager more time to reconcile and plan for any shortages.

Tenant communications are handled through a built-in email system, complete with templates according to scenario and dynamic data input fields.

Understanding money in, money out for every unit is the overarching goal of PayProp, and it does it with a series of reports and simple breakdowns for every repair, vendor and tenant payment. Invoices can be set up ahead of time or on a recurring basis.

The maintenance portal is pretty much what it sounds like, detailing projects and invoice history for the portfolio as a whole, and per address and per unit. There are internal notes tools and a method for communicating specific needs to vendors before a request is fulfilled.

What I like so much about PayProp is also what I liked so much about Baselane — the integration of banking. Being a small landlord, especially when you get started, is all about managing the in and out. It takes years for investors to fully grasp how expenses impact annual returns and ultimately, financial gain. Mistakes in this arena is what drives people out of the landlord game, and why when I was selling investment property, we often paid residential agents for their clients after a showing or two, because they would advise the buyer to upgrade countertops and install new carpet. No. Don’t do that.

But I digress.

In summary, the U.S. small rental property owner market and property managers should welcome PayProp with open arms, and celebrate by setting your Excel sheets on fire. I understand why my colleagues at HousingWire named it to their Tech100 Real Estate list for 2023.

Have a technology product you would like to discuss? Email Craig Rowe

Craig C. Rowe started in commercial real estate at the dawn of the dot-com boom, helping an array of commercial real estate companies fortify their online presence and analyze internal software decisions. He now helps agents with technology decisions and marketing through reviewing software and tech for Inman.

Comments