In these times, double down — on your skills, on your knowledge, on you. Join us Aug. 8-10 at Inman Connect Las Vegas to lean into the shift and learn from the best. Get your ticket now for the best price.

Thousands of real estate agents, brokers, and association and multiple listing service executives descended on Washington, D.C., last week to attend the Realtors Legislative Meetings, the National Association of Realtors’ midyear conference, and steer their fate in the industry.

While there, they changed how much they will pay to be Realtors, imposed fair housing education on themselves, learned best practices around artificial intelligence, got closer to alerting agents about dangerous properties, accused the Federal Reserve of making a mistake, and explored how to handle commissions and other legal issues in a charged antitrust environment. Here are six main takeaways from the event:

NAR membership dues are going up

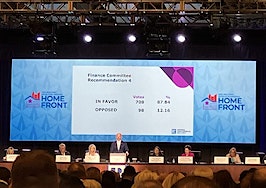

NAR’s board of directors voted overwhelmingly on May 11 to approve a proposal tying its annual membership dues to a measure of inflation in a bid to avoid eating too much into its reserves due to a predicted decline in membership this year and in 2024.

The approved policy states that, starting in 2025, NAR’s Finance Committee will use the comprehensive overall Consumer Price Index — a measure of inflation — “as a guide” each year when it recommends an annual dues amount to the board of directors.

The policy increases the likelihood of annual dues hikes, particularly since it does not include a previously-suggested cap on increases.

The board separately voted to increase annual dues for its 1.5 million members in 2024 by 4 percent to $156. NAR’s annual dues currently stand at $150, plus a special assessment for its consumer ad campaign, which was raised to $45 last year.

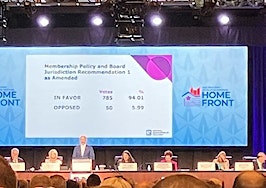

Realtors will be required to complete fair housing training

The nation’s 1.5 million Realtors will be required to complete two hours of fair housing training every three years starting in 2025 after NAR’s board of directors approved the requirement last Thursday.

Currently, the only training NAR requires of its members is a 2.5-hour Realtor Code of Ethics training every three years. The new fair housing training requirement will coincide with that ethics training schedule and go into effect more than five years after a groundbreaking 2019 Newsday investigation shook the industry with findings of widespread discriminatory real estate practices among Long Island brokerages.

NAR debuted its implicit bias certificate course, Bias Override, a year ago, on top of its Fairhaven fair housing training launched in 2020. Both are currently voluntary.

Bias Override and another NAR course, At Home With Diversity, will both be options to satisfy the new requirement. The board also approved another proposal from the Membership Policy and Board Jurisdiction Committee to update Fairhaven to become the free option NAR offers members to fulfill the new requirement.

Realtors learn AI best practices

At a Risk Management Issues Committee meeting, NAR Senior Counsel Chloe Hecht offered attendees best practices for AI to help them navigate the new technology without running afoul of copyright law or the Realtor Code of Ethics.

For NAR members, she highlighted two articles of the Realtor Code of Ethics:

- Article 2: Realtors shall avoid exaggeration, misrepresentation, or concealment of pertinent facts relating to the property or the transaction.

- Article 12: Realtors shall be honest and truthful in their real estate communications and shall present a true picture in their advertising, marketing, and other representations.

Hecht also offered these best practices:

- Always review any AI-generated content for accuracy. An AI-generation property description “might sound really nice and help you get started but it might not be accurate,” Hecht said. “So make sure you go back and you’re saying the things you want to say and you’re using AI to help you create this.”

- Make an AI-created work “your own” by changing or adding to it. “If those changes are substantial enough, it might mean that you own rights in those changes,” Hecht said.

- Don’t use AI to create a work that you want to be able to protect. “Right now AI works are not protectable under copyright law,” Hecht said.

- Do not assume any third-party content was created by AI and therefore available for your use. “Always use your best practices for third-party works: Get permission in writing and save it,” she said.

MLSs get closer to alerting agents about dangerous properties

At a Multiple Listing Issues and Policies Committee meeting, Tiffany Meyer, chair of NAR’s Realtor Safety Advisory Committee laid out a recommendation for MLSs to adopt eight data fields designed to alert agents to potentially dangerous property conditions: vacant; no heat; minimal or no exterior lighting; minimal or no interior lighting; remote/limited visibility from the road; electricity not on; inconsistent cell service; and other.

So far, five MLSs have piloted the fields and Meyer said the Realtor Safety Advisory Committee would continue to run its pilot program, add more participants, and collect more feedback.

“We plan to implement the feedback the second quarter of 2023, including from the RESO [Real Estate Standards Organization],” she said. After that, tentatively in the third quarter, the committee would encourage all MLSs to implement the fields.

“It is a strong belief and considered opinion of the Realtor Safety Advisory Committee that the recommended modifications to the MLS fields will increase safety, potentially saving lives and help ensure that every Realtor comes home safely each night,” Meyer said.

NAR’s chief economist says the Fed made a mistake

NAR Chief Economist Lawrence Yun started off his much-anticipated presentation on housing market trends with a dig at the Federal Reserve for its latest interest rate increase aiming to curb inflation, noting that inflation is already coming down.

Rent is one of the biggest drivers of inflation and that 5 percent inflation is coming at a time when rental rates are still accelerating — but not for much longer, according to Yun. Rents will come down because of “very, very robust” apartment construction, which is at a 40-year high.

Yun noted that existing-home sales are currently below their pre-COVID rates, but may be stabilizing. On the other hand, new-home sales are back to their pre-COVID levels, according to Yun. He attributed the difference to inventory: While existing homes on the market are about 40 percent below what they were in 2019, new-home inventory is higher than it has been for years.

The lack of existing-home inventory means that there’s no home-price collapse coming, according to Yun. Sixty percent of listings currently sell within a month and 28 percent are attracting multiple offers, he said.

He predicted that total home sales would bottom this year before ticking up next year as mortgage rates decline and job growth continues.

NAR’s legal team warns agents about legal issues

NAR’s legal team was busy during the conference, attending session after session to warn attendees about legal issues on the horizon.

At the event’s MLS Association Executives Session, NAR Senior Counsel Charlie Lee warned about vacant lot scams in which someone pretends to be the owner of a property in order to trick a buyer into handing over money to purchase it.

Lee offered agents these recommendations:

- Ask the seller for detailed information concerning the parcel number, annual property taxes or exact location.

- Independently research the name of the seller and check their photo ID.

- Require an in-person or virtual meeting to see their government-issued ID.

- Contact the listed property owner using a verified telephone number or by sending an overnight service letter to the address for property tax bills.

- Verify that the notary is a real person appointed by an applicable government agency. Suggest a remote online notary.

- Participants and subscribers should recommend their clients create a Google and/or property alert of their property address.

Lee also advised MLS executives to make sure their MLSs are following Digital Millennium Copyright Act (DMCA) safe harbor requirements to ensure that they will not be held liable for copyright infringement claims in regard to floor plans.

In addition, he said that due to a ruling in the 8th U.S. Circuit Court of Appeals sending a copyright case over floor plans back to the lower court, MLSs in the 8th Circuit (Arkansas, Iowa, Minnesota, Missouri, Nebraska, North Dakota and South Dakota) should consult their legal counsel to assess their possible risks and how to best handle floor plans.

Lee also told MLS executives about “unfair service agreements,” which are long-term listing agreements enforceable by lien in exchange for cash. They are also known as Non-Title Record Agreements for Personal Service (NTRAPS).

Florida-based MV Realty is the most well-known brokerage that offers such agreements. In the face of lawsuits by attorneys general in Florida, Pennsylvania, Massachusetts and Ohio, and most recently, North Carolina, MV Realty announced in February that it had “paused entering into any new agreements in all states.”

Lee noted that the American Land Title Association (ALTA) had created model legislation against such agreements and suggested that MLSs or associations interested in taking any lobbying action around the issue consider ALTA’s model legislation.

Still, Lee said MLS executives should avoid making any remarks about the business model or practices of any member or other broker or agent and that, if they receive a complaint that doesn’t have to do with MLS policy or the Realtor Code of Ethics, they refer the complainant to their state’s consumer protection agency, attorney general’s office or real estate commission.

Lastly, at a Risk Management Issues Committee meeting, Lee stressed that agents cannot count on a “standard” commission rate and that they will have to negotiate their compensation with their clients and listing brokers.

“It’s important to articulate your value proposition so that they understand why it is that you are worth what it is that you’re getting paid because all of those things provide great value,” he said.

“It should be discussed before showing the property,” he added.