No one can predict the future of real estate, but you can prepare. Find out what to prepare for and pick up the tools you’ll need at Virtual Inman Connect on Nov. 1-2, 2023. And don’t miss Inman Connect New York on Jan. 23-25, 2024, where AI, capital and more will be center stage. Bet big on the future and join us at Connect.

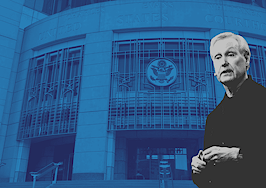

KANSAS CITY, Mo. — At a trial that could change how real estate agents nationwide are paid, RE/MAX CEO Nick Bailey, former Coldwell Banker CEO M. Ryan Gorman, and Keller Williams University executive Meredith Maples defended how they train agents in regards to commissions.

On the second day of witness testimony Wednesday in the Sitzer | Burnett trial, attorney Michael Ketchmark of Ketchmark and McCreight continued presenting the plaintiffs’ case and focused on antitrust policies held by the defendants that he then proceeded to allege they violated, largely through training materials and presentation slides at Keller Williams Family Reunion events.

Ketchmark started off the day with video deposition testimony from NAR Head of Engagement Rodney Gansho that established that NAR’s cooperative compensation rule, also known as the Participation Rule, is mandatory and that any of the franchisor defendants in the case — Keller Williams, Anywhere (formerly, Realogy), RE/MAX, and HomeServices — could have proposed to change the policy.

The Participation Rule, which requires listing brokers to make an offer of compensation to buyer brokers in order to submit a listing to a Realtor-affiliated multiple listing service, is the core rule at issue in the class-action antitrust lawsuit known as Sitzer|Burnett, which is the subject of the current trial.

Ketchmark then noted that NAR’s “Antitrust Compliance Guide” says that its members should establish fees unilaterally without consultation or discussion with competitors and that agents should never use statements such as “I’d like to lower the commission, but no one will show your house,” which Gansho confirmed.

Ketchmark subsequently called Michelle Figgs, a former senior industry analyst at Keller Williams, to the stand, again via a recorded video deposition. Her testimony referred to an email she had sent to Ruben Gonzalez, KW’s chief economist, sharing a study called “Can Free Entry Be Inefficient? Fixed Commissions and Social Waste in the Real Estate Industry.”

The 2003 study says, “The apparent uniformity of commission rates presents an enormous puzzle, especially if one believes that the cost and effort necessary to sell a house do not increase one to one with the price of housing. Why do commission rates appear to be so insensitive to economic forces? We do not have an answer to this puzzle. One possibility is that it reflects collusion by real estate brokers, perhaps enforced by the fact that every Realtor has to work through the local MLS, which makes price cutting easily detected.”

Figgs told Ketchmark that in the six years since she had read the study she had “largely dismissed” what it says.

Ketchmark then referenced notes Figgs had created from a May 2015 meeting at KW, in which she wrote that “Gary [Keller] believes strongly in collusion theory for why commissions are stable. ‘Co-opetition.’” Figgs wasn’t sure if Keller himself or someone else at the meeting made that statement.

Ketchmark then called recorded testimony from Meredith Maples, senior director of Keller William University. Maples testified that Keller Williams had not provided her with any guidance in regards to antitrust compliance and that she had not been trained to follow the provisions in NAR’s Antitrust Compliance Guide regarding commissions.

Ketchmark then showed her KW’s antitrust compliance guidelines, which prohibit commission discussions, including at industry events. He then showed various slides prepared for KW Family Reunion events that show 3 percent commissions for each side of a deal, including in the context of calculating gross commission income (GCI), and refer to a “standard 6% commission.”

For example, one slide headlined “Get Your Full Commission” questioned “What if I fail and don’t get my 6%?” Another slide showed an objection from a seller saying, “I don’t want to pay 6 percent” and an agent responding, “Ok, how about 5.99 percent?” Yet another said, “Do you want to sell homes at 6%? Do you want to help others?”

Ketchmark pointed out that such events attract some 18,000 KW agents and about 500 agents from competitors.

“When we use numbers, it’s not telling them that’s what the numbers should be,” Maples said. “It goes back to the model.”

Ketchmark pointed out that nothing on the slide said anything about a model. He quoted KW’s definition of a model: “A pattern of something to be made; an example for imitation; serving as or capable of serving as a pattern to be imitated.” He added that KW teaches its agents that a “model will work for you if you follow it.”

When Ketchmark asked Maples whether she talked about commissions in the slides despite KW’s antitrust policy, Maples said, “In the context of models, not in the context of direction.”

Maples added, “If you were to, from a training perspective, change the numbers, it would be confusing.”

Ketchmark latched onto that and said, “But in fact you did on the next page.” He referred to slides showing how many more homes an agent would have to sell to earn a million dollars if they charged a 2.5 percent commission versus a 3 percent commission.

Maples insisted that the slides, which included scripts on how to handle objections, were “models” that agents could personalize to their own businesses.

“Anything we include from a script perspective is a hypothetical situation,” Maples said, noting that KW differentiates between scripts and training.

“We don’t tell people what to charge,” she added.

Ketchmark then called Bailey to the stand, also through a recorded video deposition. Bailey confirmed that RE/MAX requires its franchisees to belong to NAR and therefore follow its MLS policies and code of ethics.

Bailey said, “I do believe that the MLS is derived from the concept of cooperation and compensation” but that if the cooperative compensation rule were no longer mandatory, RE/MAX does not believe it would change listing brokers’ behavior.

“Whether or not the rule exists or not, I don’t believe it changes anything,” Bailey said.

Ketchmark also grilled Bailey on RE/MAX’s training materials and their use of a 6 percent commission. Bailey said statements about specific commission rates were only meant as “examples.”

“It is for example purposes only,” Bailey said. “We are very clear that commissions are negotiable.”

When asked whether RE/MAX trains agents to tell homesellers that they won’t cut their commission, Bailey initially hedged and began talking about how agents should “establish [their] value proposition” but after repeated questioning he said that statements about not cutting commissions appear in education materials as an example of how to handle objections.

“If they want to cut their commission, they can,” Bailey said.

On Tuesday, Ketchmark played an agent training video from Gino Blefari where he said he’d negotiate commissions only if they went up, and that he pre-writes a 6 percent commission into listing agreements.

In the afternoon, Ketchmark played video deposition testimony from Gorman in which he first established that “all persons engaged with the [Anywhere] business” were required to comply with NAR’s Code of Ethics and that all Coldwell Banker affiliates were encouraged to become NAR members.

In his testimony, Gorman reiterated Anywhere’s stance, first announced in January 2022, that “the mandatory nature of [NAR’s cooperative compensation] rule is unnecessary and should be rescinded.” He said Anywhere had submitted a proposal to that effect to NAR in the spring of 2022.

“My understanding is that it did not progress beyond the committee to which it was submitted,” Gorman said.

Ketchmark then presented exhibit after exhibit showing that training materials for Anywhere brands Coldwell Banker, Sotheby’s, ERA, and Better Homes and Gardens Real Estate were similar and all included the same response to a seller question asking if an agent would cut their commission: “I cannot cut my commission because I would never offer you less than my best.”

Gorman said that Anywhere does not train its agents to set commissions at a certain level.

When Ketchmark asked whether Gorman could point to a single document with an example commission rate other than 6 percent, Gorman said he believed he’d seen documents with examples of 5 percent and 7 percent “as well as the vast majority being blank.”