- Freddie Mac's MiMi numerically details market activity to illustrate stability and instability across the nation.

- Scores between 80 and 120 are considered healthy.

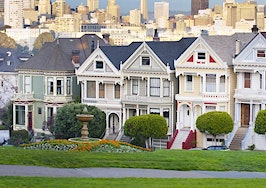

- While San Francisco scored a healthy 91.5 in June, this is a 0.11 percent drop from May.

Freddie Mac released its latest Multi-Indicator Market Index (MiMi) based on June housing market activity. MiMi numerically details national, state and metro-level market activity to illustrate market stability and instability across the nation.

On a national level, MiMi falls in the healthy range of 85 in June. This is a .08 percent rise from May and a 1.37 percent jump over the previous three months. Annually, the national MiMi is up 5.76 percent.

The Freddie Mac MiMi is calculated using four key indicators: purchase applications, payment-to-income ratios, mortgage health and employment rates. Markets in-range are scored between 80 and 120, while numbers below 80 are considered weak. Scores above 120 are elevated.

In national highlights, South Carolina and the Georgia metros of Atlanta and Augusta reached historic activity levels in June.

While San Francisco scored a healthy 91.5 in June, this is a 0.11 percent drop from May. On the other hand, San Francisco’s MiMi rose 0.11 percent in the three-month period prior to June and jumped 3.04 percent yearly.

San Francisco fell in healthy range for payment-to-income (104.5), current-on-mortgage (94.7) and employment (111.4). However, the report says purchase applications are low (55.5), up slightly month-over-month by 0.54 percent.