No real estate website is complete without an agent-matching tool, right?

Down Payment Resource, a provider of down payment assistance information, discovered this after many of its website visitors asked to be connected with an agent.

Now the company has tapped ReferralExchange, a referral platform for agents, to meet this demand.

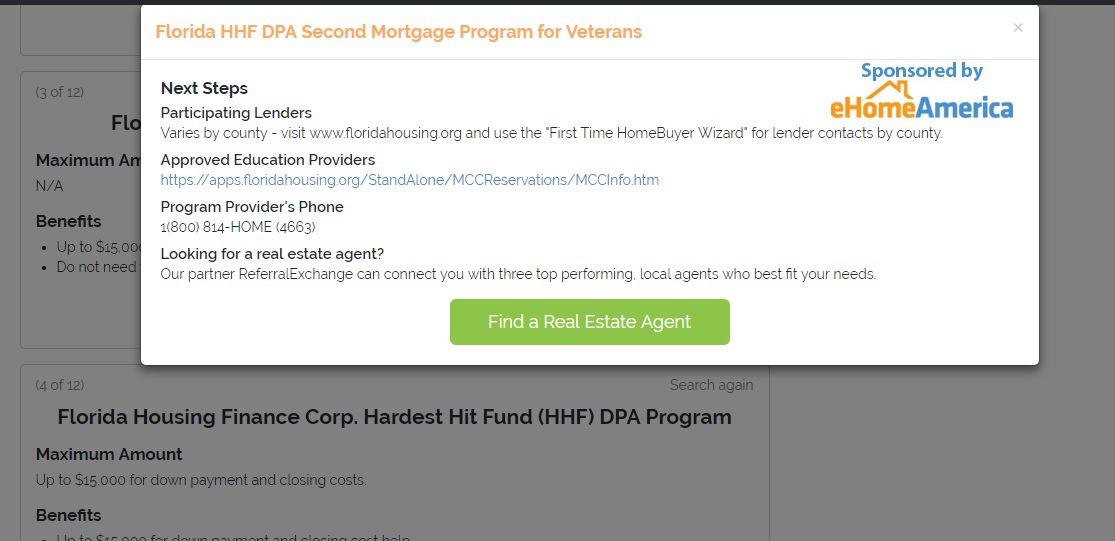

When homebuyers ask to be matched with an agent, DownPaymentResource.com draws on ReferralExchange’s technology to pair the buyer with an agent that’s deemed to meet their needs and qualifications.

After searching for down payment assistance, Down Payment Resource users are asked if they want to find a real estate agent.

ReferralExchange makes it easy for agents to send referrals to other agents and track their progress. It pockets a cut of referral fees earned by agents when their referrals convert into closings. Over 20,000 agents are active users of ReferralExchange, with the network generating 15,000 referrals per month, according to the company.

ReferralExchange also powers agent-matching tools for regional brokerages, lenders, smaller listing portals and coaching companies, said spokeswoman Deidre Woollard.

Woollard said ReferralExchange isn’t permitted to name any of these customers, presumably making Down Payment Resource the first company with an agent-matching partnership with ReferralExchange to publicize it.

Under the partnership with Down Payment Resource, ReferralExchange collects a 35 percent referral fee from agents who close leads received through its agent-matching tool. Down Payment Resource keeps 25 percent while ReferralExchange gets the remaining 10 percent.

Down Payment Resource serves up information on more than 2,400 homebuyer programs.

It also provides a down payment assistance finder that can be added to broker, agent and multiple listing service (MLS) websites, along with a service that can flag relevant down payment programs for listings on behalf of MLSs and brokers.