- Low rates have spurred demand for property, led to price increases in stable markets and stopped the landslide of prices from the 2008 crisis.

- While we don't know how every facet of the market will behave if loan rates begin to increase, we can predict that investors will lose their buying capacity and deposits will begin to yield again, though minimally.

The mortgage rates in Europe and the U.S. have been declining in recent years and finally fell to a record low in 2017, while property prices have been quickly increasing.

In 2015, the Federal Reserve System (Fed) began gradually increasing the refinancing rate. Many assume that the mortgage burden will also increase, putting pressure on property prices as investors anticipate higher return on investment.

Is the price adjustment really a matter to worry about?

How mortgage rates have affected property prices

Europe and the U.S. have been pursuing the easy money policy in order to activate their economies since 2009.

As a result, an unprecedented event — the cost of money falling to zero and negative values in some countries — has been taking place in the global economy over the last five years.

Mortgage loans have become almost free: According to Statista.com, the mortgage rates in Germany decreased from 5.2 percent to 1.5 percent between 2007 and 2016.

In 2017, German resident investors can buy flats with an 80 percent loan-to-value (LTV) mortgage at 1 percent per annum, rent them out and get yields of 3 to 4 percent per annum. Property owners can pay the mortgage with their rental income and enjoy the annual property appreciation by 2 to 5 percent, depending on the location. The cost of financing is significantly lower than the rental rates.

Bank deposits have stopped yielding and even become disadvantageous, as most European banks charge their clients for keeping money. People have to find alternative investment vehicles and increasingly opt for real estate, which is a comprehensible and reliable way of investing with relatively high yields.

All of the above has led to a situation where the real estate asset owners do not want to sell their properties at reasonable prices. If the investors “go into cash,” they will need to reinvest the money in something, and there are very few offers. Having deposited money with banks, they will have to pay negative rates.

This narrows the number of offers in the market even further.

Low rates have spurred demand for property, led to price increases in stable markets and stopped the landslide of prices in countries that suffered from the 2008 crisis.

According to Eurostat, the residential property in Austria and Germany became 20 percent more expensive between 2013 and 2016, while certain markets (e.g., Berlin and Munich) grew even more rapidly.

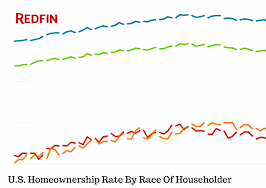

During that same period, the prices in Spain and Portugal hit bottom and then started going up, while the markets of Australia, Hungary, Ireland, Canada, Poland and the U.S. were growing actively.

The European real estate market of today can be explained using the following metaphor: Germany is a bathtub, and water is the capital. The bathtub is full, so the water overflows to the secondary markets: Hungary, Ireland, Spain, Portugal and the Czech Republic.

Low rates have also augmented the supply as more capital became available for construction. Thanks to cheap mortgage loans, the global market has seen much development over the last six years. The developers would not have carried out many of their projects, and the clients would never have purchased the constructed properties without this capital.

Will the rate increase lead to a price reduction?

The situation in the lending market has begun to change over the last two years: the U.S. Federal Reserve System has increased the refinancing rate three times since 2015 and will probably do so two more times before the end of 2017 (in June and in December).

The Fed is raising the refinancing rate cautiously. Its goal is to find an effective balance between the risks of low rates and the desire to encourage economic growth.

When it comes to the refinancing rate, the mortgage rates depend. Notably, a rise in U.S. interest rates may be followed by an increase in the rates of the U.K. and continental Europe.

While we don’t know how every facet of the market will behave if loan rates begin to increase, we can predict that:

- Investors will lose their buying capacity

- Deposits will begin to yield again, though minimally

- The volume of construction will reach its peak

- Supply of real estate in the market will increase

- Owners will want to lock in their profits or reject burdensome mortgages and properties that have lost their liquidity

All this may stop aggressive purchase growth and even cause a property price decline in peripheral locations.

For instance, a property in the U.S. was bringing its investor a yield of 5 percent per annum with a treasury yield of 1 percent. The spread (or the investor’s risk compensation) amounted to 4 percent per annum.

Later, the general rate level increased and the treasury yield grew to 3 percent. It is logical for the investors (the potential buyers of this property) to require the same risk compensation as before. This means that the yield of such a property has to increase up to 7 percent.

This can happen either with the increase of the rental flow or a reduction of the price per square meter. Long-term rental contracts are rarely reviewed, so price reduction is really the only viable option.

However, according to our estimates, when and if the regulators begin raising the rates, they will do it not rapidly but gradually, for which reason no quick price adjustment is to be expected. But it is true that the growth limit has already been reached in many developed countries. Many investors understand that the prices may go down. Such a risk is most probable in the locations where the population, income and the number of workplaces do not grow.

Our recommendations

The rate growth is a risk professional investors need to consider in advance. We recommend taking specific measures to indemnify your investments.

How to invest in order to not lose money

- Buy quality assets in locations with healthy population and income growth. Prices fall less during the recession and grow more quickly during the market recovery in central districts.

- Buy properties with long-term (10 to 20 year) fixed rental contracts. Such agreements allow getting through the period of price adjustment smoothly.

- Do not refinance the projects, but fix the rate instead.

What to do in order to earn

- Find micro-locations that are going to gain in price quicker than their neighbors due to reasons like infrastructure and logistics improvements or gentrification. Examples of such neighborhoods include, Poblenou, Barcelona, Lichtenberg, Berlin and Wynwood, Miami.

- Invest in properties that will be popular for more than 10 years (e.g., micro-apartments, hotels, warehouses and retirement homes).

- Invest in properties with growing rental revenues and capitalization rates.

- Invest in value added development and redevelopment projects.

Experienced investors choose 10-year or longer planning horizons when investing their funds in rental properties. As every real estate market is subject to cyclicality, price adjustments are unavoidable in long-term investments.

However, in the mature markets, average yield rates and property price growth rates always outrun inflation, and future price adjustments are offset.

In 2017, we recommend investing in foreign property, relying on the following criteria:

- Macro-location. A city whose labor market and population income are growing.

- Micro-location. A gentrified neighborhood near the center where price growth will surpass the city average in the following decade.

- Property type. Highly liquid properties that will be in high demand for the next 10 year or longer (e.g., micro-apartments).

- Financing. Fifty to 60 percent LTV mortgage loan at a rate fixed for the longest term possible

These recommendations will help indemnify your investments against market correction risk if mortgage rates go up.

George Kachmazov is managing partner at Tranio, an overseas property broker