Redfin is testing a new program that allows homeowners to sell a property to Redfin for as little as a 7 percent commission.

The high-tech Seattle-based brokerage revealed the service, called “Redfin Now,” in a recent filing for an IPO of $100 million.

Its synergies with Redfin’s existing services and technology are extensive and position the program to become a formidable competitor to Opendoor, OfferPad and other “iBuyers,” a moniker for platforms using new technology to make offers on homes and close quickly. The announcement marks the first time a traditional brokerage has entered this space, potentially offering a roadmap for other brokerages to do the same.

Redfin, which operates in more than 80 markets, is only testing Redfin Now in two locales: California’s Inland Empire and San Diego.

But the company, which declined to comment for this story, said in the IPO filing that Redfin might “seek to raise additional capital through equity, equity-linked, or debt financing arrangements” to fund expansion of the program.

Despite months of testing, Redfin Now doesn’t appear to have racked up significant experience. RDFN Ventures, the Redfin subsidiary under which “Redfin Now” does business, has only purchased six properties, according to a property records search by Attom Data Solutions. Redfin.com shows that Redfin has resold five of those homes and has the sixth under contract.

In most of these flips, Redfin resold the properties for only marginally more than it bought them for, suggesting Redfin Now can pay close to market value, or even full market value, for homes — particularly if we assume that Redfin Now made repairs to these early acquisitions.

Offer and fee structure

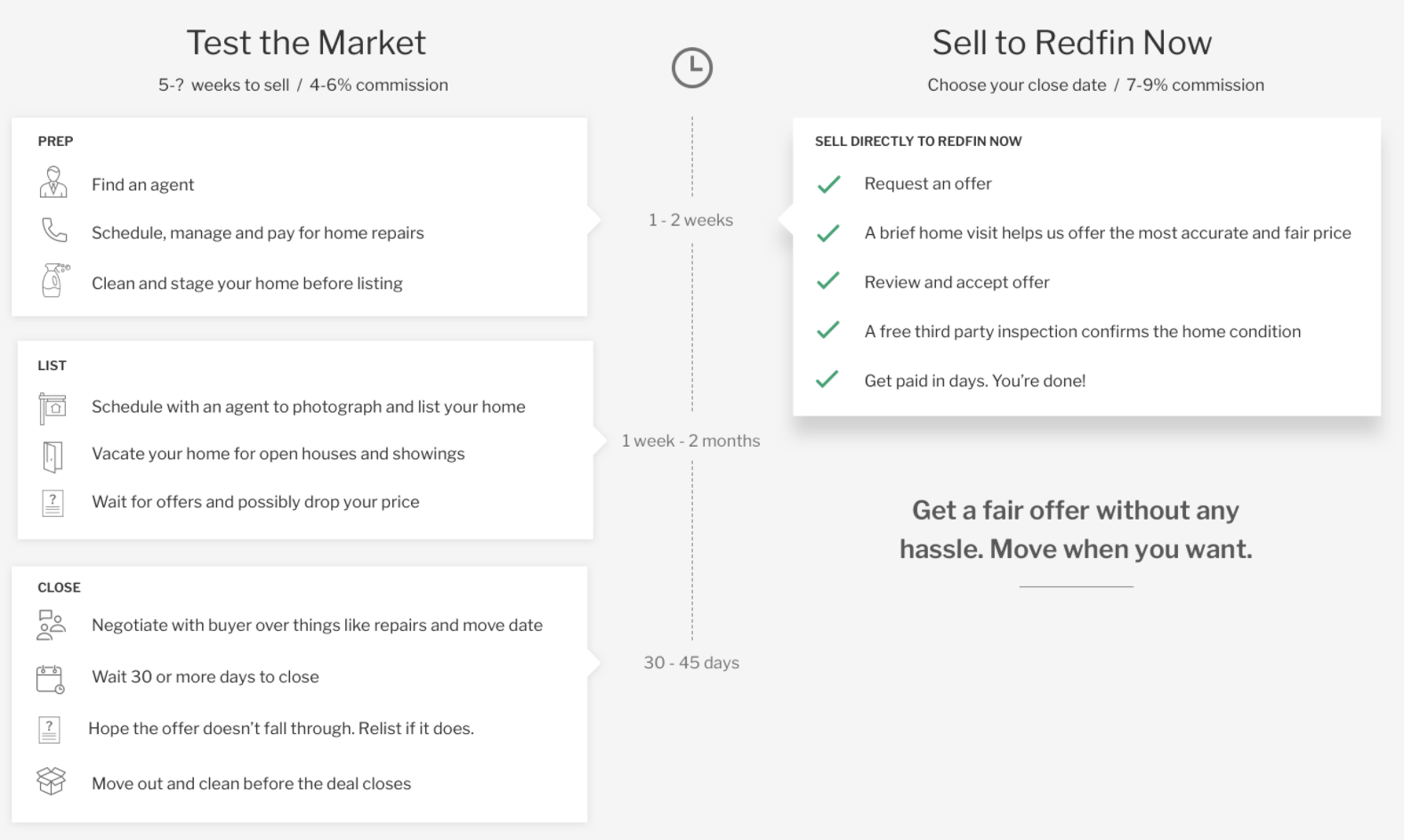

Homeowners can view an immediate offer range for a home on Redfin Now’s website. If they choose to request a formal bid, Redfin will send someone to explore the home for 30 minutes and then submit a binding offer within 24 hours.

The offer is supposed to be “fair and transparent.” To accept it, the seller will pay the following:

- A service fee ranging from 7 to 9 percent

- A repair cost credit typically ranging from 0 to 2 percent, depending on the results of a home inspection by Redfin (after an offer is accepted)

- Closing costs that Redfin pegs at around 1 percent

These fees are on the low side of what iBuyers typically charge.

Redfin Now’s site explains that, “as soon as you accept your offer, we get to work finding the next buyer for your home.” And Redfin’s IPO filing says that redfin.com’s reach of 20 million visitors, “coupled with our network of Redfin buyers, will let us effectively resell the homes we purchase through Redfin Now.”

This suggests the brokerage would give prominent placement to Redfin Now listings, as it does for its seller clients’ listings, and market properties well before completing purchases.

Redfin is also already using its website to promote the program, serving up a “Get an Offer” button on some property details pages beneath a come-on of “Sell your home, guaranteed.”

Tying into Redfin’s other services

Redfin Now means its agents could strut into listing appointments with offers in hand, essentially allowing the brokerage to provide low-cost traditional service backstopped by a competitive, guaranteed offer of last resort. (IBuyer Knock specializes in this dual offering, and Opendoor has been testing it.)

Redfin also owns a mortgage lender and title company, meaning the company could pair these ancillary services with Redfin Now — as it does with its core brokerage service — to provide a bundled end-to-end offering.

“Our goal is to build technology for Redfin Mortgage that will ultimately support a completely digital closing, leading to efficiency gains for our brokerage, title and mortgage businesses,” Redfin noted in its IPO filing.

Some Redfin Now customers use the flexibility afforded by the service “to coordinate a relocation or to buy their next home without the risk of paying two mortgages or moving twice,” Redfin Now’s site says.

The program can draw on Redfin’s agents extensive network of partner vendors for fixing and managing its acquisitions.

Redfin declined to comment when asked how it currently uses smart locks and beacons to show listings, but the brokerage could easily leverage this technology — along with its mobile app — to provide rich showing experiences of its homes to buyers unaccompanied by agents, a la Opendoor.

When asked what sets Opendoor apart from Redfin Now, Opendoor CEO Eric Wu, whose company has raised more than $700 million in equity and debt financing, had this to say:

“The increase in number of companies building a similar experience to Opendoor further validates the customer demand for an online, instant sale. Giving consumers more choice will both accelerate adoption of this modern way to sell a home and benefit homeowners through a drastically improved experience.”

Real estate giant Zillow has also dipped into the iBuyer marketplace with Instant Offers, which connects consumers with investor bids with or without the help of a real estate agent. “These startups are gaining traction,” Zillow Chief Business Officer Greg Schwartz previously wrote. “They’re well-funded, and they’re responding to the changing expectations of consumers.”

Some industry observers are scratching their heads over the timing of the iBuyer craze.

“I find it rather strange that so many companies are getting into the ‘quick sale’ business when the market is so hot,” said Timothy Ellis, who formerly served as Redfin’s Real Estate Scientist. “Opendoor, Knock, Zillow Instant Offers, Redfin Now… Why would buyers use a service like this when they can sell their home so quickly for top dollar?”

But he added that he can see Redfin Now as a “test-bed for the [iBuyer] idea or similar offshoots.”

“If they [Redfin] test with limited availability it in a few small markets, they could dial [Redfin Now] in and be prepared to quickly launch it nationwide if there’s a slowdown in the market and demand for a service like that suddenly picks up,” he said.

Editor’s note: This story has been updated with data suggesting that Redfin Now may have paid full market value for some of its early property purchases.