The coronavirus pandemic has upended the stability of many Americans’ livelihoods, potentially pushing back the dream of homeownership, and leaving more individuals stuck in the rental market. Based on current trends of increasing demand for single-family rental homes as a result of circumstances related to the pandemic, the U.S. faces a shortage of single-family rentals for the next 10 years, according to an analysis by RCLCO Real Estate Advisors.

About 6 percent of new single-family homes are built for the purpose of being rented out, which would yield roughly 700,000 new single-family units being constructed over the next 10 years, according to RCLCO’s estimates. However, if families continue to provide demand for these rentals at their current rate, RCLCO says the current rate of production of these homes will fall well short of demand.

“Of course, that could change if the number of units being produced increases dramatically, or if the COVID-19 recession leads to more substantial foreclosures pushing more units into rental inventory,” states RCLCO’s report, authored by Managing Directors Gregg Logan and Todd LaRue. “But that is not the trend to date.”

Particularly if Congress is able to act more swiftly on passing a second stimulus package and mass evictions or foreclosures are avoided, the single-family home rental market may experience significant demand for inventory as more renters are placed in uncertain economical positions more compatible with renting than buying.

“The demand for new build-to-rent product is being driven by demographic shifts resulting in more households being in the stage of life where single-family housing better suits their needs, and the housing affordability challenges that are keeping many households, especially first timers, out of the for-sale market,” RCLCO’s report reads.

“Although some are forecasting home price declines as a result of the COVID-19 recession, the ratio of household incomes to median home prices over the past two years has been at record highs, continuing the decreasing affordability trend that only paused during the recovery [after the Great Recession].

“Given strong household growth and a lower than historical ratio of housing production to that growth, recessionary impacts to home prices are likely to be short-lived and a lasting return to general housing ‘affordability’ is unlikely any time soon.”

At a time when job security may be uncertain and those who do have secure jobs are likely working remotely anyway, the flexibility of living in a single-family rental, which affords more space than an apartment and has better potential to be in the less-congested location of your choosing, is a much more attractive option for many right now.

Although more millennials seem to be entering the for-sale market more than ever, this demographic also faces roadblocks that are likely to push them into the single-family rental market.

“The homeownership rate of millennial households is below that of gen xers and baby boomers at the same age, in part because they’ve saved less for a down-payment due to economic circumstances, student loans, and other debts,” the report says. “They are either entering their family formation years or a period of time where traditional apartment living has become less desirable, and the single-family housing lifestyle is appealing, but ownership attainability is at a low point.”

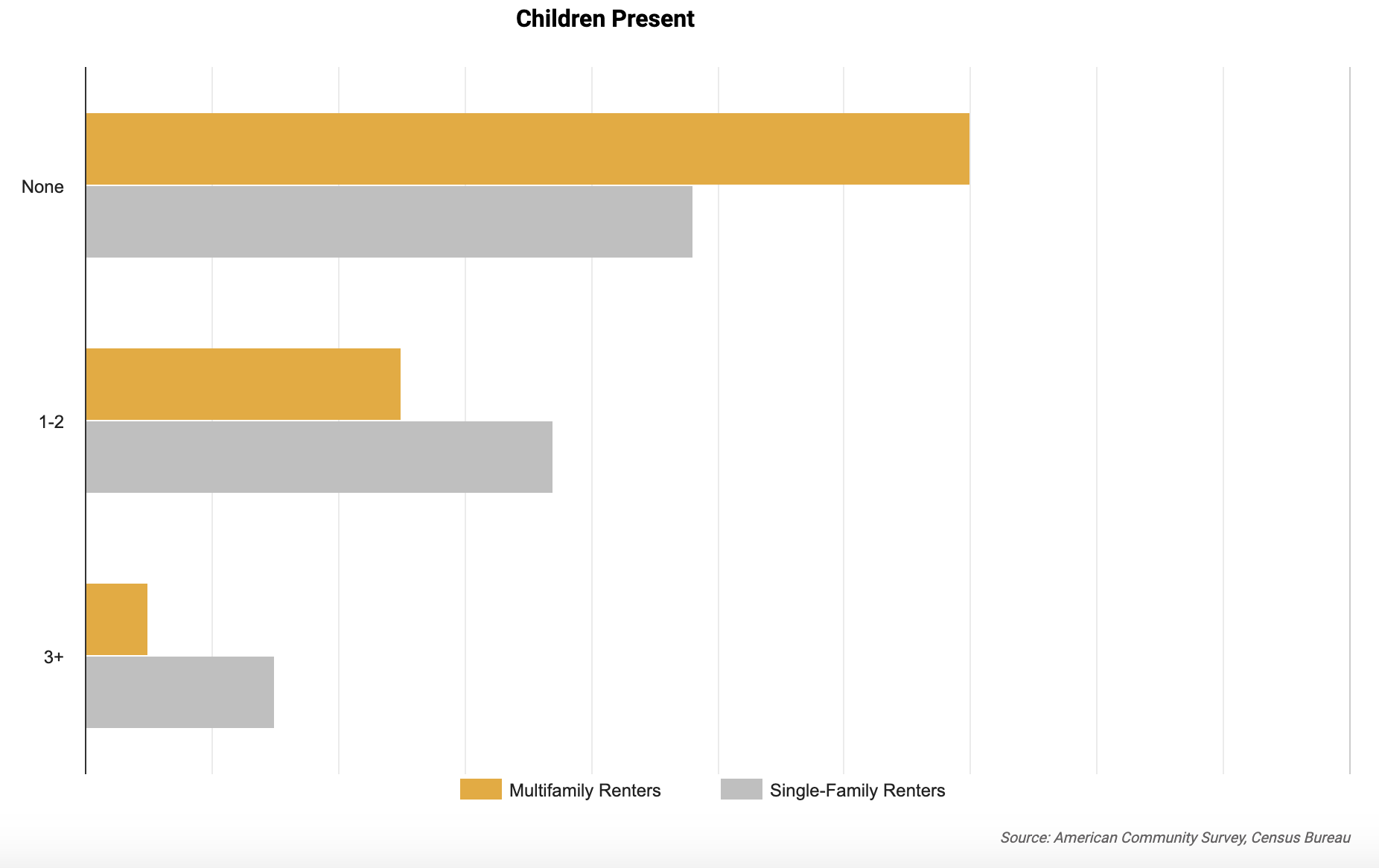

Data from the U.S. Census Bureau’s American Community Survey shows that single-family home renters tend to be a bit older and have children, making older millennials who have started families particularly apt to fall into the single-family renter category.

Leading up to the pandemic, many developers focused their efforts on multifamily developments in urban locations with shared amenities and in close proximity to entertainment and nightlife. And, though no one can anticipate the future with certainty, there’s some evidence to suggest that Americans’ living preferences could be shifting to the suburbs where there’s more space (and more single-family housing) and less chance of contracting the virus. If current trends prove long-lasting, single-family rental properties may require a boost from new construction.

“Given the anticipated undersupply of single-family rentals for the foreseeable future, this segment represents a strong opportunity for investors, builders and developers to create new rental home communities in a variety of formats, serving a growing market,” RCLCO’s report concluded.