This post has been republished with permission from Mike DelPrete.

After a brief interlude last year, iBuyers are back in a big way. The iBuyers have bought more houses, at higher prices, in Q2 of 2021 than in any other quarter. Opendoor purchased more houses in the past three months than in all of 2020.

For anyone concerned that the iBuyer model wouldn’t be popular in a seller’s market, the evidence shows that it is resonating with consumers more than ever, and market conditions are in fact fueling its growth.

$350,000 is the new $250,000

IBuyers are paying more for houses than ever before. The median purchase price of a home bought by Opendoor, Zillow and Offerpad climbed to $350,000 in May, up from a steady-state median of $250,000 for the past several years (the iBuyer “sweet spot”).

The iBuyers are still generally purchasing the same types of houses. They’re just worth a lot more (40-plus percent) due to the hot housing market. The median iBuyer purchase price closely tracks that of the overall U.S. market.

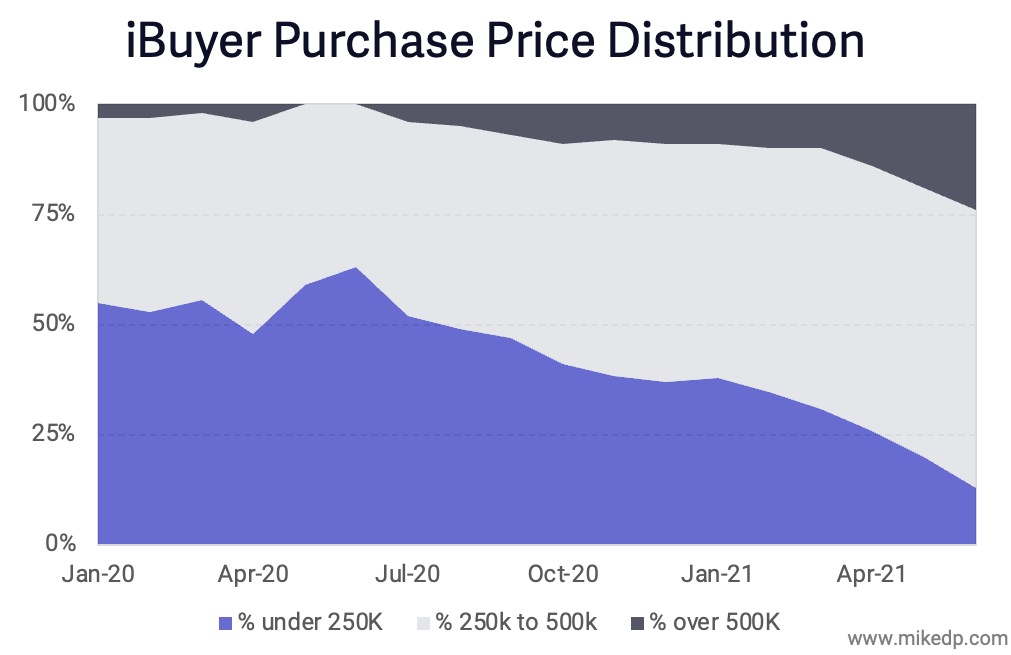

A more granular analysis shows dramatic shifts in price distribution. In the past 18 months, the percentage of homes purchased by iBuyers under $250,000 has plummeted from 55 percent to 13 percent, while the percentage of homes purchased for more than $500,000 has jumped from 3 percent to 24 percent.

This is a significant shift in the underlying economics of iBuying that affects revenues, gross profit, financing, inventory value and more. For example, in Q1 of 2020, Opendoor sold around 5,000 homes.

At an average of $250,000 each, that’s around $1.2 billion in revenue. But at an average of $350,000, revenue would be $1.7 billion — a 40 percent increase driven by home values alone and not volume.

The iBuyers will have blow-out quarters with record revenues, driven by high purchase and sale volumes and the rise in home values. IBuying is back in a big way.

A note on data sources

The data above is sourced from national public property records. There is a timing delay, which means the June numbers may be slightly high or low. But the difference shouldn’t take away from the major narrative of record volumes for the quarter.

Mike DelPrete is a strategic adviser and global expert in real estate tech, including Zavvie, an iBuyer offer aggregator. Connect with him on LinkedIn.