Through December Inman will be digging into the real estate industry’s most prominent brokerages, iBuyers and paradigm-shifters to suss out the biggest challenges each face in 2022. Check back regularly as we publish new reports on Keller Williams, Compass, Zillow and others in the days and weeks ahead.

Offerpad had a big year in 2021.

The iBuyer launched mortgage services last spring, went public in the fall with a $2.7 billion valuation and achieved surging growth in third-quarter earnings.

But with the implosion of Zillow’s own iBuyer, Zillow Offers, in October, the stakes will be high as the Chandler, Arizona-based company competes with Opendoor for marketshare in the companies’ overlapping markets throughout the U.S., and as iBuyers are now thrust into the spotlight like never before.

“I think the fact that Zillow Offers [is gone] creates opportunity for the iBuyers that isn’t such a great opportunity for homesellers,” Sean Black, co-founder and CEO of alternative financing company Knock, told Inman.

“It’s always been a luxury product in so much as you take a discount to walk away from your house without the aggravation of having showings, but the balance now is, how much more expensive is it as a solution?” Black added. “How much more are iBuyers going to be competitive, given the risk that’s out there?”

While Offerpad made a strong showing in the third quarter, reassuring investors and other stakeholders, that doesn’t mean the company can loosen its grip. Scrutiny will remain focused on Offerpad and iBuyers in general as stakeholders in the industry become more fully convinced that the model has longevity.

Beside competing with rival Opendoor, Offerpad has other challenges on the horizon, too — building trust with real estate agents and continuing to satisfy stakeholders as a public company, chiefly among them.

As Offerpad enters its first full year as a publicly traded company, here are the top five challenges it will face in 2022.

Offerpad’s rivalry with Opendoor will peak as both companies seek to establish clarity of purpose

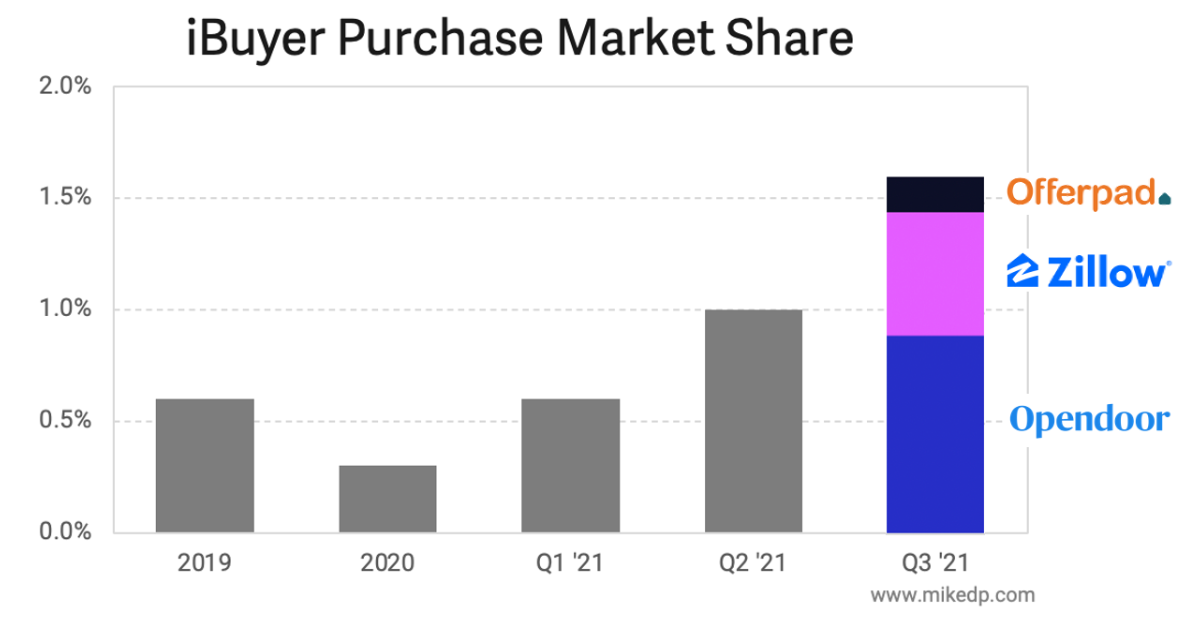

During the second quarter of 2021, the market share of iBuyers hit 1 percent of all U.S. home sales for the first time, according to Zillow. By the third quarter, iBuyers made up 1.6 percent of all home purchases in the U.S.

But Offerpad comprises a smaller share of those purchases relative to Opendoor and, until recently, Zillow, according to real estate strategic advisor and expert Mike DelPrete.

Opendoor operates in virtually all of the metro areas Offerpad services, but it also operates in an additional 20 markets, for a total of about 40 markets. Meanwhile, Offerpad holds one-fifth of the iBuyer purchase market share of Opendoor. During the third quarter of 2021, Offerpad acquired 2,753 homes, up 258 percent year over year, while Opendoor acquired nearly 15,200 homes at an annual increase of 79 percent.

With that stark difference in market share, Offerpad arguably has ground to catch up on, even as the company continues to grow steadily.

Unless Offerpad begins offering more ancillary services or ups its customer service, it will need to give consumers competitive offers or continue to expand into new markets, experts believe. In some of the markets it currently shares with Opendoor, the company isn’t yet providing more competitive offers, partially because of Offerpad’s more limited market share, Dan Noma Jr. of Venture REI, told Inman.

“You take an Opendoor offer and compare it to an Offerpad [offer], it’s significantly different,” Noma told Inman.

Mike DelPrete

Stefanie Layton, senior director of investor relations at Offerpad, told Inman the company’s current growth strategy is to prioritize market expansion, increase penetration and provide new ancillary services.

Offerpad doesn’t just have to set itself apart from Opendoor or other iBuyers, however, DelPrete told Inman. The market is becoming so crowded with different alternatives for buying and selling homes, that it’s increasingly difficult for companies to clearly define their unique value proposition to the public.

“It’s out of control,” DelPrete said. “You’ve got big incumbents like Realogy and Keller Williams playing in this space, you’ve got Power Buyers. Everybody’s out there doing all this stuff, and yeah, it’s not iBuying, but it’s kind of like it and it’s a new way to buy or sell, so I think that’s probably one of the biggest challenges that Opendoor and Offerpad face next year, is this clarity of purpose. Being able to communicate clearly to customers in a crowded marketplace where they’re not in control of the message, they’re not in control of the marketplace and what’s going on.”

Momentum and profitability post-IPO

Now that it’s officially a public company, Offerpad’s moves will be scrutinized more heavily, especially since the demise of Zillow Offers, experts say.

Sean Black | Photo credit: Knock

“[IBuyers are] going to make sure they’re building a sustainable business because now Wall Street’s eyes are on them to see if they’re going to follow into the footsteps of Zillow Offers and getting over their skis,” Black told Inman.

The company got off to a good start with its first earnings report post-IPO, with revenue up 190 percent year over year to $540.3 million and gross profit up 169 percent year over year to $53.1 million.

In addition, home sales increased 123 percent from the previous year, and the company increased personnel by 23 percent over the course of the quarter. Over the course of 2021, Offerpad also expanded into seven new markets.

However, those positive numbers follow a standout year for iBuyers more generally amid extremely favorable market conditions in which they achieved the rare opportunity of profitability. And if Offerpad, like other iBuyers, is going to please shareholders and find a way to achieve profitability long-term, it will need to find a more sustainable solution.

“The iBuyers flirted with profitability in 2021 because of this once-in-a-generation housing market activity,” DelPrete said. “Super high demand, super low supply, home price appreciation through the roof. I mean that’s been the story for the past 18 months.”

“That’s what caused their temporary profitability,” he added. “And that is not going to last — that is going away, so they will go back to this space of unprofitability or uncertainty around profitability.”

Repositioning in the market in wake of Zillow’s exit

With Zillow out of the picture, the remaining major iBuyers are undoubtedly feeling a bit of gratification about their own success in the last year, experts told Inman. Unfortunately for consumers, that could be a bad thing.

With essentially 25 percent of major iBuyer competition now gone, Offerpad, Opendoor and RedfinNow have more leverage with their fees, which has the potential to turn into consumer exploitation if gone unchecked.

“I think [iBuyers are] going to charge more, or pay less, for houses and they’re not going to worry about competing with each other as much,” Black said.

Noma added that a new “sense of entitlement” from the remaining iBuyers, Offerpad included, could end up hurting the industry as a whole.

“I think what you’re going to see now is, you’re going to see this sense of entitlement come out in ways that could be detrimental to the real estate community, potentially,” Noma said. “Just because we now lost a competitive marketplace where iBuyers were competing. So it’s actually been detrimental to our clients. I actually don’t think it’s healthy … Because now [iBuyers] know, ‘as long as I beat one other person, I could win. I only have to be this good, instead of being this great.’ And I think that that’s a problem.”

Noma added that, moving forward in an iBuyer market without Zillow, remaining players like Offerpad will likely have to continue to deal with what he called a “Zillow hangover” for some time — namely, reiterating that iBuying is not going to go away anytime soon, Zillow will just no longer be a present force in the space.

Offerpad suggested in a statement to Inman that the increased attention on iBuying in the wake of the Zillow news was actually a good thing, allowing the company to highlight its strengths thus far. “The shift in the conversation to topics that differentiate individual strategies and highlight qualities like industry expertise and execution that are necessary to succeed has been a benefit to the industry.”

Activating ‘boots-on-the-ground’ agents

Bair noted during a third-quarter earnings call that the company had witnessed a “pendulum change,” with more consumers turning to iBuying as a first option when buying or selling a home than ever before.

Even as more consumers express the desire to at least have the option of an instant offer, many real estate agents remain hesitant to do business with iBuyers because of widely held suspicions that they intend, ultimately, to push the agent out of the transaction. That remaining disconnect between agents and iBuyers could prove detrimental to both parties.

“I think [iBuyers are] very anti-agent — definitively not agent-friendly,” Black said. “And it doesn’t make sense. [IBuying is] not a mass-market solution. Ninety percent of consumers want to work with an agent; they want an independent financial advisor. This is the biggest purchase of their lives, the biggest sale of their lives, and they need an independent representative. Someone who is in the transaction is not objective.”

Although many other real estate professionals also argue the opposite — that the only way agents can continue to be competitive in future years is to learn to work with iBuyers — iBuyers like Offerpad must continue to try and find ways to build relationships with agents, likewise, for their own survival.

Noma noted that Offerpad, Opendoor and other iBuyers seem to be trying to build bridges with agents, offering training and referral rewards programs in recent years, like Opendoor’s Agent Access program and Offerpad’s Agent Partnership Program.

Dan Noma Jr. | Credit: Venture REI

“What they’re figuring out is, the agents are the boots on the ground that they need,” Noma said. “They thought for a while they could do this without them, and what they’re figuring out is, they can’t penetrate as fast without them, they do need them, and not only do they need them, the experience is better, and we should embrace it.”

On Offerpad’s side, Layton said the company values “our relationship with the agent community and are continuously evaluating additional ways to engage to find the best ways to support our collective customer base.”

While Bair has been vocal in his public messaging about relying on intel from boots-on-the-ground real estate professionals as part of a strategy for Offerpad’s success, Noma said all iBuyers could improve on the nuts and bolts of building good relationships with agents.

“The communication, the responsiveness and things like that, could always be better,” Noma said. “It’s just not great for any [iBuyers], and I think that’s one of agents’ biggest complaints. The tradeoff is, you’re getting an instant offer.”

Too far, too fast

Gaining market share in 2022 is crucial to Offerpad’s success. At the same time, there’s a fine line between growth at a healthy pace and becoming overambitious.

Black suggested iBuyers like Offerpad may need to tread more cautiously now, particularly in the wake of this year’s surging home prices.

“We’ve seen a lot of home price appreciation, [and] iBuyers make their money by flipping houses,” Black said. “So the question is, where do you slow down?”

“I think Zillow Offers is a pretty pronounced example of having gone too far, too fast,” Black added. “So the question is, how much do you pay when the market’s relatively strong, consumers can sell their homes full price without investors, and the iBuyers have to be competitive because they’re buying at the height of the market? That’s just a big question.”

Stefanie Layton | Credit: Offerpad

In its email, Offerpad said the company’s model is designed to anticipate the fluctuating market in a proactive way, and that it’s successfully been put to the test over the company’s six years in operation. “We are confident that our team has the structure, expertise and technology to support successful outcomes in any real estate environment,” Layton said.

The pandemic’s continued supply chain challenges put another wrench in the iBuyer model this year, however, as businesses nationwide faced staffing issues and materials costs surged. These complications seem to be improving, but it’s yet another factor iBuyers need to deal with into 2022.

Following Zillow Offers’ demise, Black also suggested iBuyers might already have begun to pull back a bit, at least temporarily, as home prices and demand have started to show signs of slowing.

“I think they’re all going to be more conservative,” he said. “You can see where Offerpad and Opendoor and Redfin didn’t incur the same issue that Zillow had because they really all saw the tidings a little bit and slowed down, some for seasonality purposes, others, they just saw price and pace slow down a little bit.”

But with its in-house renovations team, Layton said Offerpad is confident it can handle supply chain issues head-on.

“We do not have a one-size-fits-all approach to renovations and have adjusted our scope of renovations on a home-by-home basis in response to local supply chain constraints,” she said. “Given the strategies we have initiated have proven to be effective, we will continue to deploy this flexible approach into 2022.”