Are you receiving Inman’s Agent Edge? Make sure you’re subscribed here.

This post has been republished with permission from Mike DelPrete.

Recent growth and contraction in the mortgage, iBuyer and Power Buyer space have resulted in a reshuffling of the largest businesses aiming to disrupt the industry.

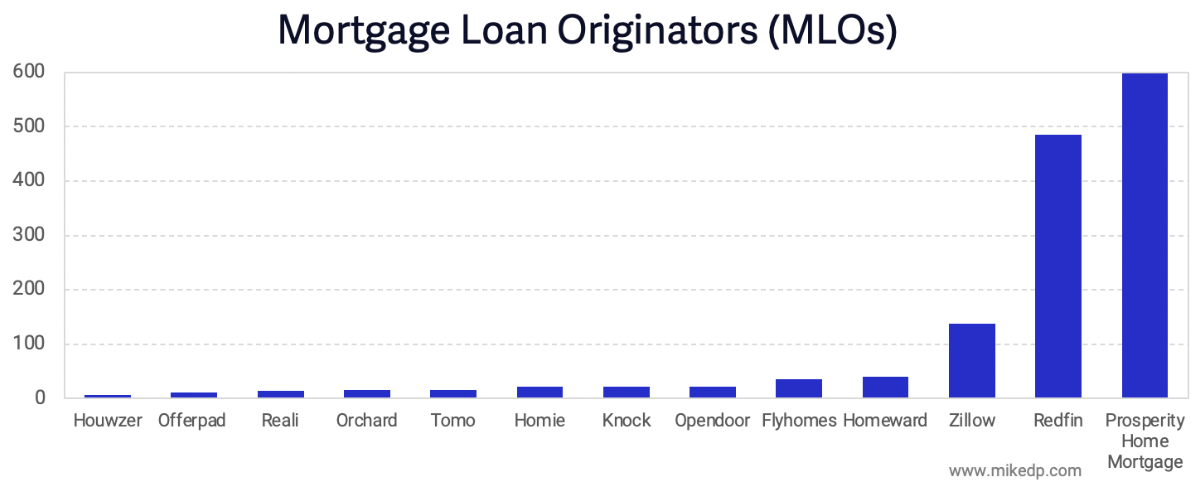

Why it matters: Mortgage is an emerging battleground in real estate, and the number of mortgage loan originators (MLOs) employed by a company is an important leading indicator of that company’s firepower and strategic intent in the space. Of note:

- Opendoor has surged to No. 3 after acquiring RedDoor.

- Significant layoffs at Knock and Homie have pushed Homeward into the No. 1 spot of emerging Power Buyers (full disclosure: I’m an advisor to Homeward).

Zillow and Knock have shed MLOs during a series of recent layoffs.

- Zillow’s MLO headcount is down 17 percent and Knock is down a massive 50 percent from December.

Better Mortgage and its employees have had a tough five months. So far, the business has lost about half — around 600 — of its MLOs through a series of layoffs.

Comparatively, Zillow still has significant firepower at its disposal; all eyes are on what’s next for Zillow Home Loans in a post-Zillow Offers world.

Redfin and Prosperity Home Mortgage (a subsidiary of mega-broker HomeServices of America) dwarf Zillow and the others in the space, highlighting the latent power of incumbency.

- Redfin (through Bay Equity), Prosperity and Zillow operate more traditional mortgage businesses, while the others offer more disruptive services.

- It’s also important to differentiate between purchase and refinance business; many of the Power Buyers and iBuyers are focused on purchase.

The bottom line: Real estate tech disruptors are investing billions to build integrated brokerage and mortgage experiences.

- Tracking MLOs over time reveals who is marshaling resources for future growth, who is making strategic retreats, and who has the most potential to effect change in the future.

Mike DelPrete is a strategic adviser and global expert in real estate tech, including Zavvie, an iBuyer offer aggregator. Connect with him on LinkedIn.