As rising interest rates take a toll on mortgage lenders’ refinancing business, home finance platform Lower is partnering with Orchard to help first-time homebuyers and existing homeowners make cash offers on their next home.

In addition to getting into the Power Buyer business, Columbus, Ohio-based Lower will also target homebuyers through a strategic partnership with iBuyer powerhouse Opendoor.

Lower Holding Co. provides mortgages, real estate brokerage services and homeowners insurance through a family of companies, including Lower LLC, Lower Realty LLC and Lower Insurance Services LLC.

Now Lower is partnering with Orchard to launch its HomePass program providing Power Buyer services for first-time homebuyers and existing homeowners.

Lower’s HomePass Move First program lets homeowners tap their existing equity to get preapproved for a mortgage and make an all-cash offer backed by Lower before selling their existing home. An Orchard agent helps Lower’s mortgage clients make an offer on their new home and sell their existing one. Lower is also partnering with Orchard to make the HomePass program available to first-time homebuyers.

Dan Synder

“Arming buyers with the most aggressive tools will help them stand out and will be the differentiator this year,” said Lower.com co-founder and CEO Dan Snyder, in a statement. “On top of that, we’re alleviating a lot of stress for current homeowners, which we anticipate will help open up inventory and move us to a more right-sized market.”

Although Lower.com did not publicize Orchard’s role in providing the HomePass program, a spokesperson confirmed the partnership, details of which are spelled out on the company’s website.

“After we get you pre-qualified for HomePass, our friends at Orchard will help you find your home,” Lower’s website explains. “You’ll have a dedicated Orchard Home Advisor, plus access to on-demand touring so you can see houses as soon as they hit the market.”

Lower and Orchard “earn revenue on the real estate and mortgage transaction, just like a traditional agent and lender,” Lower says. If finalizing permanent financing takes longer than 30 days, HomePass clients will pay rent (typically $50 to $100 per day) to cover expenses such as utilities and maintenance.

The HomePass Move First program is available in nine markets served by Orchard — Atlanta; Denver; Montgomery County, Maryland; Raleigh-Durham, North Carolina; and Austin, Dallas-Forth Worth, Houston and San Antonio, Texas.

New York City-based Orchard — an end-to-end platform providing real estate brokerage, mortgage and title services — announced this week that it was expanding its offerings to help first-time homebuyers make cash-backed offers.

The new “Buy with Orchard” program is currently available in Denver and four Texas markets — Austin, Dallas-Fort Worth, Houston and San Antonio.

Lower, which announced a $100 million Series A funding round last summer, is also building an agent matching service for homebuyers. Last fall Snyder told Inman the agent matching project was in a beta mode, with 1,700 agents in a network spread out across the country from Tampa, Florida, to Los Angeles.

“We don’t have enough agents in our network, candidly — it’s something that we really need,” Snyder said in September. “We’re getting the word out some … and we’re looking to make big headway in the next quarter.”

Lindsey LeBerth, Lower’s director of communications, said in an email to Inman that Lower’s agent matching service “is still a priority of ours to help connect great agents with customers. We’ve grown the service 66 percent from Q4 to Q1, and when needing an agent, 95 percent of customers are successfully placed — the outlying 5 percent is due to geographical limitations.”

Although Lower has openings in marketing, sales, product and technology, it’s not seeking real estate brokers or agents. The company is collecting information from agents at other firms who are interested in joining Lower’s referral network.

Orchard, on the other hand, is currently advertising more than 40 openings for agents in markets around the country. The company did not immediately respond to a request for comment.

Opendoor launching mortgage financing app

In another bid to bring in more purchase loan business, Lower has entered into a strategic partnership with iBuyer Opendoor to provide mortgages through a mortgage financing app that Opendoor is planning to launch this summer.

In a letter to shareholders accompanying Opendoor’s first quarter earnings, the company said it’s “preparing to launch a fully digital financing product that can provide a pre-approval in less than 60 seconds,” with Lower on board as a “strategic partner.”

“Our partnership with Lower.com enables us to offer a broader suite of products, such as FHA/VA loans, ensures financing-product coverage across our ever-expanding market footprint, and adds fulfillment flexibility,” the May 5 letter to Opendoor shareholders said. “This is particularly important as our mortgage team launches our digital Opendoor financing app in the coming weeks.”

LeBerth told Inman that Lower’s “mortgage-as-a-service infrastructure … allows companies like Opendoor to offer their consumers the full menu of home financing options, while expanding their lending footprint from a handful of states to more than 91 percent of the U.S. population. Customers can choose to finance through a conventional, VA, or FHA loan with this partnership.”

Rising interest rates have the entire mortgage lending industry scrambling to compete for homebuyers, as incentives to refinance existing mortgages at lower rates evaporate.

Mortgage originations expected to fall by 40 percent this year

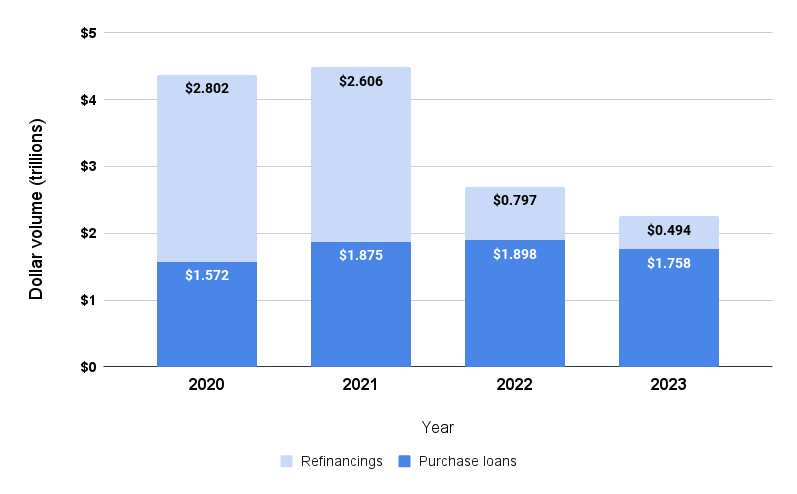

Source: Fannie Mae housing forecast, May 2022.

Fannie Mae economists expect mortgage originations to fall by 40 percent this year, to $2.695 trillion, with mortgage refinancings projected to fall by 69 percent, to $797 billion.

Mortgage lenders that have downsized to adjust to the end of the refinancing boom include Better, Pennymac, Guaranteed Rate, Keller Mortgage, Mr. Cooper and Wells Fargo. The nation’s biggest mortgage lender, Rocket Companies Inc., expects buyout offers made to 2,000 employees will save $180 million a year, while LoanDepot executives say they don’t expect to turn a profit this year and will lay off workers and suspend the company’s quarterly dividend.

Get Inman’s Extra Credit Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.