Are you receiving Inman’s Broker Edge? Make sure you’re subscribed here.

This post has been republished with permission from Mike DelPrete.

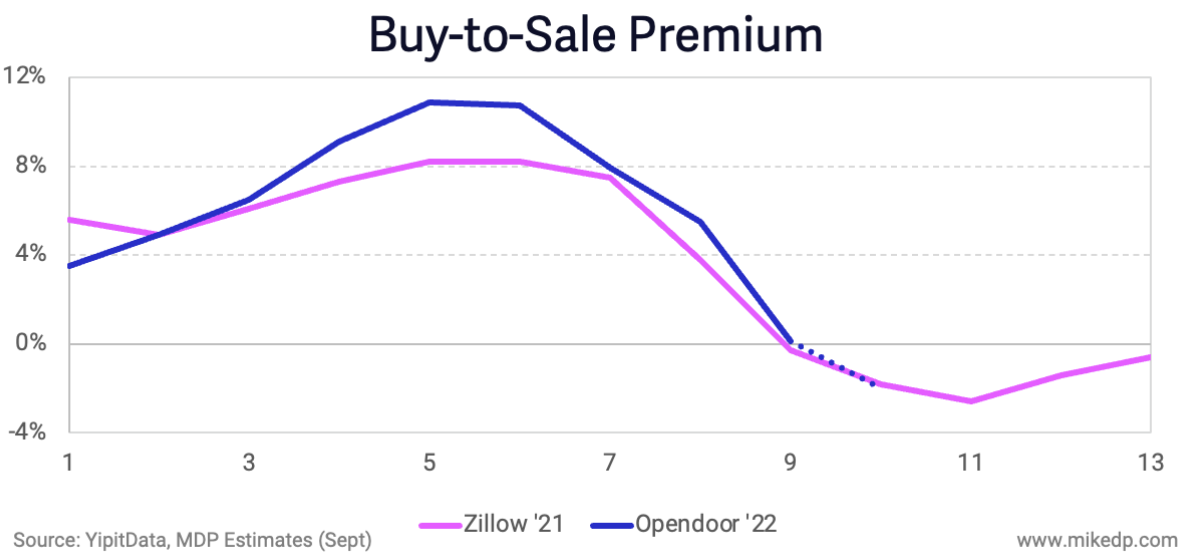

Opendoor’s buy-to-sale premium — the difference between the purchase and resale price of its homes — has reached a record, negative low.

Why it matters: For the first time in its existence, Opendoor is entering territory, where, in aggregate, it is selling homes for less than their purchase price.

- This certainly puts the company (and business model) under pressure, and is reminiscent of the situation faced by Zillow last year.

Go back: Opendoor outperformed Zillow during the dark days of 2021 (when Zillow Offers imploded); its buy-to-sale premium never dipped below zero percent.

- At the time, this demonstrated that Opendoor’s pricing operation was a powerful competitive advantage.

But 2022 is different; transposing Zillow’s performance in 2021 to Opendoor in 2022 shows a similar deterioration in the buy-to-sale premium.

- Even Opendoor’s pricing operation can’t keep up with the rapidly changing market (or perhaps this was a calculated risk Opendoor was willing to take).

(I’ve estimated a negative two percent buy-to-sale premium in September, but it’s still too early to know where the month will land.)

While Opendoor’s buy-to-sale premium is approaching the same negative levels that sunk Zillow last year, it doesn’t mean the result will be the same.

- Zillow experienced a system-wide iBuying failure, and exited because it was unwilling to accept the risks to its entire business going forward.

- Opendoor, built from the ground up as an iBuyer and willing to accept those same risks, is vigorously managing the current situation.

Opendoor’s buy-to-list premium, a leading indicator of future profitability, appears more optimized than Zillow’s in 2021; the distribution is less concentrated with more potential resale upside.

- It would be fair to say Opendoor’s pricing operation is more nuanced and sophisticated.

Opendoor is also leveraging aggressive price cuts.

Opendoor is also leveraging aggressive price cuts.

- The initial buy-to-list premium (blue line) represents new houses listed in a current month, while the current buy-to-list premium (pink line) includes houses listed in previous months.

- The difference is price cuts; Opendoor cutting the initial listing price down to the current listing price — which it is doing energetically across its markets.

Some perspective: Opendoor is selling around 2,000 houses per month with an average sale price of $400,000. A buy-to-sale loss of two percent amounts to a $16 million loss.

Some perspective: Opendoor is selling around 2,000 houses per month with an average sale price of $400,000. A buy-to-sale loss of two percent amounts to a $16 million loss.

- Yes, and: Opendoor is racking up other expenses, including $3,500 buyer agent commission bonuses and seller concessions, to previously unseen levels.

- The result is going to be a pretty tough Q3.

The bottom line: This is market whiplash — just six months ago I was talking about how Opendoor was going to make record profits from home price appreciation.

- You can’t have highs without the lows — this is the nature of iBuying, and now is Opendoor’s chance to prove its model works during a significant downturn.

Mike DelPrete is a strategic adviser and global expert in real estate tech, including Zavvie, an iBuyer offer aggregator. Connect with him on LinkedIn.