The Shutdown has opened, but has been replaced by Stuck.

Interest rates are stuck, the 10-year Treasury wandering north of 2.5 percent, and mortgages wandering south of 4.5 percent.

Delayed September data is slow-side: factory production up 0.1 percent, retail sales ex-autos no gain at all, core CPI up 0.1 percent, and only 1.2 percent year-over-year.

In the first glimpse of October the manufacturing ISM pink-cheeked to 56.4, up 0.2 from September, but given the Shutdown no telling its validity.

“Obamacare” is stuck. Hoo-ee, baby. Any big-website rollout will have trouble, and techies tell me the expected failure rate is 50 percent. However, those not experienced in running large organizations have management confused with flipping switches.

This executive branch has even less management experience than its predecessor, these the two least experienced since Harding. In an irony of the stuck, we won’t be able to tell if “Obamacare” will work until it starts to.

The Fed is stuck. It met this week, but shed no light. Markets assume that it will need to see a lot of post-Shutdown data before its next try at Taper Roulette.

Housing is stuck. NAR’s index of pending sales was expected to be flat in September and instead fell 5.6 percent, even seasonally adjusted. Housing boomers are scrambling to explain the obvious stall, in largest part because the economy is not going anywhere without housing.

Goldman leads the pack in blaming the rise in rates caused by the taper try. Nice try, but rates today are only a half-percent higher than in spring. A legitimate explanation goes to the diminished supply of distressed housing for sale, rising prices thereof, and the dampened ardor of cripple-shooters.

But the deep reasons are these: Incomes are not rising, which means that damaged households cannot repair themselves, and mortgage credit is absurdly tight. Stuck. Follow that thread in a meander past a financial oddity, and sneak up on the whys and wherefores of mortgage dysfunction.

The oddity: Jumbo mortgage rates are the closest to “conforming” since the crisis began in July 2007. A caution: be careful mentioning the jumbo Fannie spread. Holding constant the down payment, credit score, and housing type, the spread today is only about 0.25 percent.

Two intellectually impaired media groups have leapt on to the story: one saying the spread is zero, or even upside down, the other in political space saying, “See, the private sector is fine — we don’t need Fannie anymore.”

Details of the spread are not quite so pleasant as the headline. You can get a Fannie loan with as little as 5 percent down and a credit score as low as 620. You’ll pay heavily in rate and/or mortgage insurance, but the loan is available.

You cannot get a jumbo 30-year fixed-rate mortgage with less than 20 percent down OR a FICO less than 720, and you’ll pay a penalty for a down payment as small as 20 percent and a FICO below 740.

The natural position of jumbos in the ’80s and ’90s before the bubble was a spread of 0.25 percent to 0.5 percent — just where we are.

But with tough underwriting and limits on loan size, you could get jumbos with 90 percent and 95 percent loan-to-value ratios. The spread exploded to 2 percent and more after 2007, really no market at all, but has consistently narrowed as quantitative easing (QE) put a floor under mortgage freefall.

The private sector back? Jumbo dollar originations this year will total a very few tens of billions.

Total Fannie-Freddie and VA-FHA? Not quite a trillion. The “private sector” is a handful of struggling and overregulated banks and a couple of in-and-out securitizers.

QE has compressed the yield on anything banks can buy, the list further shortened by good and bad regulation. Thus banks tip-toe into jumbos with an agenda partly interest rate, but just as much trying to loss-leader households with high net worth into being bank customers.

Minimal jumbo securitization traces to nonbank investors desperate for fixed-income returns. Jumbos are as attractive as anything.

Give thanks daily for QE and Fannie Mae. This economic recovery depends on housing more than any other single factor. Housing isn’t going anywhere without credit, and mortgage credit is still on life support.

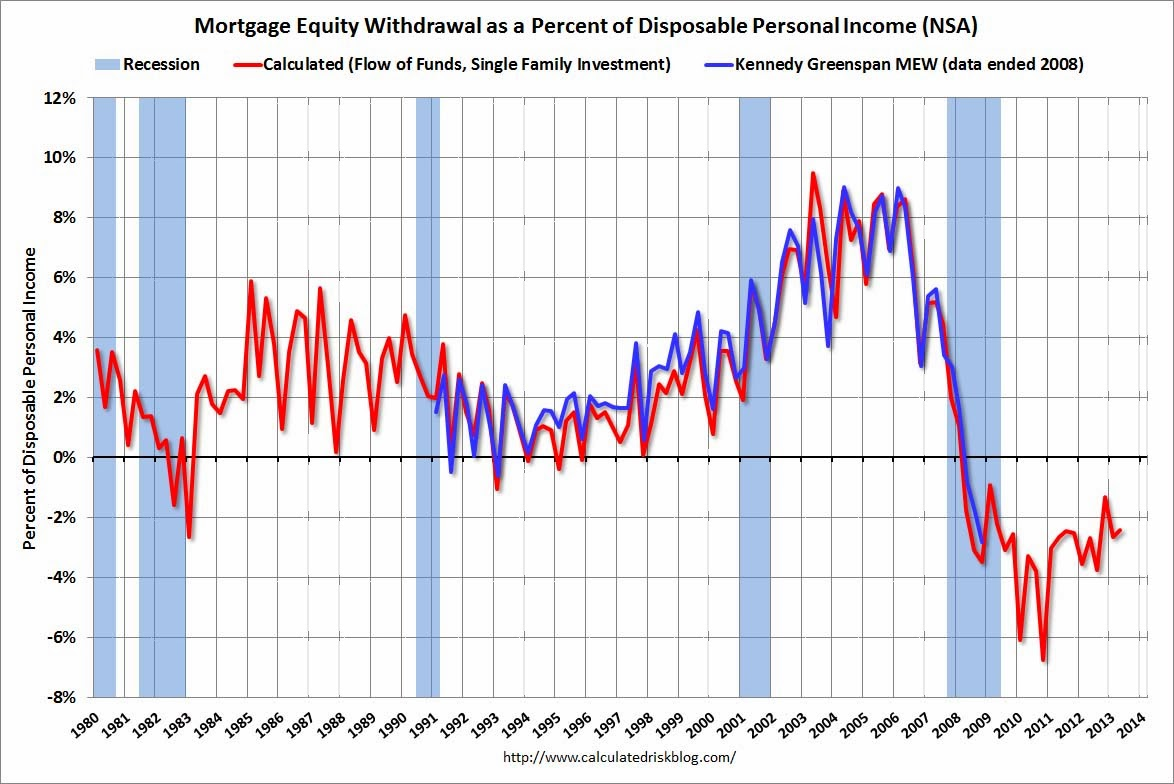

Those suspicious of QE might consider still-negative extraction of equity, roughly a $200 billion annual evaporation of disposable income. QE in some ways acts as a systemic replacement.

Glance at mortgage equity withdrawal (MEW) today versus normal, non-Bubble times, and the shortage is double the evaporation, almost half the QE total.

Every trader is still watching the 10-year “head and shoulders” (below).

Break 2.47 percent and we’ll dive to 2.2 percent or lower, mortgages re-entering the threes. Break 2.7 percent going up and we’ll re-test the September top.

Lou Barnes is a mortgage broker based in Boulder, Colo. He can be reached at lbarnes@pmglending.com.