- The median home price increased 4.4 percent to $249,000 in May in all the communities covered by MORe.

- Blue Island, Calumet City, Steger and Dixmoor saw increases in home prices of more than 200 percent.

- Generally, homes in the Chicago's west and north suburbs sold in less time.

The housing market in Chicago‘s west and north suburbs are really heating up so far this year.

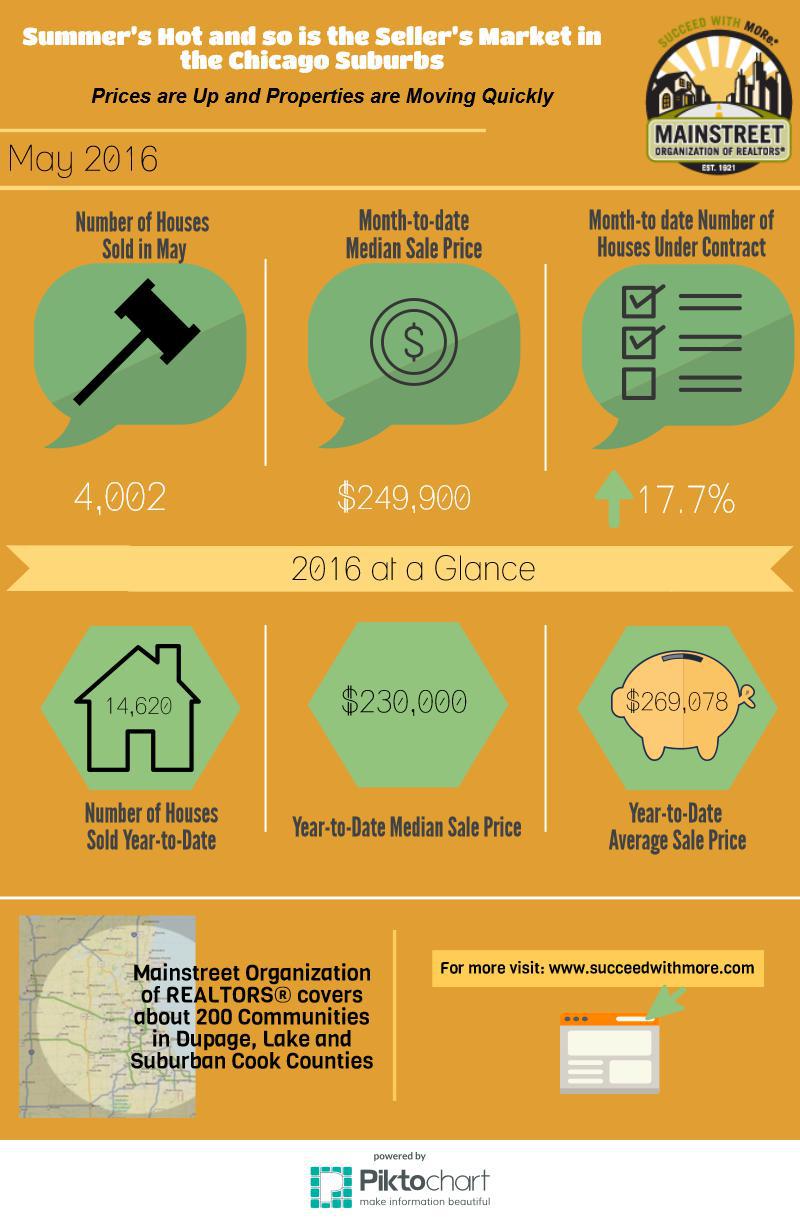

According to recent data released by the Mainstreet Organization of Realtors (MORe), Lake, DuPage and parts of Cook counties are witnessing an increase in home prices as of May compared with the same time last year. More homes are also selling and at a faster pace than they were last May, the organization says.

In May 2016, the number of homes for sale in the 200 communities covered by MORe increased by 9.1 percent to 4,002, and the median home price inched up 4.4 percent to $249,000.

“This is a good, healthy, sustainable market,” said Lynn Madison, the president of the Mainstreet Organization of Realtors. “Prices have been on a steady upswing since the beginning of 2015.”

Homes were listed for an average of 98 days in May, which was a dip of 4.9 percent annually.

Figures overall are showing that 2016 continues to be a year of improvement for the local market. On a year-to-date basis, the number of homes sold annually increased 8.2 percent and the average sales price grew 4.3 percent.

Most significant changes in Chicago suburban markets

Of the markets covered by MORe, a few saw massive month-over-month median price increases in May. Blue Island saw an uptick of 201.3 percent, Calumet City an increase of 202.7 percent and Steger saw an increase of 239.6 percent.

Dixmoor saw a whopping 411.8 percent increase. The Cook County village is still very low in its price range with a median value of $87,000, but it’s up from $17,000 last year.

A few locations in the Chicago suburbs were on the opposite end of the spectrum, posting significant median price decreases. Burr Ridge saw a slow down in its housing market with an increase in days on market and a dip in median home prices by 32.7 percent.

Lynwood also saw a big dip of 42.3 percent. But the biggest dip was reported in South Chicago Heights, where prices fell 50 percent annually in May.