Rezi, a New York City-based startup that helps landlords fill vacant apartments, has raised $30 million.

New York hedge fund Mark 2 Capital, Promus Equity Partners and Bessemer Venture Partners all contributed to the fund, as did the venture capital firms Greylock Partners, Global Founders Capital, Mayfield and Altair. The seed accelerator program Y Combinator, which assisted Rezi with its 2016 launch, also contributed, according to an announcement issued in a press release early last month.

With the funding, Rezi intends to invest $10 million to buy out vacant apartments and arrange agreements with building owners. The company is also attempting to attract tenants by promoting its platform and by advertising properties on a number of listings websites.

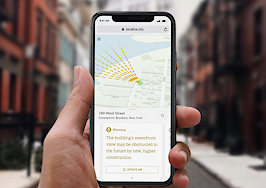

Courtesy of Rezi

“We personally view ourselves as a technology business,” Rezi cofounder Sean Mitchell told Inman last week. “Our investors see the potential for a meaningful improvement for both landlords and tenants in conducting these transactions.”

Launched as a fintech solution for landlords who need money immediately, Rezi is part of a wave of startups using technology to change the present-day rental process. Rezi’s new Upfront program lets property owners choose between collecting rent immediately or at particular intervals. The idea is to help homeowners avoid vacant apartments by finding tenants more quickly than they would be able to do alone.

“Where tenants typically need to wait several weeks to reach an agreement with multiple parties, we could potentially eliminate all of that back-and-forth with the ability to find, apply and execute those landlord-tenant agreements,” Mitchell said.