Luxury homes have experienced a sustained level of sales, as affluent, primarily urban-dwelling consumers, able to now work remotely, decided to either move or find new, co-primary single-family homes in suburbs and resort-community settings.

They are seeking homes that offer live-work spaces, gyms, larger kitchens and outdoor play and entertainment spaces with recreational opportunities from the front door.

In addition to the lifestyle benefits, they see these investments as a diversification of their financial portfolios from the frothy stock market. They also embrace the opportunity to move from high-income tax states to lower ones, generating substantial income tax savings.

Although they buy in cash, they can leverage their dollars with the current historically low interest rates by then obtaining mortgages on the homes to free up money to put into other investments.

As an owner of a luxury home, it’s hard to turn a blind eye to selling right now; this is creating some inventory on that end of the spectrum.

According to Redfin, we have seen new listings in the U.S. increase month over month since December 2020. The run-up in construction material costs has caused more homebuilders to focus on this segment, as it has the margins to absorb these costs, while the affordable market does not.

Luxury home consumers, generally knowledge-based workers, have not been as affected by the COVID economy as the middle- and lower-market consumers have. Therefore, their purchasing power remains high — and they can make cash offers.

The spike in house prices due to low inventory on the rest of the spectrum has pinched consumers in the affordable and mid-priced markets. Despite the low interest rates, there are appraisal gaps that are requiring more cash from buyers than the down payment needed, often disqualifying them for loans.

Then there is the issue of competing against cash buyers, many of whom are investors, further limiting the ability of other buyers to purchase mortgage-financed homes. Lastly, with disruptions in income, layoffs, etc., over the last 12 months, qualifying for a loan is still challenging.

Let’s see if the First-Time Homebuyer Act makes a difference. Unfortunately, the mortgage rates ticking up will most likely cancel out the benefit for first-time buyers who have not already jumped into the market.

In Jackson Hole, Wyoming — where I’m based — we experienced a phenomenal demand over the past year resulting from our orientation to an outdoor lifestyle, open spaces and friendly tax climate.

It happened in two waves. First, in the single-family luxury homebuyer segment, which consisted of COVID refugees fleeing cities that have been subject to burdensome state and local taxes.

The second wave included younger, virtual workers, many in tech or finance, who were freed up by their employers to work anywhere. They have the incomes to participate in our elevated housing market, where condos start at $700,000 and single-family homes most recently start at $2 million-plus.

Wyoming ranks at the top for being the most tax-friendly state in the country. This incentive, combined with the mountain lifestyle, makes it a coveted locale for new co-primary home and tax residences.

That said, there is a nationwide housing inventory shortage that will take years, if not longer, to balance out with demand. This will continue to prop up the market and provide stabilization of current home prices.

The recent surge of home values is not correlated with an increase in incomes for many. The expected increase in mortgage rates will negatively impact the first-time and middle-market buyers, reducing their buying power.

If the Biden administration gets the proposed increase in capital gains tax to 43 percent, it will further reduce luxury-home inventory, as sellers might choose to wait for a more favorable time to sell in the future, and buyers might not want to cash in their stocks to diversify into real estate.

If the capital gains tax goes up dramatically, persistent inventory shortages continue, combined with loss of buying power from increasing mortgage rates, and the discrepancy between home values and incomes, I could see some stagnation happening through all market levels. Both buyers and sellers might go into a holding pattern until the market conditions improve.

While we are still in a seller’s market, I have changed all of my marketing to focus on homesellers, showcasing my history and success with how to present a new listing in a market that will most likely see competing offers.

There is a bit of art to doing this to generate both the highest return for your seller and with the least amount of liability as you manage everyone’s expectations. I’d suggest for agents to create case studies to include in listing presentations; this is a great way to gain the confidence of a seller and demonstrate your capabilities.

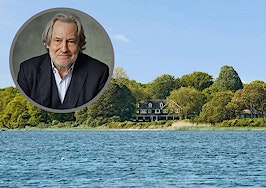

Latham Jenkins is a residential luxury real estate broker in Jackson Hole, Wyoming. Connect with him on Instagram or Twitter.