Are you receiving Inman’s Broker Edge? Make sure you’re subscribed here.

This post has been republished with permission from Mike DelPrete.

Compass’ second quarter results are in with a higher than expected cash burn rate for the quarter, but paired with a robust set of new cost-cutting initiatives.

Why it matters: Compass has a cash burn problem (it spends more than it makes) and it needs to significantly reduce expenses to remain solvent — which is exactly what it’s doing.

- Management’s top goal is “generating free cash flow” as it announces a new, $320 million cost reduction program.

- Compass’ CEO took the unusual step of asserting that “Compass will not run out of cash.”

Go deeper: Compass’ challenge is that it burned through another $45 million in Q2, typically the most profitable quarter of the year for real estate brokerages.

- Last year, Q2 was the only quarter when Compass generated free cash flow with a $41 million gain.

- Cash burn was higher in Q1 than last year, and higher in Q2 than last year; in a rapidly cooling market, the pressure is on for the rest of the year.

Between Q1 and Q2, Compass grew its brokerage revenue in line with its peers (except Douglas Elliman for some reason).

- The cooling market appears to be affecting all brokerages evenly, regardless of brand, tech platform, agent compensation, or anything else.

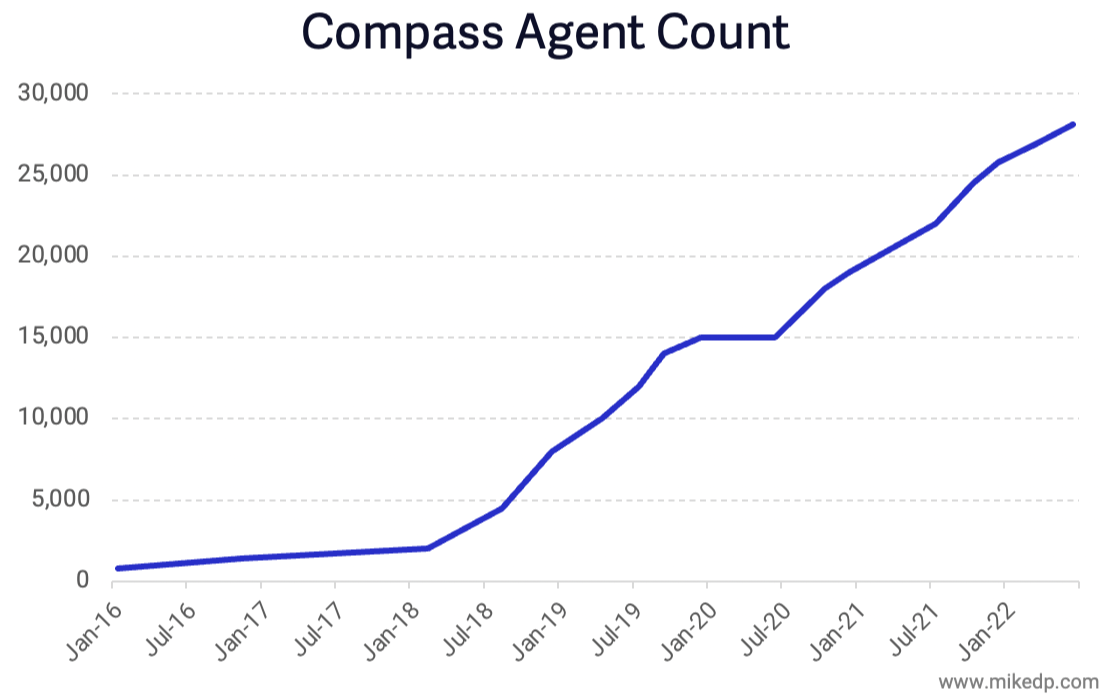

Compass is retaining its agents; there has yet to be a noticeable decrease in agent growth, a positive sign for the company.

After layoffs earlier in the year, Compass is cutting deeper with a $320 million “cost reduction program.”

- These cuts will target technology spend and agent incentives (remember, Compass has a 1,000-person tech team).

- For reference, Compass is on track to spend $360 million on technology in 2022 (excluding stock-based compensation expense) — the cuts will likely hit its tech team hard.

The bottom line: Compass continues to have a cash burn problem, but running out of cash would be a weird outcome.

- To become cash flow positive, Compass is making major cuts — the question is, can it do so while still remaining attractive to, and providing the same value to, its agents.

Mike DelPrete is a strategic adviser and global expert in real estate tech, including Zavvie, an iBuyer offer aggregator. Connect with him on LinkedIn.