Compass started 2023 with a cash balance of $362 million — which includes a $150 million drawdown from its revolving credit facility

- Without that additional loan, Compass’ cash balance would have been $212 million — dangerously low for a company that just burned $143 million in a quarter.

The key to breakeven is Compass’ ability to reduce its non-GAAP operating expenses (OpEx), primarily achieved through layoffs.

- OpEx has dropped significantly over the past six months and is on track to drop further through the rest of the year.

- It appears that Compass is aiming for OpEx of around $950 million for 2023, down about 30 percent from $1.35 billion in 2022.

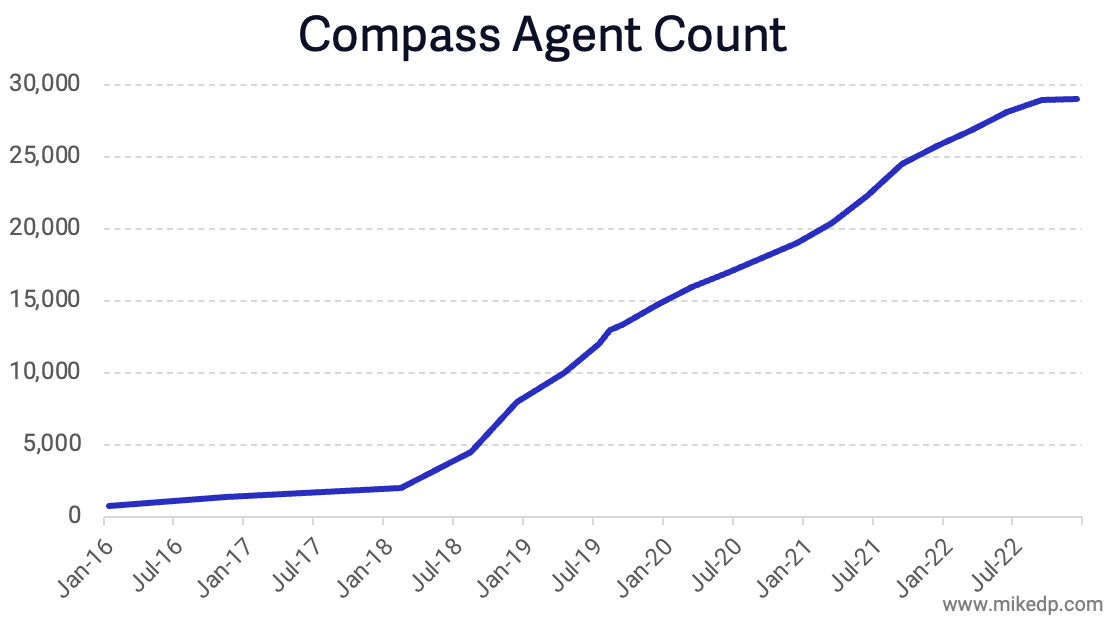

It’s fair to say that any brokerage, Compass included, falls apart if it’s unable to recruit or retain agents.

- For the first time, Compass’ agent count has gone flat, reflecting the challenging market environment for agents (fewer transactions = fewer agents).

- Yes, but: It takes several data points to create a trend, and most brokerages are seeing a similar slowdown in agent count growth.

Analysis time: Assuming Compass’ national market share and revenue per transaction remain consistent with 2022, we can see what needs to be believed for the company to reach breakeven in 2023.

- Compass’ current non-GAAP operating expense target of $950 million suggests that 4.5 million transactions in the national market are necessary to give Compass the revenue and gross profit necessary to break even for the year.

- A bear case of 4 million transactions would require Compass to cut an additional $100 million of operating expenses to reach breakeven.

- Please note: these are back-of-the-envelope calculations that provide directionality, not certainty.

What to watch: Like other brokerages, Compass only has so many levers to pull to reach breakeven.

- On the revenue side, the company is considering franchising as a less-expensive growth strategy, and will be trying to accelerate its mortgage joint venture.

- If the market remains soft and revenue drops, the only option is to cut even more costs out of the business.

The bottom line: Compass is not alone in needing to cut costs during a significant market downturn — its future depends on it.

- The company dipped into its “emergency reserve” last quarter — $150 million from its revolving credit facility — for the home stretch to profitability.

- It appears that Compass has made the deep cuts necessary to achieve breakeven this year, as long as nothing else unexpectedly goes wrong.

Mike DelPrete is a strategic adviser and global expert in real estate tech, including Zavvie, an iBuyer offer aggregator. Connect with him on LinkedIn.