“Homebodies” — homeowners who don’t want to give up their rock-bottom mortgage rates and seniors choosing to age in place — are keeping home sales from reaching their full potential, according to an analysis by First American Financial Corp.

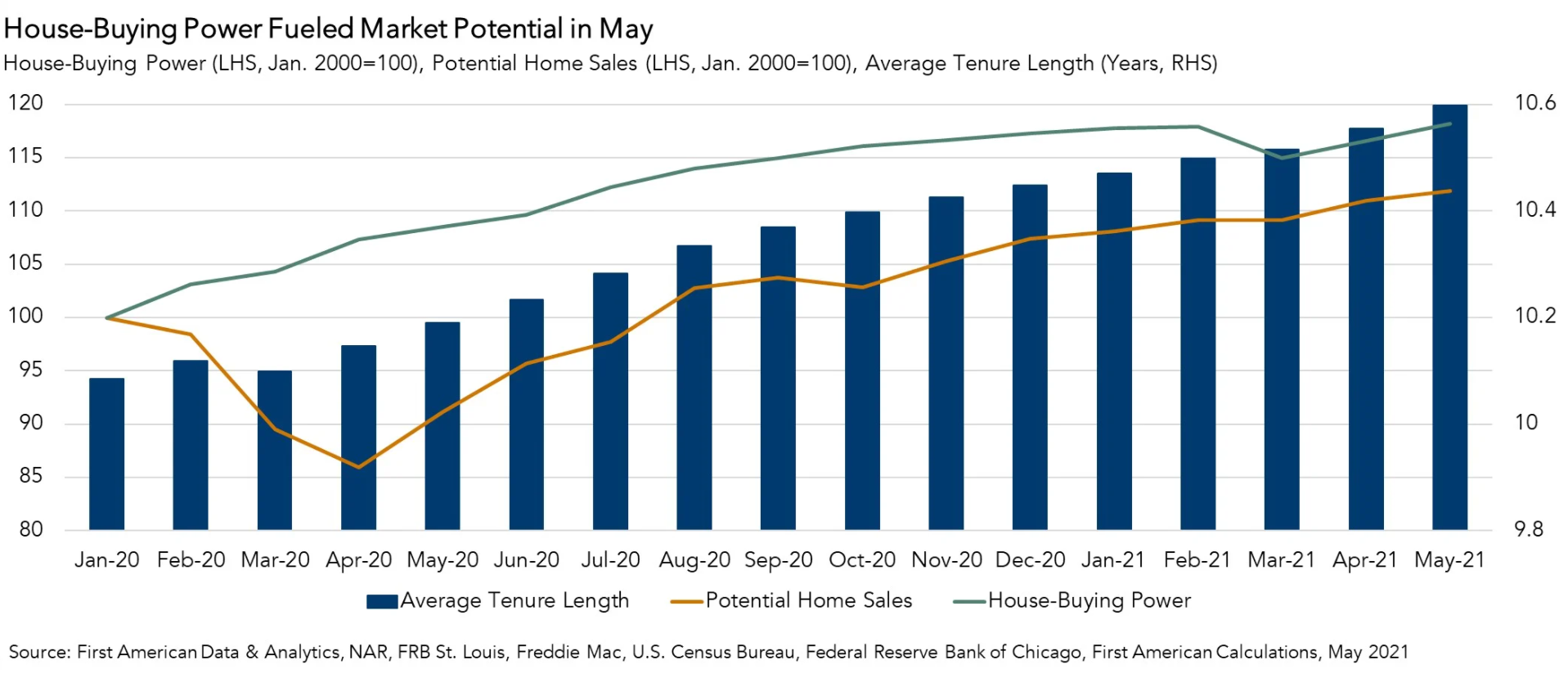

According to the latest numbers from the National Association of Realtors (NAR), existing homes sold at a seasonally-adjusted annual rate of 5.8 million in May. But First American’s Potential Home Sales Model suggests existing home sales could have hit an annualized rate of 6.34 million last month, if not for the historic lack of supply.

Mark Fleming | Photo credit: First American

Thanks to rising household income and a dip in mortgage rates, First American estimates that the average American’s “house-buying power” increased by approximately $7,100 in May.

But, “You can’t buy what’s not for sale – and the homebodies don’t seem ready to relieve the supply pressure, keeping a lid on market potential growth,” said First American Chief Economist Mark Fleming in a blog post.

The average length of homeowner occupancy hit an all-time high of 10.6 years in May, First American noted, muting the impact of increased house-buying power and potential home sales.

“Two trends are locking homebodies in place and driving the increase in tenure length,” Fleming said. “First, for homeowners with rock-bottom rates, modestly higher rates in an historically low inventory environment may disincentivize some from selling their homes, thus preventing more supply from reaching the market. Second, seniors are choosing to age in place.”

According to NAR, there was only a 2.5-month supply of homes on the market at end of May, far short of the 6 months seen in a more balanced market. At 1.23 million units, inventory was up 7 percent from April to May, but down 20.6 percent from a year ago, NAR said, helping drive a 23.6 percent annual increase in the median existing-home price, to $350,300.

Lawrence Yun | Photo credit: NAR

NAR Chief Economist Lawrence Yun said the supply of listings “is expected to improve, which will give buyers more options and help tamp down record-high asking prices for existing homes.”

In their latest monthly forecast, Fannie Mae economists said they are expecting “at least a modest increase in listings in coming months as COVID worries wane, some homeowners reassess their living situations once the future of work-from-home arrangements becomes clearer, and mortgage forbearance programs expire.”

But Fannie Mae downgraded its forecast for second and third quarter home sales, citing listing shortages and a slowdown in new home construction. If home price increases and rents don’t cool, they warned, that could prompt the Federal Reserve to start talking about taking steps to combat inflation, such as tapering its $120 billion in monthly purchases of Treasurys and mortgage bonds.

Doug Duncan | Photo credit: Fannie Mae

“If interest rates rise to reflect the increase in inflation based on an expectation of tighter future monetary policy, home sales would likely moderate along with house price appreciation,” Fannie Mae Chief Economist Doug Duncan said.