Adam Neumann‘s new real estate venture is coming out of the gate hot with a major league backer and a $1 billion valuation — before officially launching.

The former WeWork chief executive is going all in on residential rentals with his new company Flow, with the New York Times reporting on Monday that the fledging startup is receiving an investment of approximately $350 million from the venture capital firm Andreessen Horowitz.

The investment brings Flow’s valuation to approximately $1 billion as Neumann plots a major foray into the residential rental market, which Marc Andreessen described as “ripe for disruption” in a blog post announcing the investment.

“Make no mistake, this kind of mission is a heavy lift. Only through a seismic shift in the way industry relationships are structured and the mechanisms through which value is delivered can we hope to address the underlying problems of the current system and build the solution,” Andreessen wrote in the blog post. “Doing this requires combining community-driven, experience-centric service with the latest technology in a way that has never been done before to create a system where renters receive the benefits of owners. This means rethinking the entire value chain, from the way buildings are purchased and owned to the way residents interact with their buildings to the way value is distributed among stakeholders.”

Neumann is also reportedly planning on making a sizable investment into the company in the form of his own cash and real estate assets as it prepares to launch in earnest in 2023. Andreessen will be a member of Flow’s board, according to the Times.

With Flow, Neumann aims to rework the residential market with a focus on branded properties with communal spaces and consistent services and amenities. Neumann has already accumulated a residential real estate portfolio of over $1 billion since his high profile departure from WeWork, including rental properties in Miami, Nashville, and Atlanta that include approximately 4,000 rental units that will serve as some of the first Flow properties.

In his blog post, Andreessen wrote that the current prevalence of remote work has made the rental property ripe for reimagining.

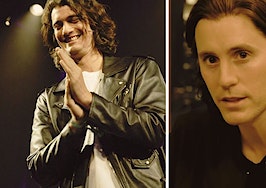

Marc Andreessen | Justin Sullivan / Getty Images

“As a result, they will experience much less, if any, of the in-office social bonding and friendships that local workers enjoy,” he said. “For many of these people, increased screentime and reduced in-person interaction will cause challenges that are not just limited to work, such as alienation and loneliness. This is not a good path for anyone and it needs to be addressed directly, right now.”

He also hinted that the company may seek to address the growing share of Americans stuck in rentals long term as the dream of homeownership has become harder and harder to attain.

“You can pay rent for decades and still own zero equity — nothing,” he wrote. “There’s a reason the federal government started subsidizing home mortgages: someone who is bought in to where he lives cares more about where he lives. Without this, apartments don’t generate any bond between person and place and without community, no bond between person to person.”

Neumann famously took the startup he founded to highs unthinkable for a commercial real estate company, redefining the industry and the modern office in the process, but resigned after a chaotic period in which the company filed for an Initial Public Offering, offering a glimpse into its books for the first time and revealing massive losses.

After Neumann resigned, the company installed Sandeep Mathrani, a commercial real estate traditionalist, as CEO.

Andreessen, who is also invested into Neumann’s crypto startup Flowcarbon, wrote that the company was excited to continue working with Neumann, who he called a revolutionary.

“Adam is a visionary leader who revolutionized the second largest asset class in the world — commercial real estate — by bringing community and brand to an industry in which neither existed before,” the post reads. “We understand how difficult it is to build something like this and we love seeing repeat-founders build on past successes by growing from lessons learned. For Adam, the successes and lessons are plenty and we are excited to go on this journey with him and his colleagues building the future of living.”